Editor's PiCK

Outflows from U.S. Bitcoin ETFs intensify…assets under management fall below $100bn

Summary

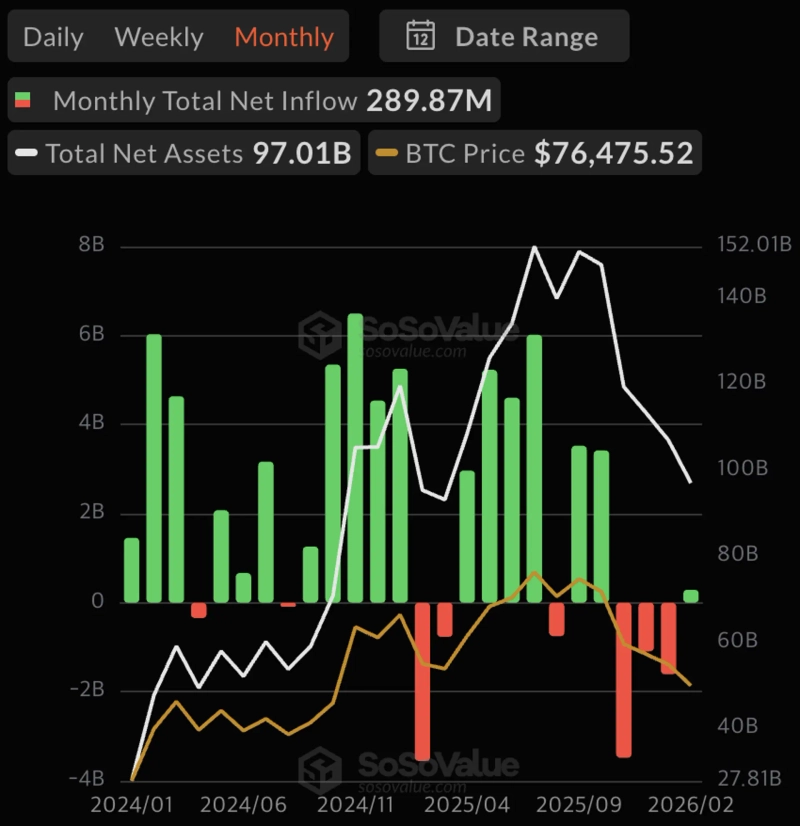

- Outflows from U.S. spot Bitcoin ETFs intensified, driving assets under management (AUM) below $100 billion.

- Spot Bitcoin ETFs recorded net outflows for three straight months from November last year through last month—the first such streak since their 2024 launch.

- NovaDius Wealth Management said many Bitcoin ETF holders have moved into unrealized losses, but because most are medium- to long-term investors, the risk of large-scale redemptions or selling pressure is limited.

Outflows from U.S. spot Bitcoin (BTC) exchange-traded funds (ETFs) have accelerated, pushing net assets under management (AUM) below $100 billion.

As of the 4th (local time), data from SoSoValue showed spot Bitcoin ETF AUM at roughly $97 billion. It is the first time since April last year—about 10 months—that spot Bitcoin ETF AUM has fallen below $97 billion. A net outflow of $270 million on the previous day (the 3rd) delivered a direct hit.

Spot Bitcoin ETFs posted net monthly outflows for three consecutive months from November last year through last month. It is the first time since their 2024 launch that spot Bitcoin ETFs have recorded three straight months of net outflows on a monthly basis.

The outflow trend in spot Bitcoin ETFs has coincided with the recent downturn in the crypto market. According to CoinGecko, total crypto market capitalization has shed $470 billion (about KRW 680 trillion) over the past week. Cointelegraph reported that “the decline (in spot Bitcoin ETF AUM) occurred amid broad-based selling across the crypto market.”

Still, analysts say it is unlikely that ETF outflows will translate into large-scale selling pressure. Nate Geraci, CEO of U.S. asset manager NovaDius Wealth Management, wrote on X that “a significant share of current Bitcoin ETF holders has moved into unrealized loss territory,” adding that “because most ETF investors are medium- to long-term holders, the likelihood of immediate large-scale redemptions or selling pressure is limited.”

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)

![Trump ally Myron, a Fed governor, resigns White House post…pushing for rate cuts until Warsh arrives? [Fed Watch]](https://media.bloomingbit.io/PROD/news/75fa6df8-a2d5-495e-aa9d-0a367358164c.webp?w=250)