The US, Japan, and the UK cut back, while the EU and China increase... Divergent government bond maturity strategies [Global Money X-File]

Summary

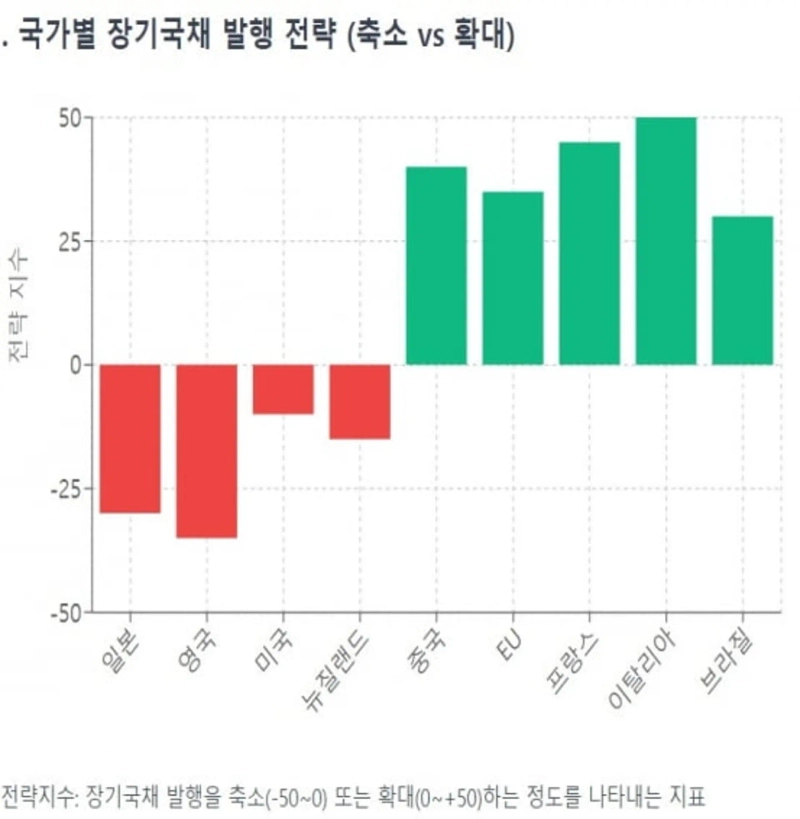

- Japan, the United States, and the United Kingdom are currently adopting strategies to either reduce or freeze the size of long-term bond issuance.

- On the other hand, the European Union, Germany, and China are increasing long-term bond issuance to fund large-scale infrastructure and economic stimulus initiatives.

- Depending on bond maturity strategy, various investment risks such as interest costs, rollover risks, and national credit ratings can arise.

Recently, the government bond policies of major global economies have diverged. Japan, the United Kingdom, and the United States are either maintaining or reducing the issuance of long-term bonds with maturities of over 20 years. In contrast, the European Union (EU), Germany, and China are aggressively expanding long-term bond issuance. This is a result of a complex interplay of each country's economic situation, monetary policy, and changing investor preferences. Countries with higher interest burdens generally preferred short-term bonds, while those pursuing large-scale government projects increased their long-term bond issuance.

