Hidden $80 Trillion Debt... 'Financial Time Bomb' in the FX Swap Market [Global Money X-File]

Summary

- There are concerns that the global FX swap market could become a financial crisis trigger due to a hidden debt of $80 trillion.

- An analysis indicates that non-bank financial institutions hold debt not reflected on balance sheets, limiting actual risk management and the government's monitoring capabilities.

- While South Korea's FX liquidity in the banking sector is sound, the surge in FX swap transactions by non-banking institutions like the National Pension Service and insurance companies poses a risk to financial market stability.

There are concerns that the rapidly expanding global foreign exchange (FX) swap market could serve as the detonator for a worldwide financial crisis. An analysis highlights that non-bank financial firms borrowed the related $80 trillion in debt, but since it is not recorded as liabilities on their balance sheets, the level of risk is high.

What is happening?

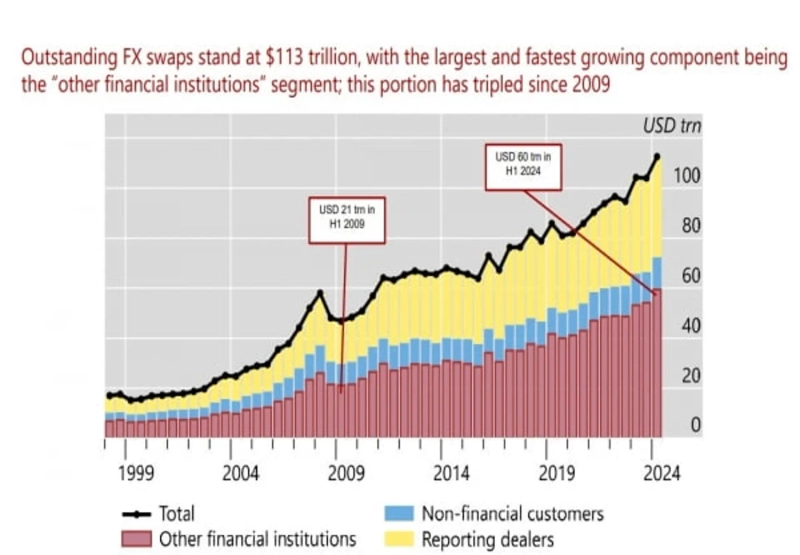

Shin Hyun Song, Head of the Monetary and Economic Department at the Bank for International Settlements (BIS), warned last month that there are significant risks in the foreign exchange (FX) market. He pointed out that the total volume of FX swaps, forward contracts, and currency swaps worldwide is $113 trillion—a massive figure. Of this, $80 trillion is said to be hidden debt belonging to investors (non-bank financial institutions). In the event of a financial crisis, everyone may rush to obtain dollars all at once—a phenomenon known as a 'dollar scramble.'

What is invisible dollar debt?

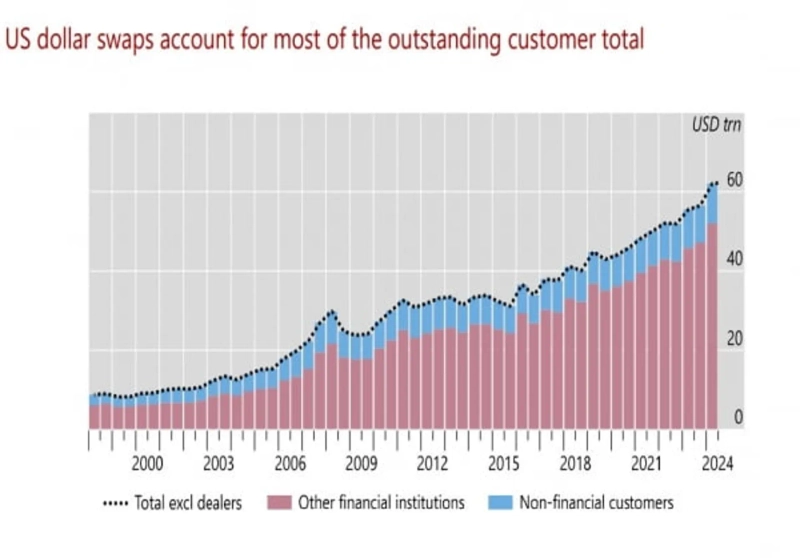

A foreign exchange (FX) swap is a transaction where two currencies are exchanged at a predetermined rate and then exchanged back at a later date. The debt arising from this is not recorded as a standard loan but is classified as a derivative, meaning it does not clearly appear in financial statements. In reality, it has the same effect as borrowing dollars. However, since it does not appear on financial statements, the true scale of the debt is not easily visible. This makes it difficult even for governments to pinpoint the exact situation. According to BIS data, recent FX derivatives transactions have surged to a record $130 trillion, of which 88% are tied to dollar trades.

Why is the 'dollar scramble' dangerous?

FX swaps and forward contracts usually have extremely short maturities—just 3 to 6 months. Normally, when a contract matures, it can be rolled over with a new one. However, if a financial crisis hits, trust in the industry can collapse, and everyone may attempt to secure dollar cash at the same time.

This happened during the 2008 global financial crisis and the 2020 COVID-19 crisis. At that time, dollar funding costs soared in South Korea, causing the won-dollar exchange rate to spike. The BIS has warned that the current situation could be similarly dangerous. There are also concerns that, unlike in the past, central banks cannot supply dollars as easily, so a crisis could spread even more quickly.

How did the FX swap market grow?

The global financial system changed after the 2008 crisis. Before the crisis, banks directly held mortgage loans and corporate bonds, making it relatively easy to track risks (leverage = growth in bank assets). After the crisis, the scale of funds and insurers buying and holding government bonds greatly increased, and the share of banks decreased. As invisible debts (risks) rose, it became harder for governments to monitor the entire picture.

Government debt has started to accumulate faster than private debt. Instead of borrowing from banks, 'issuing and selling bonds' has become commonplace. As governments also jumped in, the bond market has grown overwhelmingly large. Non-bank investors, now major players in the bond market, must hedge 'currency risk' when investing in overseas government bonds—most easily through short-term FX swaps. Outstandings have surged from $21 trillion in 2009 to $60 trillion in 2024, a threefold increase in just five years.

What is the situation in Korea?

Korea is considered to be more stable than in the past. The banking sector’s short-term foreign debt ratio and FX liquidity conditions are favorable. However, risks remain high for non-bank institutions like insurance companies and the National Pension Service. These institutions manage currency risk for overseas investments via forward or swap transactions. Should financial markets destabilize, they could simultaneously rush to secure dollars, shaking up the market.

Korea faces increased potential risk in a crisis because the National Pension Service invests heavily overseas, and insurers use a large volume of short-term FX transactions. For this reason, the Bank of Korea has even signed a $6.5 billion dollar supply swap line agreement with the National Pension Service.

Reporter: Kim Joo-wan kjwan@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.