Summary

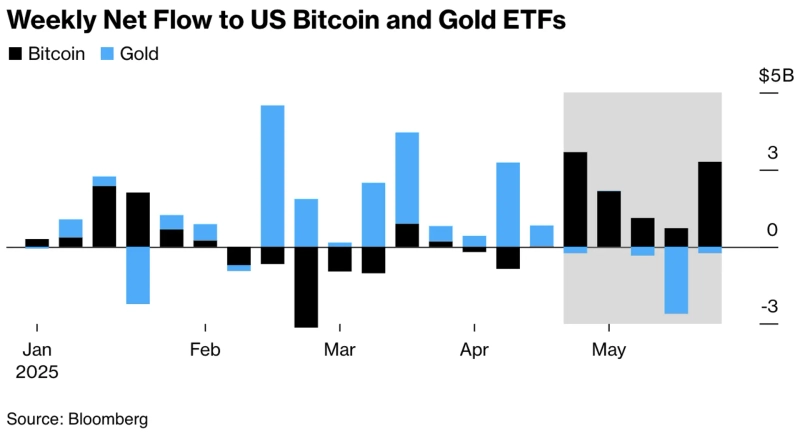

- Bloomberg reported that in the past five weeks, over $9 billion has flowed into the United States of America Bitcoin ETF.

- They noted that, as global trade tensions have eased, funds focused on gold have shifted to Bitcoin, while more than $2.8 billion has been withdrawn from gold funds during the same period.

- Bloomberg conveyed that there are views of Bitcoin being recognized as an alternative store of value, potentially establishing itself in the long run as a more popular hedge than gold.

Over the past five weeks, more than $9 billion has flowed into United States of America spot Bitcoin (BTC) ETFs. Recent analysis suggests that as global trade tensions ease, funds that were concentrated in gold are moving into Bitcoin.

Bloomberg reported on the 28th (local time), "In the past five weeks, over $9 billion has flowed into United States of America Bitcoin ETFs," stating, "Notably, BlackRock IBIT played a major role." Bloomberg also shared, "(Meanwhile) more than $2.8 billion have exited gold-based funds during the same period."

The inflow trend toward Bitcoin ETFs has strengthened due to the recent easing of trade tensions. Bloomberg explained, "With the easing of trade tensions, demand for traditional safe assets like gold has decreased," adding, "As concerns over United States of America fiscal soundness grow, there is a stronger tendency to view Bitcoin as an alternative store of value (SoV)."

There are even views that Bitcoin could establish itself in the long term as a more popular hedge than gold. Geoff Kendrick, Global Head of Digital Asset Research at Standard Chartered (SC), told Bloomberg, "Thanks to its decentralized nature, Bitcoin is more effective (than gold) against financial system risks," adding, "Bitcoin can simultaneously serve as a hedge against both private-sector risks such as the 2023 Silicon Valley Bank (SVB) collapse and risks to government institutions like those associated with the United States Department of the Treasury."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)