As the US stock market stalls, Korean retail investors sell Tesla and buy US Treasuries

Summary

- It was reported that Korean retail investors are actively investing in US Treasuries, with net purchases totaling ₩2.1 trillion.

- Recently, as the US Treasury yield surpassed 5%% per annum and prices fell, investor interest focused on bargain hunting and long-term bond ETFs.

- In contrast, US stocks including Tesla faced a selling trend and investor sentiment weakened.

Net purchases worth ₩2.1 trillion last month

₩340 billion in Tesla sales

30-year yield tops 5% per annum

Bargain-hunting as prices drop

Betting on long-term bond ETFs as well

Korean retail investors have started accumulating US bonds. With the enthusiasm for US stock investments weakening and US Treasury yields rising, the appeal of fixed income has increased.

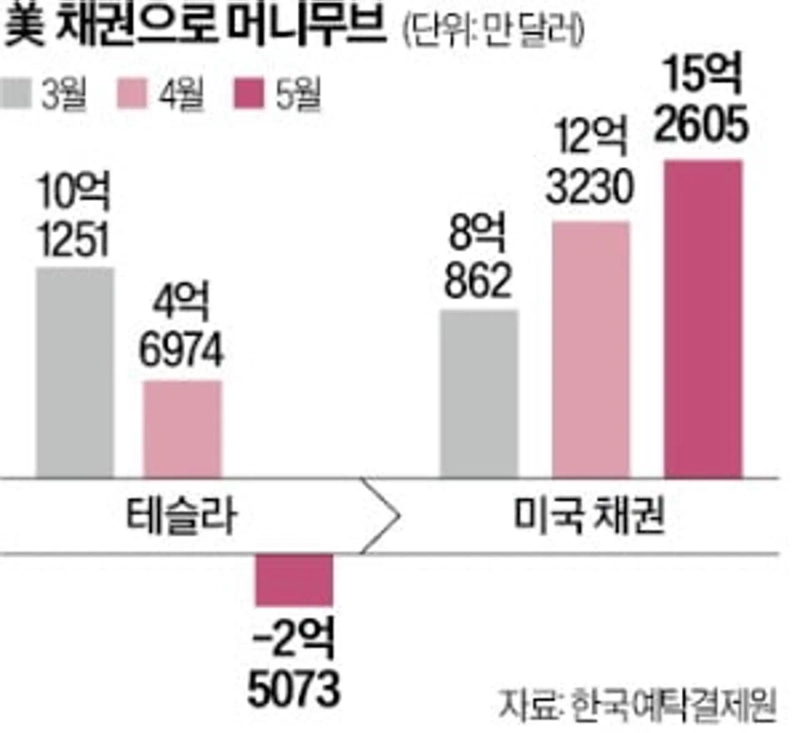

According to the Korea Securities Depository on the 8th, domestic investors made net purchases of $1,526,050,000 (about ₩2.1 trillion) in US Treasuries last month. This is an increase of 23.84% compared to the previous month.

Recently, US Treasury yields have surged to around the 'psychological resistance level' of 5%, spurring buy-side activity. On the 21st of last month, the 30-year US Treasury yield rose as high as 5.09% per year. The 10-year US Treasury yield—which serves as a global benchmark—also surged to 4.60% per year that day. US Treasury yields soared as the national credit rating was downgraded and concerns grew over the fiscal deficit.

Investors viewed the decline in US bond prices caused by higher yields as a buying opportunity. Last month, the second most-bought US stock by Korean retail investors ($175,040,000) was the 'Direxion Daily 20+ Year Treasury Bull 3X Shares' (TMF), which seeks to deliver three times the daily performance of the ICE U.S. Treasury 20+ Year Bond Index. The long-term Treasury ETF 'iShares 20+ Year Treasury Bond ETF' (TLT) ranked fourth in net purchases ($134,100,000). During the same period in the domestic ETF market, individual investors bought ₩92 billion worth of 'ACE 30-Year U.S. Treasury Active ETF (H)'. The 'TIGER 30-Year U.S. Treasury STRIPS Active ETF (Synthetic H)' and 'TIGER 30-Year U.S. Treasury Covered Call Active ETF (H)' also attracted private capital of ₩47 billion and ₩39 billion, respectively.

On the other hand, US stocks saw a clear sell-off. During the same period, $250,730,000 (₩342.1 billion) worth of Tesla was sold. Tesla ranked number one in net overseas stock purchases every month from January to March this year, and continued as the second most bought stock in April, but the sell-off outpaced buying starting in May. The sharp declines in Tesla (-35%) and NVIDIA (-19%) in the first quarter dampened investor sentiment toward US equities. In May, domestic investors became net sellers of US stocks, offloading $1,310,850,000 worth for the first time in seven months.

Reporter Jo Ara rrang123@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.