Editor's PiCK

Bitcoin ETFs see $269.93 million in net outflows…BlackRock alone posts net inflows

Summary

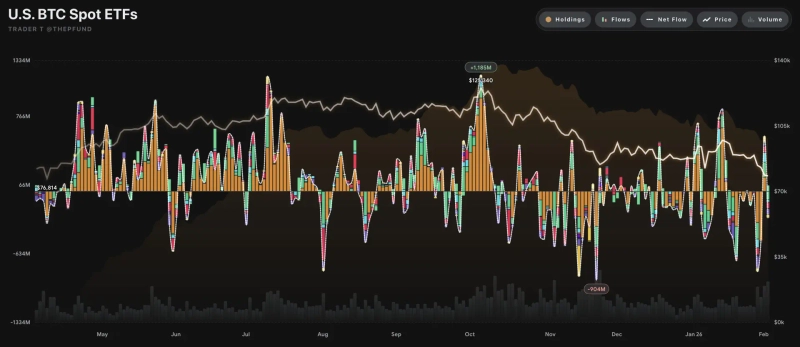

- In the US-listed spot Bitcoin ETF market, $269.93 million in net outflows was tallied, extending the weak trend.

- Among major ETFs, only BlackRock’s IBIT posted $62.12 million in net inflows, while Fidelity’s FBTC saw $148.70 million in net outflows.

- Amid a Bitcoin price pullback, short-term profit-taking and risk-off sentiment were reflected in ETF flows, but with continued inflows into BlackRock’s IBIT, some analysis suggests institutional demand has not fully faded.

US-listed spot Bitcoin exchange-traded funds (ETFs) extended their weak trend as $269.93 million in net outflows were recorded.

According to Trader T on the 3rd (local time), total net outflows across Bitcoin ETFs came to $269.93 million. Among major ETFs, only BlackRock’s iShares Bitcoin Trust (IBIT) posted net inflows, while most other large ETFs saw withdrawals.

BlackRock’s IBIT was the only fund in positive territory, taking in $62.12 million in net inflows. By contrast, Fidelity’s FBTC recorded the largest net outflow, with $148.70 million leaving the fund.

Bitwise’s BITB saw $23.42 million in net outflows, while ARK Invest’s ARKB logged $62.50 million in net outflows. Grayscale’s GBTC also saw $56.63 million exit, and the Grayscale Mini Bitcoin Trust (BTC) likewise posted $33.80 million in net outflows.

Elsewhere, Franklin’s EZBC recorded $2.19 million in net outflows and VanEck’s HODL saw $4.81 million in net outflows. Invesco’s BTCO, Valkyrie’s BRRR, and WisdomTree’s BTCW were flat, with no net flows.

Market participants say the ongoing pullback in Bitcoin prices is feeding through to ETF flows via short-term profit-taking and a risk-off stance. Still, with inflows into BlackRock’s IBIT continuing, some argue institutional demand has not fully faded.

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE

![Did it crash because of Trump?…The 'real reason' Bitcoin collapsed [Hankyung Koala]](https://media.bloomingbit.io/PROD/news/d8b4373a-6d9d-4fb9-8249-c3c80bbf2388.webp?w=250)