Editor's PiCK

[Today's Global Trending Coins] Ethereum, Bitcoin, Irisnet and More

Summary

- Ethereum is reported to be attracting key investment interest, continuing both a price surge and net inflow into US spot ETFs.

- Bitcoin is noted for surpassing $110,000, resuming net ETF inflows, and an increase in the Coinbase premium, indicating sustained US investor buying activity.

- Plasma is signaling increased investment demand, bolstered by the surge in deposits from its token sale and the growing stablecoin market.

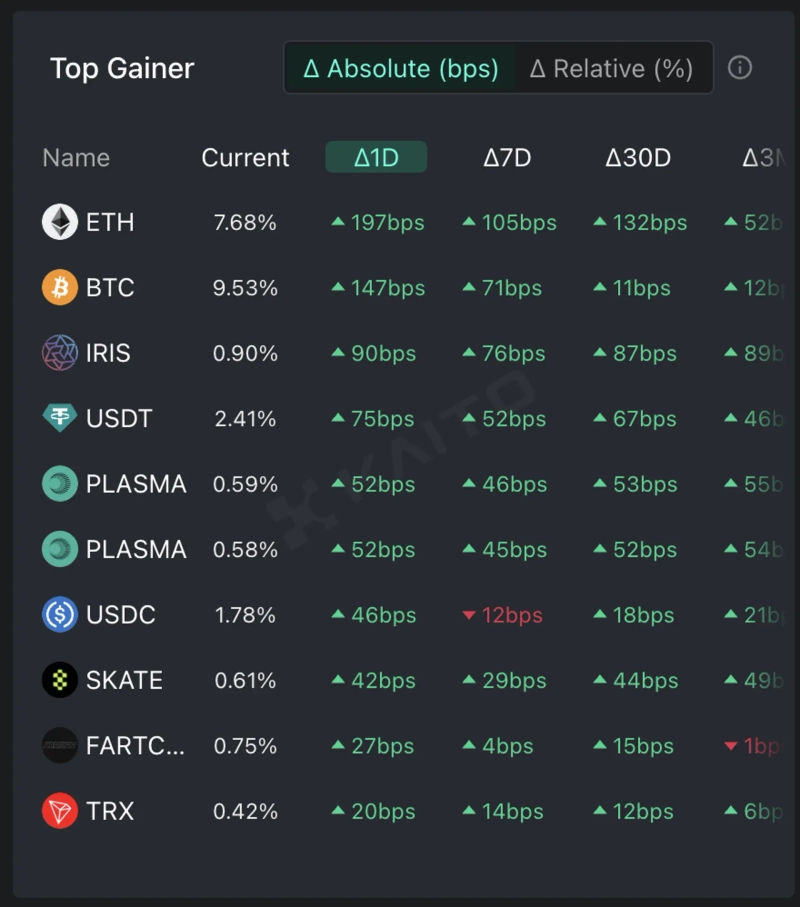

According to Kaito, an AI-powered web3 search platform, and its Token Mindshare (an index that quantifies a specific token’s influence within the virtual asset market), as of the 10th, the top 5 most trending keywords related to virtual assets are Ethereum (ETH), Bitcoin (BTC), Irisnet (IRIS), Tether (USDT), and Plasma (PLASMA).

Ethereum garnered investor attention with a price surge on this day. As of the afternoon, Ethereum was trading at around $2,686 on CoinMarketCap, up about 7.8% from the previous day. Inflows into US spot Ethereum ETFs also continue. According to Trader T, the US Ethereum ETF saw 16 consecutive trading days of net inflows as of the previous day (the 9th). Cointelegraph reported, "If Ethereum maintains stability above the key $2,570 level and sustains momentum, there is potential for it to rise to between $3,100 and $3,600."

Bitcoin also drew attention by surpassing $110,000 on this day's rally. It’s the first time Bitcoin has crossed $110,000 in about two weeks since the end of last month. As of the afternoon, Bitcoin is trading at around $109,463 on CoinMarketCap, up about 3.6% from the previous day. The US spot Bitcoin ETF recorded a net inflow of $385 million on this day, returning to net inflows for the first time in three trading days. Crypto Dan, a columnist at CryptoQuant, analyzed, "The Coinbase premium has been gradually increasing, which shows that US investors’ buying demand is providing support," adding, "This is a typical pattern seen after a correction during an upward cycle."

Irisnet’s trading volume surged, seemingly leading to an increase in its online mentions. According to CoinMarketCap, as of this day Irisnet’s trading volume was about $366,000, up approximately 28% from the previous day. As of the afternoon, Irisnet was trading at around $0.0012 on CoinMarketCap, up about 2.3% from the previous day.

Tether drew attention recently due to interest in an IPO by its issuer. Previously, on the 8th, John Ma Artemis, the founder, valued Tether at $515 billion. In terms of market capitalization, this places Tether at 19th globally, ahead of Coca-Cola and Costco. However, Paolo Ardoino, Tether’s CEO, stated in a community post on the 9th that "there is no need for an IPO." Meanwhile, US federal prosecutors indicted the Russian CEO of a crypto payment firm for embezzling $500 million using Tether—the news also influenced the uptick in Tether’s online mentions.

Plasma gained attention on the previous day (the 9th) by raising $500 million in deposits through a token sale. Plasma is a project developing a blockchain optimized for stablecoins, with the goal of driving transaction fees to ‘zero’ in stablecoin transactions. Initially, Plasma aimed for $50 million in deposits with this token sale, but explosive demand led to actual deposits reaching 10 times that amount. CoinDesk reported, "The total supply of stablecoins has surpassed $250 billion, establishing itself as the mainstream of the crypto industry," adding, "Plasma’s fundraising is a market signal of the growing investment demand for stablecoins."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)