"Bitcoin Options Market 'Calm'... On-chain Indicators Suggest 'Calm Before the Storm'"

Summary

- It was stated that low volatility is observed in the Bitcoin options market.

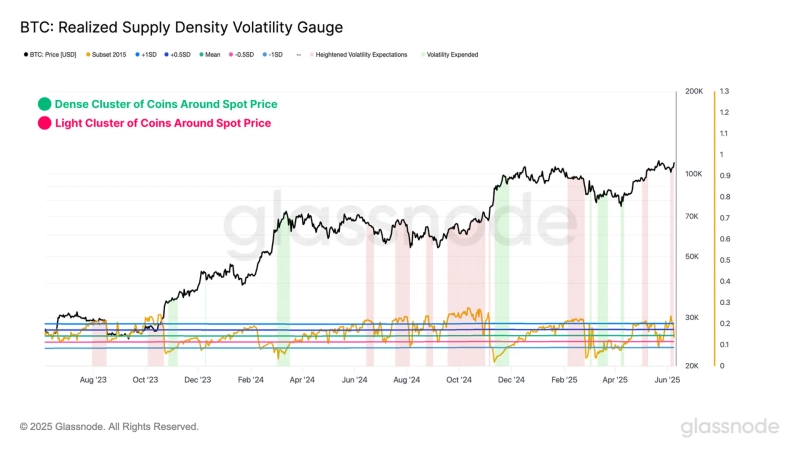

- On-chain indicator Realized Supply Density suggests rising market sensitivity and the potential for increased short-term price volatility.

- Glassnode assessed that complacency about volatility in the options market could actually signal upcoming heightened volatility.

While the Bitcoin (BTC) options market is reflecting low volatility, on-chain indicators are warning that the likelihood of short-term price swings has increased.

According to NewsBTC, a cryptocurrency-focused media outlet, on the 12th (local time), on-chain analysis firm Glassnode cited 'Realized Supply Density' data in its weekly research report, stating, "Currently, the market sensitivity of Bitcoin is increasing," and added, "Even minor price movements could affect a large number of investors, increasing the likelihood of expanded volatility."

The report said this indicator has shown a steady rise over the past few weeks.

In contrast, the options market is showing the exact opposite trend. On this day, the implied volatility (IV) of Bitcoin options showed a downward trend across many segments, suggesting that market participants do not expect significant volatility for now.

Glassnode noted, "This kind of 'complacency about volatility' has historically served as a sign of upcoming increased volatility," and assessed that, "There is currently a phase in which on-chain data and options market expectations are in conflict."

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)