Editor's PiCK

[Column] Why Do Custodial Crypto Firms Trade at a 500% Premium?

Summary

- As of 2025, the premium for major custodial crypto firms has reached 400–500%, resulting in extremely high investment risk.

- With the expansion of crypto ETF approvals for assets like Bitcoin, investment alternatives are broadening, and it is likely that premiums will quickly converge toward 20–50%.

- Only a very small number of companies consistently generating ecosystem-specialized profits will be able to maintain a limited premium in the ETF era.

Seojoon Kim, CEO of Hashed

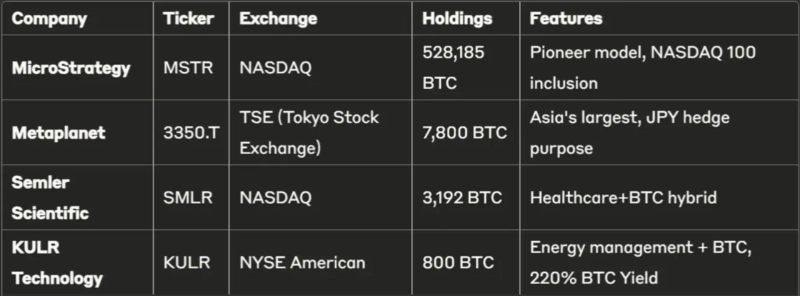

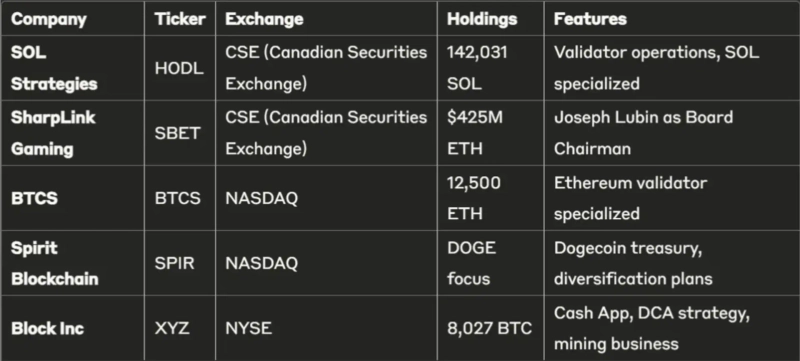

Companies following MicroStrategy's Bitcoin model are now diversifying beyond Bitcoin into Solana, Ethereum, and Dogecoin.

As of 2025, the total Bitcoin holdings of listed companies have exceeded 1 million BTC, and new guidelines from the U.S. Financial Accounting Standards Board took effect in January 2025, mandating fair value reporting of cryptocurrencies by corporations.

In January 2025, President Trump announced the official establishment of a dedicated crypto organization and a diversified crypto reserve strategy—including XRP, SOL, and ADA. With the appointments of the new SEC chair Paul Atkins and Crypto Czar David Sacks, the regulatory environment is rapidly improving, and the U.S. is solidifying its status as a "global cryptocurrency hub."

Key Company Classification

1) Bitcoin Custody Firms

2) Altcoin Custody Firms

3) Major New Entrants

Business Model Analysis

Capital Raising Methods

Companies are sourcing funds for accumulating cryptocurrencies in various ways. Issuing convertible bonds and equity is standard, while innovative approaches like ATM (At-The-Market) issuance or Metaplanet's moving-strike warrant program have emerged.

Revenue Generation Strategies

Ecosystem-specialized revenue models are evolving beyond simple holding. BTC Yield is used as a new indicator to measure the increase rate of Bitcoin holdings per share, and SOL Strategies generates staking income by operating validators. Metaplanet achieved a return of 88% with its Bitcoin option premium strategy.