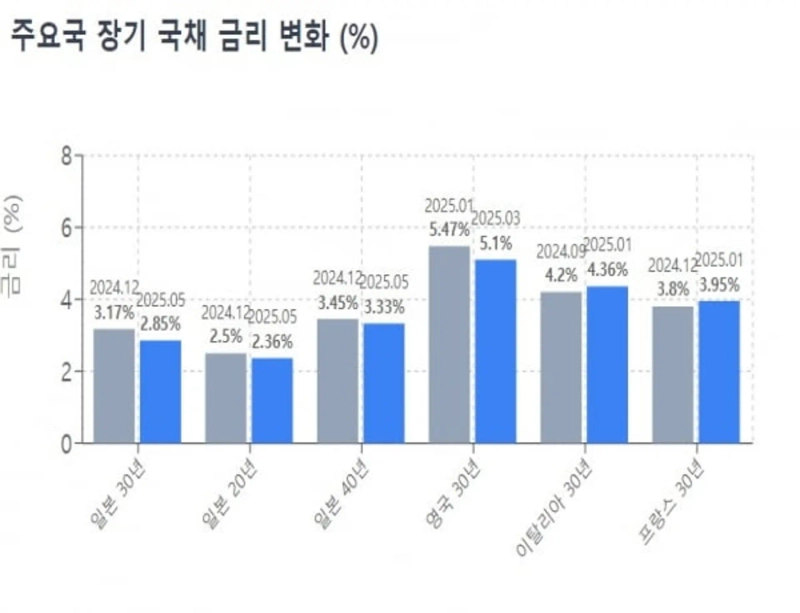

According to Reuters on the 9th, the Japanese government is currently considering reducing the issuance of long-term government bonds with 30-year and 40-year maturities. Since the end of 2023, the Bank of Japan (BOJ) has signaled a reduction in bond purchases, sending long-term interest rates sharply higher. As a result, the Japanese Ministry of Finance is reportedly reassessing bond maturity structures to restore market supply-demand balance. A Japanese Ministry of Finance official stated, “If investor demand slows more than expected, we will consider a reduction in ultra-long-term bonds.”

The United States has recently refrained from increasing long-term bond issuance. Since the second half of 2023, the US Treasury has kept the size of long-term bond auctions for maturities over 10 years unchanged for five consecutive quarters. Scott Besant, US Treasury Secretary, commented last February, “We do not plan to change our bond issuance schedule for the next several quarters.” This was in contrast to market experts, who expected an increase in long-term bond issuance was inevitable at the time.

However, the $70 billion US 5-year Treasury bond auction held on the 28th of last month was deemed a success. The coupon rate was 4.071%, lower than expected. This suggests robust demand, meaning there was no need to offer higher rates. In the $16 billion issue of 20-year US Treasuries on the 21st, the coupon rate hit 5.047%, the highest since the 20-year bond was reintroduced in 2020. That means demand for the longer maturity was weak.

Previously, the UK announced last March that it would reduce the proportion of long-term bonds in its 2025-2026 fiscal year government bond issuance. The UK Debt Management Office announced, “The share of bonds maturing in over 15 years will fall from 20% to 13%.”

On the other hand, more countries are expanding long-term bond issuance. The European Commission is issuing large-scale long-term EU bonds to provide joint funding for member states. In March, it issued a €7 billion 25-year NextGenerationEU (NGEU) bond, which attracted orders of about €86.5 billion—over twelve times the issue size.

Germany, which has traditionally had a conservative government bond issuance policy, is also now expanding 30-year bond issuance. In December last year, the German government announced it would raise the size of its 30-year bond issuance from €2.2 billion in 2023 to €2.6 billion this year. Rohan Khanna, Head of Interest Rate Strategy at Barclays, commented, “Germany’s so-called ‘fiscal awakening’ will alleviate collateral shortages and significantly alter the role of Bunds in the European government bond market.” The French government issued €10 billion worth of 30-year bonds in January, which saw orders over thirteen times the amount on offer.

China, too, is set to issue a large volume of long-term government bonds this year. In the “2025 Government Work Report,” the Chinese government announced plans to issue ¥1.3 trillion in ultra-long-term special government bonds with 20-, 30-, and 50-year maturities—an increase of ¥300 billion compared to last year’s ¥1 trillion. These will be issued in tranches over 21 sessions between April and October. On the 23rd of last month, a ¥50 billion 50-year bond auction cleared at a rate of 2.10%.

There are two main reasons for this divergence in government bond issuance policies. The first is changing investor attitudes. Traditional long-term bond investors, such as pension funds and life insurers, have recently hesitated to buy new long-term issues. In Japan, life insurers and bank trust departments have adjusted their strategies due to prolonged low interest rates, dampening 20- to 40-year bond demand.

