Editor's PiCK

The 'Lee Jae-myung era' begins for Korean coins…"ICO and Bitcoin ETF to be fully permitted"

Summary

- The Lee Jae-myung administration has announced key virtual asset pledges such as approval of Bitcoin ETFs, introduction of a Korean won stablecoin, and conditional permission for initial coin offerings (ICOs).

- If a spot Bitcoin ETF is launched domestically, virtual assets will be officially incorporated into the institutional financial sector, leading to a significant market impact.

- The promotion of conditional ICO approval is expected to encourage the return of blockchain firms that went overseas and help expand the domestic virtual asset ecosystem.

'Lee Jae-myung administration' launched

A series of pro-virtual asset pledges announced

If Bitcoin ETF is allowed, Korea would be 2nd in Asia

Korean won stablecoin rollout expected to accelerate

With the launch of the Lee Jae-myung administration, which put forth a series of pro-virtual asset pledges during the presidential race, the atmosphere surrounding the domestic virtual asset industry is quickly changing. Some predict President Lee may pursue a 'Korea First' strategy that goes beyond simply easing regulations in the industry.

According to the '21st Presidential Election Manifesto' by the Democratic Party of Korea on the 5th, key virtual asset pledges of President Lee include approval for spot Bitcoin (BTC) ETFs, introduction of a Korean won stablecoin, and conditional permission for initial coin offerings (ICOs). In particular, should a spot Bitcoin ETF be launched in Korea, it would mean virtual assets are officially incorporated into the institutional financial system, which could have significant market impact. Financial authorities originally opposed spot virtual asset ETF approval due to concerns that risks in the virtual asset market could spill over to the existing financial system.

Currently, the only place in Asia to approve Bitcoin and other virtual asset ETFs is Hong Kong. Hong Kong, aiming to be the "Asia virtual asset hub," approved Bitcoin and Ethereum (ETH) ETFs as early as April last year. Japan has also begun to revise related laws with an eye toward introducing a Bitcoin ETF, but is still in the review stage. If the Korean government expedites its pledges, it could become the second country in Asia after Hong Kong to allow Bitcoin ETFs.

The motivation for introducing a Korean won stablecoin stems from the intention to build a domestic currency-based digital finance ecosystem. President Lee compared last month’s passive stance toward stablecoins to "Joseon's isolationist policy at the end of the dynasty" during a discussion with economic YouTubers. The Democratic Party’s Digital Assets Committee recently described the Korean won stablecoin as "a strategic asset to secure sovereignty and boost global competitiveness in Korea’s digital economy era." Industry experts say the rise of stablecoins as future payment methods makes fostering a Korean won stablecoin inevitable for securing digital economic sovereignty.

Can Korea regain its leading position in virtual assets?…Expectation for 'reshoring'

The current administration's conditional approval of ICOs appears intended to encourage "reshoring"—the return of domestic companies from abroad. ICOs are a type of "coin-IPO" in which virtual asset companies raise funds by issuing tokens. The government previously banned ICOs entirely in 2017 due to concerns about capital market disruption. As a result, domestic blockchain projects such as Kakao’s Kaia (KAIA) and Nexon’s Nexpace (NXPC) all issued virtual assets overseas.

If ICOs are permitted domestically, blockchain companies that went abroad to avoid regulations could again turn their focus to Korea. If the Democratic Party’s reshoring initiative succeeds, capital, talent, and other resources will naturally flow into the domestic virtual asset industry, fueling ecosystem expansion. An industry insider commented, "With growing demand for ICOs as the virtual asset market expands, it’s positive that the government is eager to ease regulations," adding, "However, since ICOs are only conditionally approved, the specifics of the issuing requirements will be key to policy effectiveness."

The Democratic Party's control over both executive and legislative branches is also fueling industry expectations. The party plans to establish a legal foundation for the Korean won stablecoin through the soon-to-be-introduced "Digital Asset Basic Act." The draft law is said to specify criteria and authorization entities for issuing the stablecoin. With both ruling and opposition parties recognizing the necessity of institutionalizing virtual assets and a parliamentary composition favoring the majority party, the act could take effect as early as next year.

"Tasks remain, including changing negative perceptions…Nurturing the industry as a strategic sector is essential"

Some experts warn that the administration's will alone may not be enough to deliver on its pledges. There are calls to first change lingering negative perceptions of virtual assets carried over from the previous administration. Professor Jong-seop Lee of Seoul National University’s Business School suggested, "To incorporate virtual assets as a base asset class, not only legislation but also nurturing ecosystem players such as asset managers and authorized participants (APs) must occur, and developing 'safeguards' as robust as those for traditional capital markets—one by one and with expertise—should also be a priority."

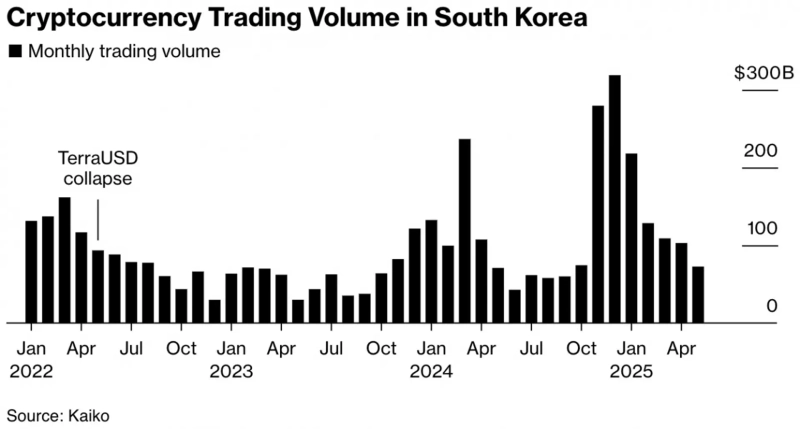

With domestic virtual asset trading volumes declining, the urgency for policy action is increasing. According to virtual asset data analytics firm Kaiko, last month’s domestic virtual asset trading reached $72.6 billion, a 29.5% decrease from the previous month ($102.9 billion) and roughly a third of the volume in January ($218 billion). Another industry insider noted, "Enhancing the global competitiveness of the domestic virtual asset ecosystem is the key challenge for this administration," adding, "As there are already many front-runners, it’s essential to nurture the virtual asset industry to a 'strategic' level in order to reduce overseas dependence."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)