Editor's PiCK

Over $1 Billion in Futures Positions Liquidated Following Israel’s Preemptive Strike

YM Lee

Summary

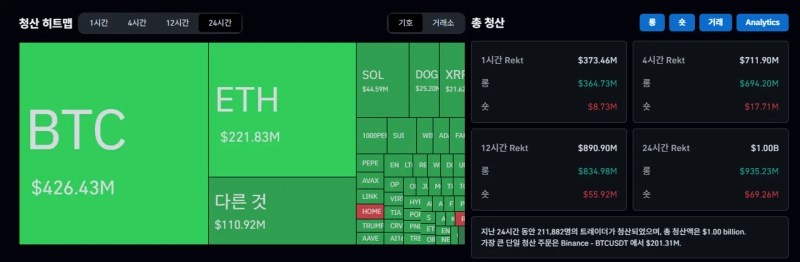

- It was reported that the virtual asset futures market plunged due to Israel’s preemptive strike.

- It was stated that the size of liquidated futures positions reached approximately $1 billion over the past 24 hours.

- The amount of long position liquidations stood overwhelmingly at $935 million, with Binance recording the most liquidations.

As Israel launches a preemptive strike against Iran and Middle Eastern tensions escalate, the virtual asset (cryptocurrency) futures market has experienced a sharp downturn.

According to CoinGlass data on the 13th (local time), the total amount of liquidated cryptocurrency futures positions in the past 24 hours reached approximately $1 billion, with $935 million in long positions (buy) and $69.26 million in short positions (sell).

Binance saw the highest share of liquidations, totaling $428.6 million, followed by Bybit ($320.8 million) and OKX ($110.43 million).

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)