Editor's PiCK

Despite 'tariff shock', inflation rises only 'moderately'... Powell faces growing dilemma [Fed Watch]

Summary

- Despite U.S. tariffs, the recent consumer price inflation rate lagged expectations, which could be viewed positively by investors.

- Market expectations for a rate cut are rising, and the federal funds futures market now assigns the highest probability to two cuts within this year.

- Forecasts suggest that a rate cut could be postponed until at least July, and uncertainty over Powell as chair may further influence investors.

Trump presses: "Must cut by 1%P"

Citing next Fed chair to shake Powell

Last month, the increase in consumer prices fell short of expectations, easing concerns about inflation triggered by tariffs. The consumer price index announced on the morning of the 11th (local time) showed a 2.4% increase year-over-year. The U.S. central bank (Fed) had forecast that tariffs would push up prices, but this has not materialized yet. As calls for rate cuts grow louder, the Fed's worries are deepening.

Looking at the price data for the day, prices of items expected to be affected by tariffs—such as automobiles and clothing—did not rise but instead fell. Some categories, including home appliances, auto parts, and audio equipment, did see price increases. Overall, however, the scale of the increase was smaller than expected.

However, it remains unclear whether this can be interpreted as tariffs having little impact. First, it appears that companies stocked up on inventory in advance of tariff hikes. Also, as consumer sentiment has weakened, companies are reportedly hesitant to raise prices easily. Some say that May data is too early to fully gauge tariff effects.

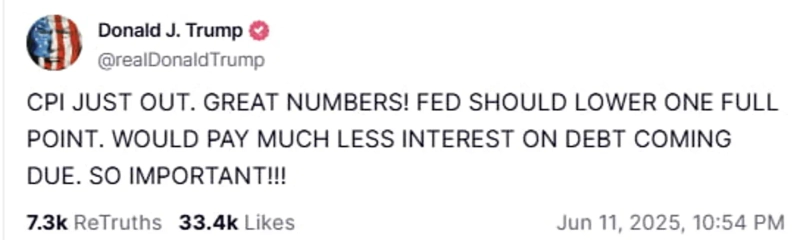

In any case, the unexpected data immediately intensified pressure to cut rates. President Trump immediately posted that the Fed should lower rates by 1 percentage point. His reasoning is that doing so would reduce interest payments for all economic participants.

Currently, the federal funds futures market indicates that the odds are highest for two more cuts totaling 0.5 percentage points by December. This would imply an even greater reduction than currently projected. The Wall Street Journal reported that unless inflation rises strongly through summer or early fall, the Fed is expected to cut rates further in the second half of the year.

However, it is unlikely that participants will immediately cut rates at next week's FOMC. Even after the CPI figures, the probability of a cut reflected in futures is only 0.2%. Given remarks by Fed officials that they'll watch until July, a likely timing for rate cuts would be sometime after September.

Meanwhile, attention is also increasing over the next Fed chair. Previously, President Trump stated that Powell is acting too slowly and expressed intent to nominate a successor in advance. Yesterday, Bloomberg News reported that Treasury Secretary Besant is being mentioned for the role, drawing attention. Although the White House immediately denied it, attempts to undermine Powell now appear to be in full swing.

Washington=Lee Sang-eun, correspondent selee@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.