Summary

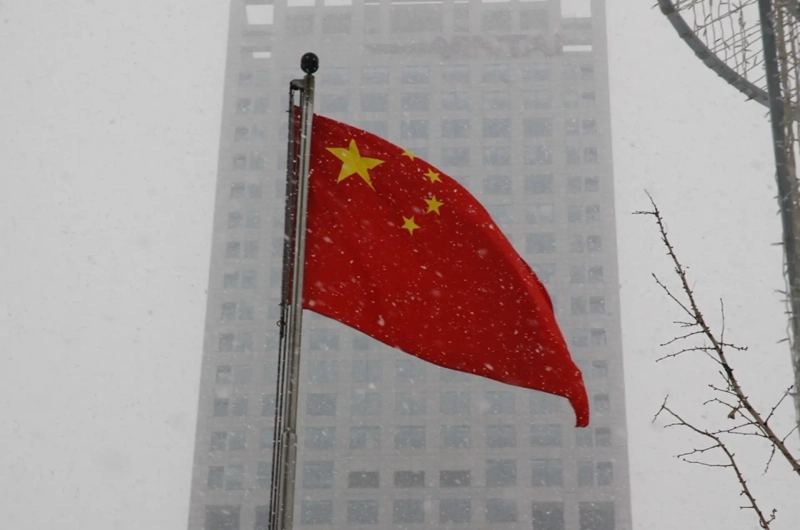

- The Producer Price Index (PPI) for the People's Republic of China has fallen for 32 consecutive months, indicating deepening manufacturing recession and structural demand contraction.

- The Consumer Price Index (CPI) has also declined for four consecutive months, raising persistent concerns about deflation.

- Despite government stimulus measures to boost consumption, continued price drops amid the triple whammy of the U.S.-China trade conflict and sluggish real estate market suggest the deflationary trend persists.

Manufacturing Slump... Deflation Concerns Mount

The Producer Price Index (PPI) for the People's Republic of China has declined for 32 consecutive months, indicating a prolonged downturn across the manufacturing sector. Despite the government rolling out various stimulus measures to boost consumption, continued price drops are fueling growing concerns about deflation.

On the 9th, the National Bureau of Statistics of the People's Republic of China announced that the May PPI fell by 3.3% year-on-year. This decline is steeper than April (-2.7%) and fell short of the market expectation (-3.2%) compiled by Reuters. This figure marks the sharpest drop in 22 months and demonstrates that the Chinese industrial sector is facing simultaneous structural demand contraction and supply glut pressures.

The People's Republic of China's Consumer Price Index (CPI) also shows no signs of recovery. May's CPI declined by 0.1% compared to the same month last year, marking four consecutive months in the negative. The rate of decline is the same as in March and April.

Reuters reported, "As the world's largest manufacturer, the People's Republic of China is facing a triple threat: tougher U.S. tariffs, a sluggish real estate market, and shrinking domestic consumption," adding, "Although U.S.-China trade talks are scheduled to resume, continuing uncertainty is intensifying price competition among export companies." The agency further noted, "While the Chinese authorities are implementing various stimulus programs for consumption, such as the ‘replace old products with new ones’ initiative, the ongoing sluggish real estate market and continued U.S.-China conflict are maintaining downward pressure on prices."

Teresa Teng, chief statistician at the National Bureau of Statistics, stated, "Some sectors are sensing positive changes, such as an improvement in supply-demand imbalances."

Hyein hey@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.