Editor's PiCK

Decentralized exchange spot trading market share nears 25%, hits all-time high

Summary

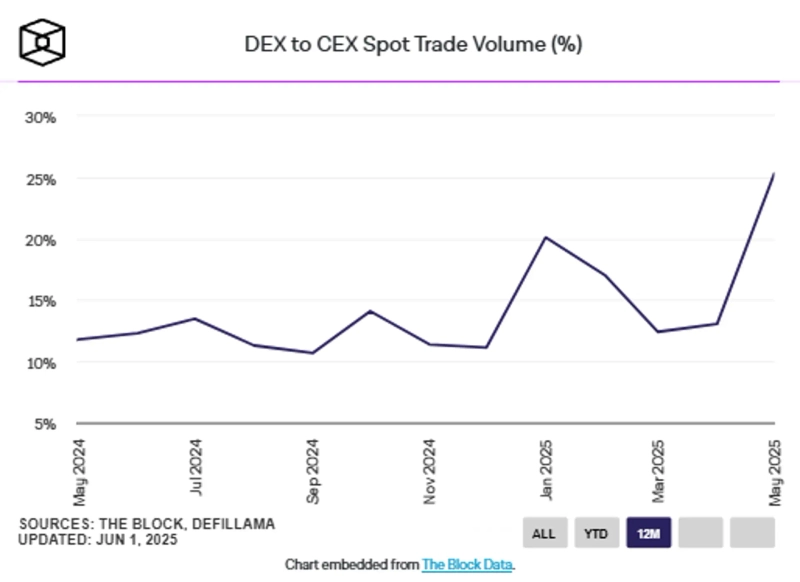

- The Block reported that in May, the spot trading volume of decentralized exchanges (DEX) reached 25% of the total, marking an all-time high.

- Kim Seo-joon, CEO of Hashed, interpreted this change as a paradigm shift from centralization to decentralization, and suggested that Solana (SOL)-based meme coins being listed on DEX before centralized exchanges (CEX) had an influence.

- May's monthly DEX trading volume was tallied at $410.2 billion, with PancakeSwap (CAKE) leading at $171.6 billion, followed by Aerodrome (AERO) and PumpSwap, each at $15 billion.

In May, decentralized exchanges (DEX) accounted for 25% of the total spot cryptocurrency trading volume, reaching a record high.

According to The Block on the 2nd (local time), decentralized exchanges took up 25% of the total spot trading volume in the market, hitting an all-time high. The previous record was 20% in January.

Kim Seo-joon, CEO of Hashed, commented, "This represents not just a shift in market share, but a paradigm shift from centralization to decentralization," adding, "The fact that a popular Solana (SOL)-based meme coin launched on DEX before central exchanges (CEX) likely had an impact." He further explained that improvements to personal wallet usability, regulatory issues on centralized platforms, and a decline in trust also played a role.

Meanwhile, according to data from The Block, May's monthly DEX trading volume reached $410.2 billion. PancakeSwap (CAKE), based on the Binance Coin (BNB) chain, led with $171.6 billion in trading volume, while Base (BASE)-based Aerodrome (AERO) and Solana-based PumpSwap each recorded $15 billion and followed behind.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)