Editor's PiCK

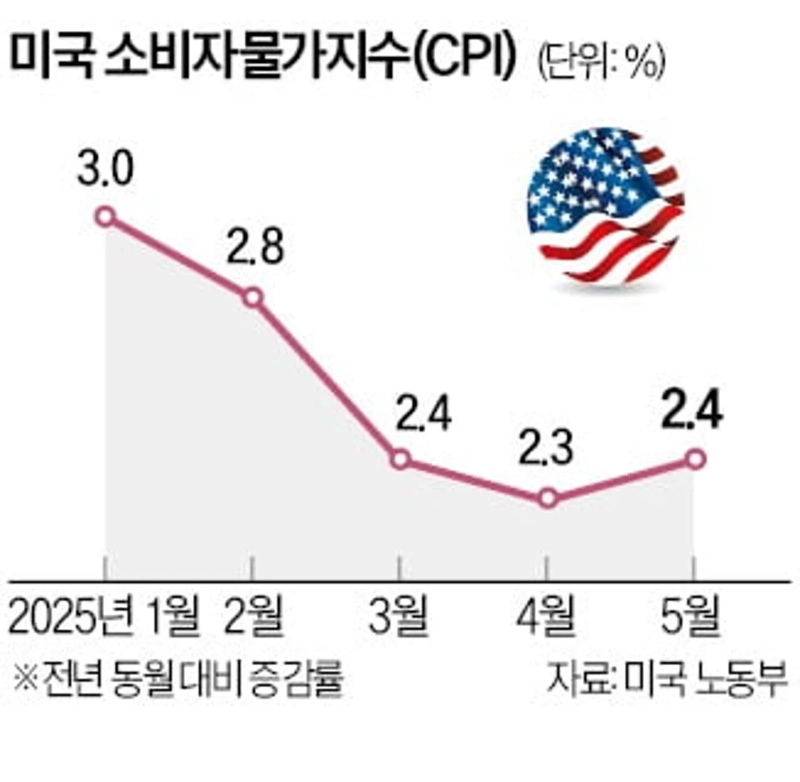

U.S. May CPI up 2.4%, slightly below expectations…No 'Tariff Shock'

Summary

- In May, the U.S. Consumer Price Index (CPI) rose by 2.4%, slightly below expert expectations.

- Despite the Trump administration’s policy of high tariffs, the rate of price increases remained mild, easing market concerns.

- In the interest rate futures market, there is a 99.8% probability that the FOMC meeting on the 18th will result in no change to the policy rate.

Next week, FOMC likely to hold rates steady

The U.S. consumer price inflation rate in May saw a slight increase. Despite the Trump administration’s high-tariff policies, the increase was not as significant as experts originally feared.

On the 11th, the U.S. Department of Labor announced that the May U.S. Consumer Price Index (CPI) rose 2.4% compared to the same month last year. This is a slightly larger increase than in April (2.3%). However, it fell short of the expert projection (2.5%). On a monthly basis, CPI increased by 0.1%, also below expectations (0.2%).

Excluding the volatile energy and food sectors, core CPI rose 2.8% year-on-year and 0.1% month-on-month. Both annual and monthly increases in core CPI were below market expectations.

Analysts focused on May’s inflation data ahead of the Federal Open Market Committee (FOMC) meeting on the 18th. This was due to speculation that the impact of the Trump administration’s tariff policies would be reflected. President Trump announced reciprocal tariffs by country for trade partners worldwide on April 2. However, following a U.S.-China agreement to significantly lower tariffs for 90 days, the inflationary effect was expected to be less severe than initially feared.

Reuters analyzed that, despite the imposition of high tariffs by the Trump administration, most retailers were selling inventory stockpiled before tariffs, resulting in a slow response from U.S. consumer prices. Economists further noted that inflation is expected to accelerate in the second half of this year.

Amid continuing tariff policy uncertainty and concerns about the fiscal deficit, the Federal Reserve (Fed) is gaining support for the possibility of a rate cut after the second half of the year. According to CME FedWatch, the interest rate futures market sees a 99.8% chance that the policy rate will be held at 4.25–4.5% at the FOMC meeting on the 18th.

Sangmi Ahn, saramin@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.