In the UK, the 2022 collapse risk of pension funds’ Liability Driven Investment (LDI) strategies played a major role. The LDI crisis occurred when UK pension funds using leveraged LDI strategies faced margin calls as rates spiked, pushing the long-term bond market to the brink. Subsequently, pension funds reduced leveraged investments in long-term bonds, and demand for 30- to 50-year issues dropped sharply. The UK Debt Management Office stated last March, “The demand from UK pension funds and life insurers has declined significantly in recent years.”

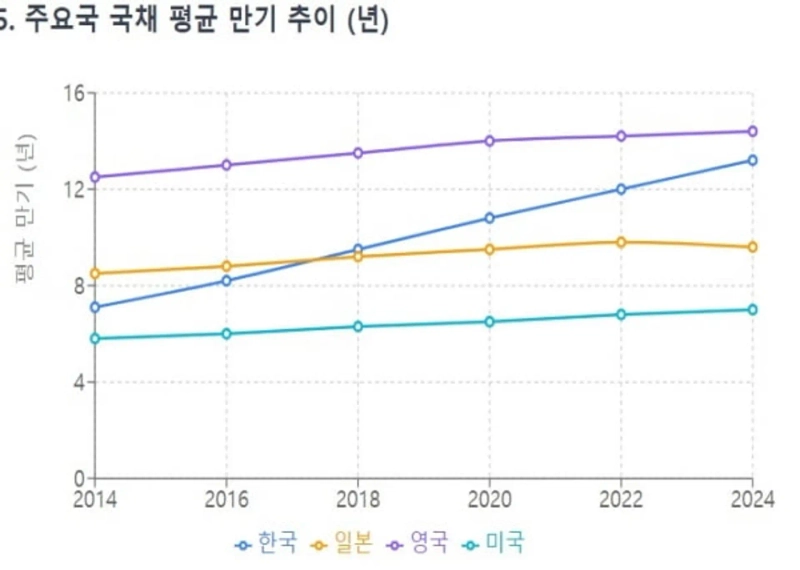

Bond maturity strategies also differ due to interest burden and fiscal policy. Extending average maturities allows governments to lock in rates for longer but increases their interest costs upfront. Shortening maturities makes it cheaper to raise funds in the short run, but increases exposure to future rate volatility.

Typically, fiscal authorities who place more importance on fixed interest costs prefer longer maturities. Those seeking to minimize immediate interest costs prefer short-term bonds. Recently, as government bond yields have risen in Japan and the UK, fiscal authorities (governments) have pivoted to shorter maturities to control rising funding costs (interest). The US is doing the same: national debt (as measured by total bond issuance) is surging, but short-term bonds are favored to limit the jump in debt-servicing costs.

In contrast, Germany, the EU, and China face different circumstances. They are pursuing large-scale projects requiring major funding for the future. In March, the German parliament passed a constitutional amendment enabling €500 billion in infrastructure and defense investment—the largest stimulus package ever. China, too, is carrying out large-scale fiscal spending for economic stimulus. Ultra-long-term special government bonds, introduced in 2020 in response to the COVID-19 pandemic, have been used as a funding source for infrastructure projects.

Each side’s bond strategy entails different risks. Increasing short-term bonds leads to higher rollover (refinancing) risk; a sudden spike in rates or liquidity crunch can sharply drive up government funding costs. The US is currently under rollover stress. When the 10-year Treasury yield approached 4.5% after Donald Trump’s new reciprocal tariff proposals in April, the US government announced tariff relief measures every time—a key reason cited by market watchers.

Increasing long-term bonds raises average government borrowing costs and can prompt credit rating downgrades. Last month, Fitch downgraded China’s credit rating for this reason.

The global government bond ‘duration divide’ looks set to continue. In Europe and China, interest rates are stable and the need for large-scale funding endures. This supports the maintenance of “long bond maturities and locked-in rates.”

Japan and the UK already have long average government bond maturities and their central banks are maintaining quantitative tightening. There is little incentive to borrow for even longer. Katsunobu Kato, Japanese Minister of Finance, noted last month, "If rates rise, government bond interest costs rise and pressure policy spending." Demand from key buyers is also falling, so the short-term bond preference is likely to continue.

By Juwan Kim kjwan@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.