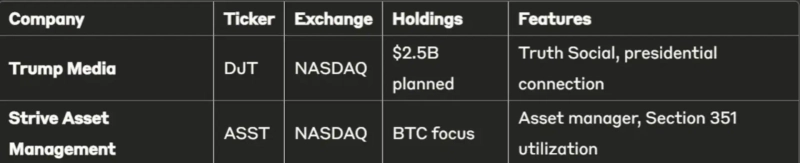

Current NAV Premium

Premium Rankings

By Region

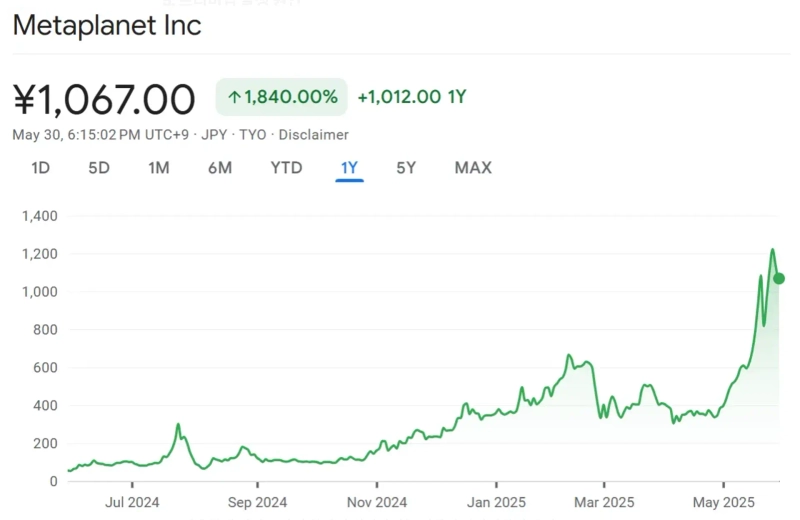

Japan: Extreme premium (500%) due to a fiscal crisis—debt-to-GDP ratio of 235%—and fears of yen depreciation

Canada: High premium (466%) from scarcity effect, due to absence of SOL ETF and a crypto-friendly CSE environment

U.S.: Relatively stable (150–200%) amid a mature capital market and ETF competition, with high NASDAQ liquidity

Causes of Premiums

Structural Factors

Scarcity premium is the central factor. A lack of vehicles for public company exposure to each cryptocurrency creates leverage effects, resulting in stronger share price volatility relative to underlying asset price movements. Accessibility premium, arising from investors seeking to avoid the complexity of direct crypto investments, also plays a significant role.

Differentiating Factors

The ability to generate ecosystem-based income is key to a sustainable premium. Validator operations and staking rewards, expectations of NASDAQ 100 inclusion, and insider networks formed by the participation of core Ethereum ecosystem figures all differentiate these companies.

Dynamics of Premiums With Crypto Price Changes

Bull Market: Premium Expansion Mechanism

- When the underlying asset (BTC) rises by 10%, Treasury companies' stock prices increase by 15–30%, demonstrating a beta amplification effect

- MSTR example: In 2024, BTC rose 140%, while MSTR rose 257% (1.8x leverage)

- Premium expansion sequence: Small caps (KULR, Semler) → Mid caps (SOL Strategies) → Large caps (MSTR)

- Inflow of traditional investors seeking to avoid the complexity of direct crypto investing

- Surging demand from institutional investors for "indirect exposure"

- Retail investors drawn to a "leverage play" mindset

Bear Market: Rapid Premium Contraction

- When BTC falls 10%, Treasury companies' stock prices can plummet 20–40% in a "leverage trap"

- 2022 bear market example: BTC fell 77%, while MSTR plunged 86%

- Premium collapse sequence: Small caps first → then large caps in a domino effect

- Concentration of short selling pressure: In 2025, Metaplanet became Japan's most heavily shorted stock

- Vicious cycle of margin calls and forced liquidations

- Plunging trading volume as institutions flee risk

2025: Current Extreme Situation

- Unprecedented premium levels: 500% (Metaplanet), 466% (SOL Strategies)—all-time highs

- "Premium bubble" warnings: 10x Research highlights "dangerous NAV distortions"

- Volatility indicators: MSTR volatility at 220% vs. BTC at 80%

- Structural market instability: Premiums highly concentrated in a few firms, increasing systemic risk

