Summary

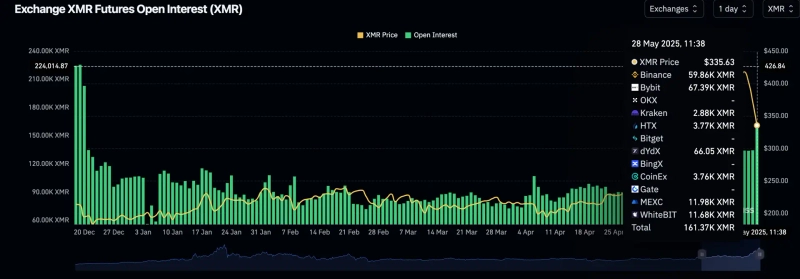

- Monero's open interest has reached its highest level since December last year, reflecting expectations for a rebound.

- An increase in open interest generally indicates a rise in short positions, but for Monero, an increase in long positions is notable.

- Investors are showing investment expectations for Monero through a buy-the-dip strategy.

Privacy coin Monero (XMR) has seen its open interest (OI) reach its highest level since December last year.

On the 28th (local time), CoinDesk reported, "Monero has shown a sharp decline over the past three days," but added, "The perpetual futures open interest surged by 20% over three days, reaching its highest level since December last year." It further stated, "This reflects the market's interest in Monero's upward potential."

Typically, an increase in open interest accompanying a price drop indicates a rise in short positions. However, it explained that Monero is showing a different pattern.

The media stated, "Monero's perpetual futures funding rate remains positive," indicating "a surge in open interest for long (buy) positions rather than short (sell) positions." It added, "Investors seem to be employing a buy-the-dip strategy."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)