Summary

- It was reported that the US stock market has returned to an upward trend thanks to a mutual tariff adjustment agreement between the United States and China.

- J.P. Morgan stated that the US S&P 500 index could rise up to 6170 in the short term.

- It was reported that the US-China tariff agreement has led to diminished recession risks and growing expectations for increased corporate earnings.

Market Stabilized by Tariff Agreement with China

J.P. Morgan: "S&P 500 could reach 6170 at peak"

The United States stock market is rebounding, shaking off the shock from the tariff war. With the agreement on tariff adjustments between the United States and China, there is growing anticipation that the US stock market could quickly head toward its previous highs.

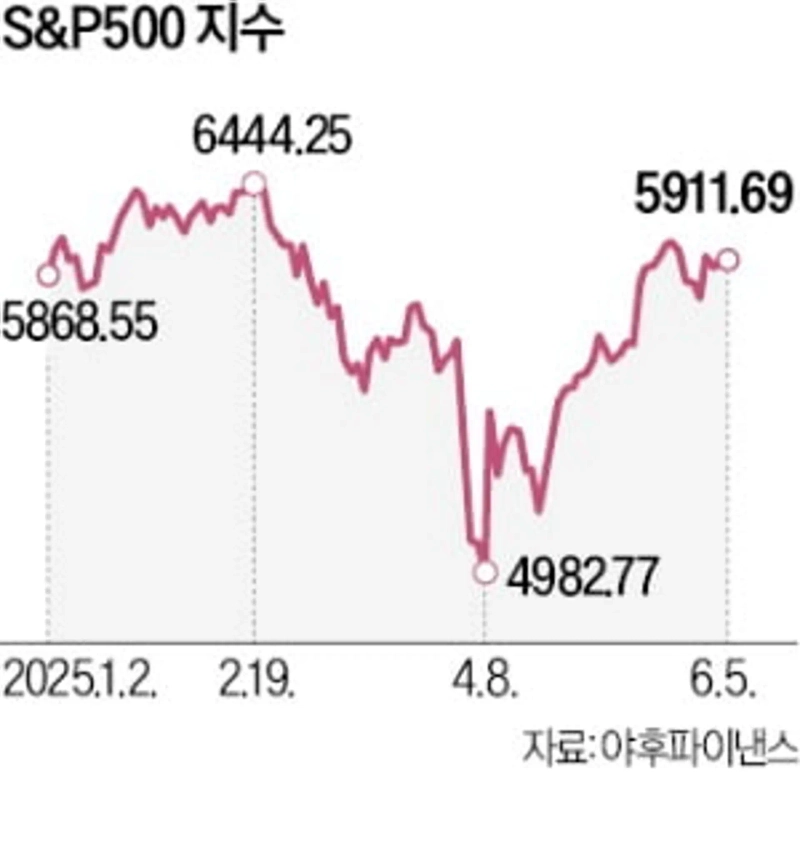

According to Investing.com on the 10th, the S&P 500 index in the United States had risen 0.74% through last month compared to the start of the year. Due to President Donald Trump's tariff policies, the index at one point last month had fallen by as much as 15.28% from the beginning of the year, but most of the loss was recovered.

The mutual tariff adjustment agreement between the United States and China led to market stabilization. The United States decided to lower additional tariffs on China from 145% to 30%. China also agreed to reduce tariffs on the United States from 125% to 10%. The period for the tariff reduction is set at 90 days. An asset management firm representative said, "The fact that the market immediately regained its position once some tariff uncertainty was lifted means that global investment sentiment toward US stocks is still alive."

Experts expect that the nature of the tariff war now resembles the first Trump administration, so the market may move in a similar fashion. Lee Euntaek, a researcher at KB Securities, said, "During Trump's first term, after the 90-day grace period in the US-China tariff war, the S&P 500 kept climbing until it reached record highs," adding, "Once the market nears previous highs, pessimists lose ground and optimism dominates." The previous high of the S&P 500 is 6144.

Optimism is also spreading on Wall Street. The investment bank J.P. Morgan stated in a memo to clients, "The US stock market is climbing out of the black hole and is now positioned to rise gradually," and predicted, "The S&P 500 index could reach between 6125 and 6170 in the short term." Goldman Sachs also raised its 3-month target for the S&P 500 index from 5700 to 5900, citing the US-China tariff agreement easing recession risks and improved corporate earnings. Oh Han-bi, a researcher at Shinhan Investment Corp., commented, "Stocks like Palantir and NVIDIA are likely to lead the market even amid renewed volatility."

By Maeng Jin-gyu maeng@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.