Editor's PiCK

Canary Capital Group LLC Submits S-1 Filing for Canary Staked CRO ETF

Summary

- Canary Capital Group LLC announced that it submitted an application for a spot staking ETF based on Chronos (CRO) as the underlying asset to the U.S. SEC.

- The ETF was reported to be designed for general investors to directly access CRO holdings and staking income, adopting Chronos chain’s PoS system and a dual-income model.

- The ETF’s ticker symbol and listing exchange have not yet been decided, and the launch timing will be determined by the SEC’s review schedule.

Canary Capital Group LLC has submitted an application for a spot staking exchange-traded fund (ETF) based on Chronos (CRO) as its underlying asset.

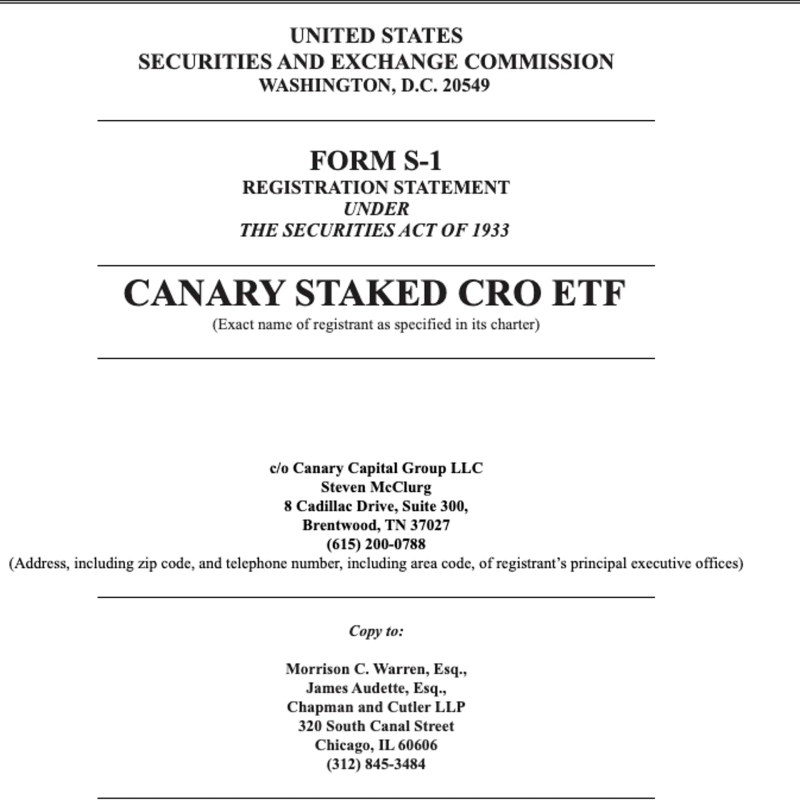

According to the U.S. Securities and Exchange Commission (SEC) Electronic Data Gathering, Analysis, and Retrieval system (EDGAR) on the 30th (local time), Canary Capital Group LLC submitted a registration statement (S-1) for the 'Canary Staked CRO ETF.' This ETF is designed to allow general investors to access CRO holdings and staking revenue through a listed exchange.

According to the filing, the ETF employs a dual-income model by directly holding CRO using Chronos chain's proof-of-stake (PoS) system, while simultaneously obtaining additional CRO through validator activities. Furthermore, the ETF is structured for direct holding of the underlying asset, Chronos (CRO), distinguishing it as a spot-based structure compared to a futures ETF.

Meanwhile, the ETF's ticker symbol and listing exchange have not been determined yet, and the launch timing will be decided according to the SEC's review schedule.

Chronos is the core blockchain infrastructure of the Crypto.com ecosystem. On this day, the price of CRO is trading at $0.09303, down 5.06% from the previous day according to CoinMarketCap.

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.