- "Premium Cliff" risk as ETF approvals near

- Chain collapse possible from regulatory change or hacking incidents

Asymmetry of Premium Volatility (Gradual Up, Sudden Down)

- Bull market: Premiums gradually expand over 2–3 months

- Bear market: Premiums contract sharply within 1–2 weeks, an asymmetric pattern

- "Leverage death spiral": Decline → margin calls → forced selling → further decline

Premium as a Sentiment Indicator

- Below 150%: Healthy level

- 150–300%: Signs of speculative overheating

- Above 300%: Extreme risk, due for correction

Sustainability of Premiums and Investment Risks

Current Risk Level

As of 2025, market risk is surging. MSTR volatility is at an extreme 220%, while Metaplanet is Japan's top short target. 10x Research warns of "dangerous NAV distortions," stating "retail investors are paying high markups for Bitcoin exposure."

Accelerating Premium Erosion

Structural changes in 2025 are speeding the erosion of premiums. As ETFs proliferate, Bitcoin and Ethereum ETFs are followed by SOL ETF (expected in H2 2025) and XRP ETF (expected in 2026). More competitors are emerging as successful models are proven, and the Trump administration's comprehensive crypto law has completely improved the environment for institutional direct investment.

The only sustainable component of any premium is ecosystem-specialized profits. Validator operations by SOL Strategies (annual 5–8% staking yield), Metaplanet's options strategy, and additional yield via DeFi participation are key. If supplementary returns reach 5–10% annually, a 50–100% premium is justifiable.

Investment Strategy and Conclusion

2025 Investor Dilemma

- Ultra-short term (H2 2025): Temporary premium may persist due to Trump policies, but volatility will be severe

- Short term (2025–2026): Premiums begin collapsing amidst an ETF approval rush; "value trap" risk increases sharply

- Mid-to-long term (2027 onward): Premiums mostly vanish, leaving only ecosystem-driven firms with limited survivability

Exchange-Specific Considerations

- NASDAQ listings: High liquidity and institutional accessibility, options trading possible, but regulatory risk and tax complexity are drawbacks; suitable for large institutions and safety-seeking investors

- CSE listings: Crypto-friendly regulation and relative undervaluation are strengths, but low liquidity and limited institutional participation are negatives; suited for small-scale and high-growth-seeking investors

- TSE listings: Access to the Asian market and yen-hedge benefits, but extreme premiums and high volatility are negatives; suitable for Japanese residents and yen-hedge investors

2025 Tailored Strategies

Early Differentiation Models: In 2025, transition from mere holding to ecosystem-specialized profit models is essential

Recalibrate Entry Timing: 400–500% premiums are extremely risky; wait for entry below 100%

Phased Exit Preparation: Take profits in phases before the H2 2025–2026 ETF rush

Hedging Strategies a Must: Prepare for premium collapse by using short selling or put options

Core Warnings and Reassessment of Investment Risks

2025 marks an inflection point in cryptocurrency Treasury Strategy. Scarcity and accessibility premiums are vanishing rapidly, and even leverage effects are becoming limited. The current 150–500% premium is expected to rapidly converge to 20–50% in 2025–2026 as the ETF rush unfolds.

In particular, extreme premiums of 400–500% are considered uninvestable, and investors should treat the "premium collapse" risk as a core factor.

Post-2025 Survival Conditions

The simple holding model will quickly become obsolete after 2025. Only a handful of companies generating ecosystem-specialized revenue are expected to maintain a limited premium of 50–100%. Only companies creating continuous added value within each blockchain ecosystem may remain competitive in the ETF era, and even these players are likely to enjoy only modest premiums after 2027.

■ Profile of Seojoon Kim, CEO of Hashed

△Early graduation from Seoul Science High School

△Graduated from POSTECH, Computer Science Department

△Nori Chief Product Officer (CPO) and co-founder

△CEO of Hashed

△Venture Partner at SoftBank Ventures

△Advisor, National Assembly Special Committee on the Fourth Industrial Revolution

△Member, Ministry of Education's Future Education Committee

The views expressed by outside contributors do not necessarily reflect the editorial stance of this publication.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)