Bank of Korea warns: "Republic of Korea's potential growth rate drops 6%p over 30 years... three times that of Japan"

Summary

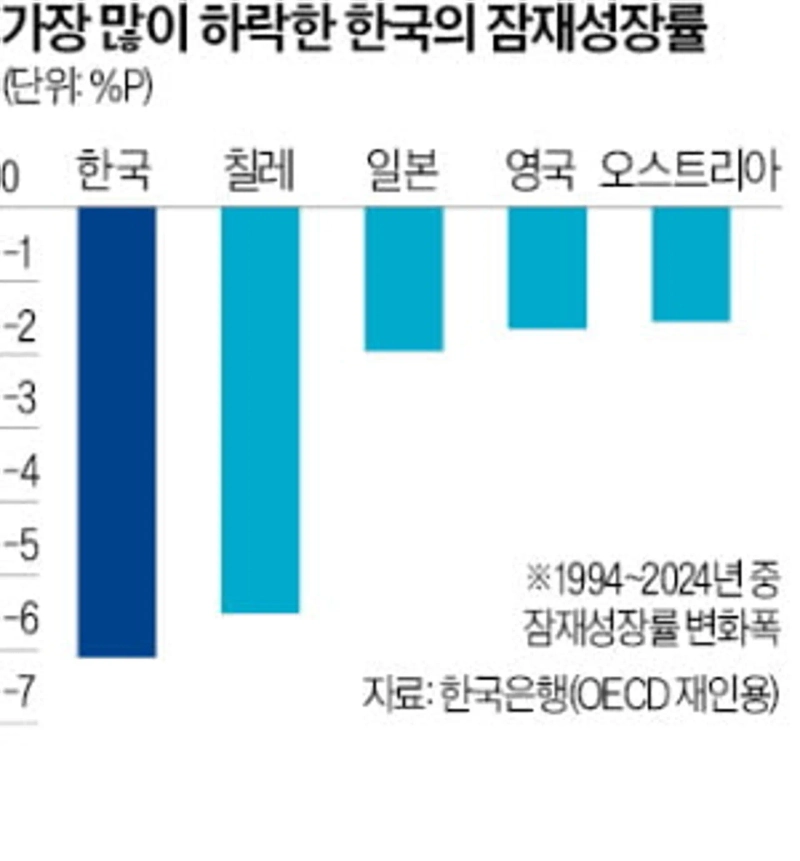

- The Bank of Korea diagnosed that the potential growth rate in Republic of Korea is falling faster than any other OECD country.

- It stated that the possibility of quarterly negative growth has tripled compared to 10 years ago.

- They emphasized the need for improving the corporate investment environment and structural reform for sustainable growth.

Population decline makes Republic of Korea the most serious case among major countries

"Foster innovative companies and utilize foreign workforce"

The Bank of Korea has diagnosed that the pace of decline in the Republic of Korea’s potential growth rate is the steepest among Organisation for Economic Co-operation and Development (OECD) countries. It was analyzed that as the potential growth rate falls, the possibility of quarterly negative growth has tripled compared to 10 years ago. The Bank of Korea urged structural reforms, referencing cases in the United States of America, Australia, and United Kingdom, which succeeded in reversing their potential growth rate declines.

Bank of Korea warns: "Republic of Korea's potential growth rate drops 6%p over 30 years... three times that of Japan" On the 10th, the Bank of Korea issued two reports: ‘The rapid deterioration in our economic fundamentals requires structural improvement’ and ‘Increasing frequency of negative growth recently, urgent structural reform along with business cycle responses.’ The Bank of Korea viewed a 6%-point drop in Republic of Korea's potential growth rate over the past 30 years as the most severe among OECD countries. Republic of Korea's potential growth rate was close to 8% in 1994, but now falls below 2%. The next largest decline was Chile, with a fall of 5.5% points during this period, and Japan followed with -1.8% points.

The potential growth rate is an economic indicator that shows a country’s fundamental strength, meaning the maximum growth rate achievable using labor, capital, and productivity without igniting inflation. Generally, as an economy grows in scale, its rate declines, but for Republic of Korea both the magnitude and speed of the drop were particularly pronounced. Even when examining the change in potential growth rate during the period when per capita gross domestic product (GDP) increased from $30,000 to $40,000, Republic of Korea’s rate dropped by approximately 1.4% points, making it the steepest decline. In contrast, the United States of America, Netherlands, and Canada saw their potential growth rates rise during this period.

The sharp fall in Republic of Korea's potential growth rate was most influenced by population decline. In contrast, the United States of America saw its population and investment increase, boosting productivity and rebounding the potential growth rate.

As the potential growth rate plummeted, the likelihood of quarterly negative growth in Republic of Korea also increased. According to the Bank of Korea’s analysis, the probability of negative growth rose from 4.6% in 2014 to 13.8% last year—a threefold increase. The amplitude of business cycle–driven growth rate fluctuations did not change significantly, but since the benchmark potential growth rate dropped, negative growth was recorded more frequently.

The Bank of Korea emphasized, "It is necessary to actively respond to the decline in the working-age population through improvement of the corporate investment environment and fostering innovative companies to enhance productivity, as well as increasing the birth rate and utilizing foreign labor." It also stressed, "Bold structural reforms are needed for sustainable growth."

Jin-Kyu Kang, reporter josep@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.