Summary

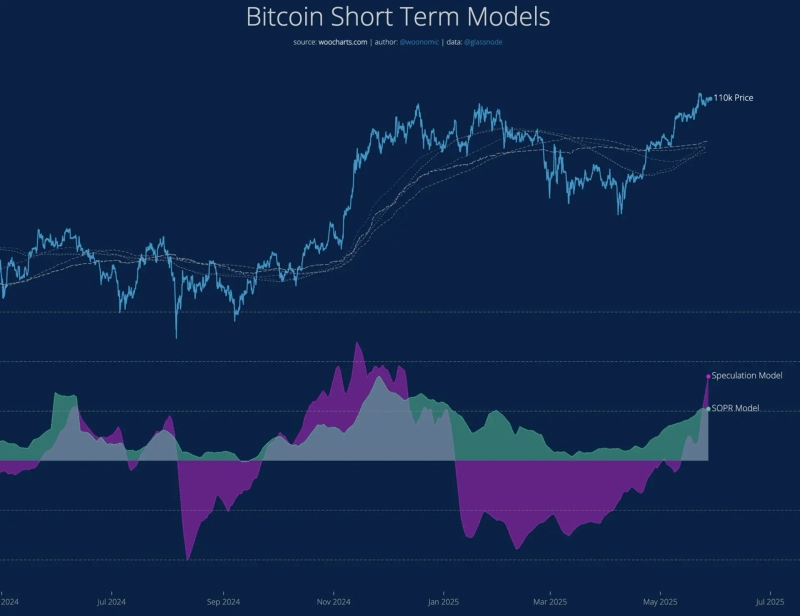

- Willy Woo analyzed that the speculative buying pressure has intensified, increasing the likelihood of a short-term correction for Bitcoin.

- He stated that considering the "SOPR indicator," the probability of profit realization by investors has also increased.

- He reported that due to decreased network fund inflow, Bitcoin may face a bearish divergence.

An analysis has emerged that the speculative buying pressure on Bitcoin (BTC) has intensified, increasing the likelihood of a short-term correction.

On the 27th (local time), on-chain analyst Willy Woo stated on X (formerly Twitter), "The speculative sentiment towards Bitcoin is extremely overheated," and "The likelihood of a short-term correction is increasing." He added, "Considering the SOPR (Spent Output Profit Ratio) indicator, the probability of investors realizing profits is also high."

Furthermore, he mentioned, "The network's fund inflow has decreased over the past three days," and "If Bitcoin does not reach a new all-time high soon, a bearish divergence may form, leading to a short-term correction."

As of 7:06 PM, Bitcoin is trading at $109,813 on the Binance USDT market, up 0.05% from 24 hours ago.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit