Summary

- It was reported that Ethereum (ETH)'s recent price rally was led by the perpetual futures market and leveraged trading.

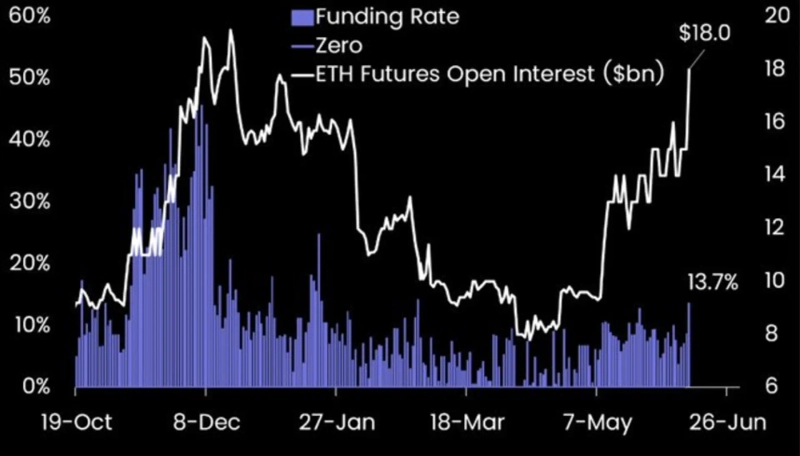

- Ethereum's open interest (OI) and funding rate have each reached levels close to the December high and the highest since February, respectively.

- The Ethereum derivatives trading volume surged 38% in 24 hours, surpassing Bitcoin, and it was noted that risk has risen due to the leverage-fueled surge.

An analysis suggests that the price increase of Ethereum (ETH) has been led by the perpetual futures market rather than the spot market.

On the 10th (local time), Matrixport stated in a report, "The current Ethereum rally is based on leveraged futures trading, not spot trading," adding, "Ethereum open interest (OI) is close to its high from December last year." They further mentioned, "The Ethereum funding rate has also surged to 13.7%," noting that, "This is the highest level since February."

However, since this sharp rise is driven by leverage, the risks have also increased. The report explained, "Demand for Ethereum call options has also increased significantly. As a result, Gamma Hedging is occurring, which is creating serious gap risk." The report continued, "This contrasts with Bitcoin (BTC), which continues to rise based on spot demand."

Meanwhile, according to The Block, a media outlet specializing in digital assets (cryptocurrencies), Ethereum derivatives trading volume jumped 38% over the past 24 hours to reach $110 billion, significantly outpacing Bitcoin derivatives trading volume.

As of 4:12 PM, Ethereum is trading at $2,798 on the Binance USDT market, up 4.76% from 24 hours ago.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

![Trump ally Myron, a Fed governor, resigns White House post…pushing for rate cuts until Warsh arrives? [Fed Watch]](https://media.bloomingbit.io/PROD/news/75fa6df8-a2d5-495e-aa9d-0a367358164c.webp?w=250)