Summary

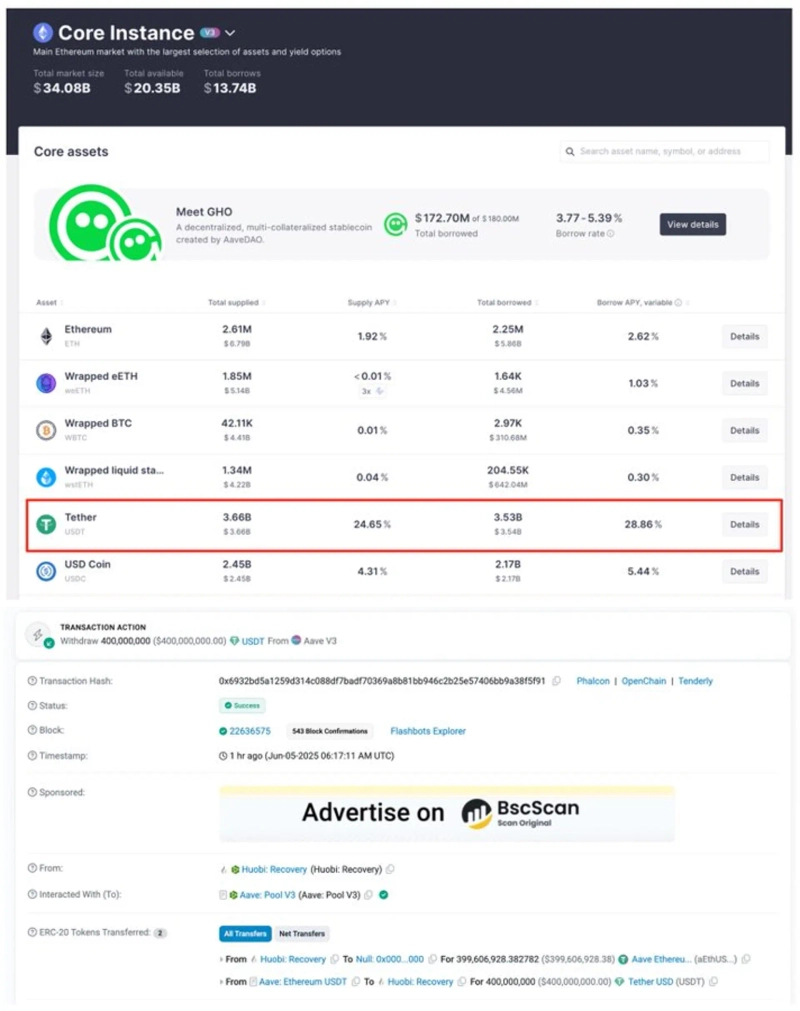

- An HTX-linked wallet address was found, through on-chain analysis, to have withdrawn a large sum of 400 million USDT from Aave.

- Due to this withdrawal, the USDT lending rate (APY) and deposit rate on Aave reportedly surged to 28.86% and 24.65%, respectively.

- After this unusual fund movement, several arbitrage addresses began depositing USDT to exploit the high interest rates.

A wallet address, believed to be associated with HTX (formerly Huobi), has attracted market attention after withdrawing 400 million Tether (USDT) in a large-scale transaction from the decentralized finance (DeFi) lending platform Aave.

On the 5th, on-chain analyst IX stated on X (formerly Twitter), "A wallet address suspected to belong to HTX withdrew 400 million USDT from Aave just an hour ago," adding, "As a result, the USDT lending interest rate (APY) on Aave surged to 28.86%, and the deposit rate also soared to 24.65%."

He commented, "Such large-scale capital outflows in a short period are rare," and questioned, "What could the intention possibly be?"

He further added, "Yet, seeing many arbitrage addresses already starting to deposit USDT to take advantage of the surging rates only brings a smile to my face."

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

![Rotation from tech to blue chips…Micron plunges 9.55% [Wall Street Briefing]](https://media.bloomingbit.io/PROD/news/d55ceac4-c0d2-4e63-aac9-f80fd45dfbbd.webp?w=250)

![[Market] Bitcoin drops intraday to the $72,000 level… debate over 'safe-haven credibility' reignited](https://media.bloomingbit.io/PROD/news/e3aeb7f7-851b-4479-bfd0-77d83a3b7583.webp?w=250)