Editor's PiCK

Financial Market Impact of the 'Israel-Iran Conflict'... 3 Scenarios [Global Money X-File]

Summary

- If the Israel-Iran conflict remains localized, financial markets are expected to exhibit safe-haven preference and risk asset adjustment, with shocks being limited and short-lived.

- If the conflict expands to the greater Middle East, the report predicts sharp rises in oil and gold prices, global stock corrections, and weakening of emerging market currencies, resulting in intense volatility and prolonged market aftereffects.

- Should a full-scale war and U.S. intervention occur, global markets could enter a state of panic, with soaring oil/gold prices, stock crashes, and a surge in the U.S. dollar—impacts on par with the 2008 financial crisis.

After Israel bombed Iran's nuclear facilities and military leadership, clashes between the two countries continued to intensify. Immediately following news of the strike on June 13, global financial markets displayed strong risk-aversion behavior. Price volatility surged across major asset classes such as equities, commodities, and currencies.

Due to a preference for safe-haven assets, the volatility index (VIX) jumped by more than 15% from the previous day, exceeding 20. Right after the news coverage, major global stock indexes opened with a sharp decline, while international oil prices spiked into double-digit gains almost instantly.

On the other hand, bond markets such as U.S. Treasuries saw prices swing and strengthen. Let’s look ahead at the potential financial market implications as the situation develops. Relevant foreign media and expert opinions have been referenced.

Scenario 1: Limited Continuation of Conflict (Localized Skirmishes Only)

This scenario assumes that despite Israel’s airstrike on Iran, escalations remain within localized bounds. Iran refrains from large-scale retaliation despite leadership and nuclear facility casualties. Instead, it resorts to limited missile launches or drone attacks in response. Iranian proxy forces, such as Hezbollah in Lebanon, also hesitate to become actively involved. The conflict is contained between Israel and Iran. The United States provides intelligence and military support to Israel but avoids direct involvement and keeps its distance.

China only expresses concerns about "serious consequences" without further escalation. The assumption is that diplomatic efforts will be attempted to prevent the situation from worsening. Iran refrains from extreme measures such as closing the Strait of Hormuz. The need for continuous foreign currency income from oil exports and the desire to maintain support from allies like China work as restraining factors for Iran.

The global financial market is expected to see a typical pattern of 'increased safe-haven demand and adjustment in risk assets.' The shock is expected to be limited and short-term. In fact, immediately after Israel’s airstrike, global markets reacted within anticipated boundaries. The Wall Street Journal explained, "As expected, stock prices fell, while gold and oil rose, and Bitcoin rebounded substantially after a steep drop."

In forex, safe-haven currencies like the dollar are predicted to gain strength, while emerging market currencies weaken. On the day after the airstrike, the U.S. dollar index rose for a fifth consecutive session, whereas the Korean won declined. On June 13, the won-dollar exchange rate surged by over 16 KRW intraday (won weakening) to reach 1,371 KRW. This reflects investor preference for the dollar and other safe-haven assets due to Middle East risk. Similarly, during the Israel-Hamas conflict, both the dollar and gold strengthened.

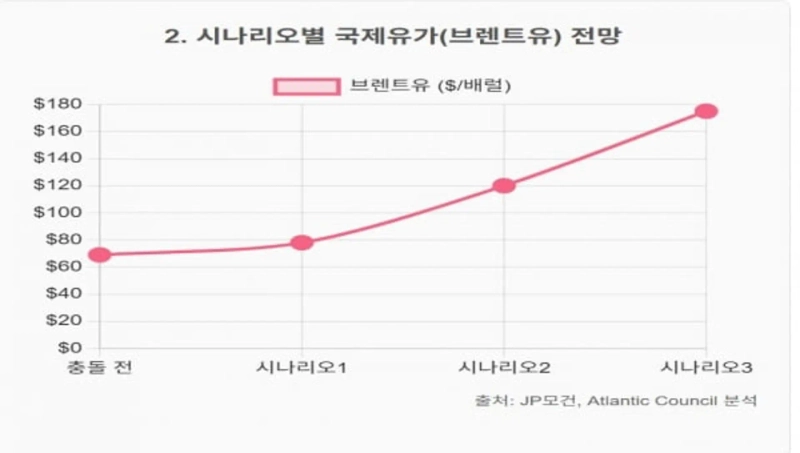

For commodities, international oil and gold prices are expected to rise, but the magnitude is limited. News of the Israel-Iran clash pushed Brent crude up as much as 13% intraday, but it stabilized around $78 per barrel. WTI July futures spiked as much as 8% intraday, surpassing $73. This marked the biggest increase since the onset of the Russia-Ukraine war in early 2022.

However, absolute prices are not yet at crisis levels. The rise is mild compared to the 1970s oil shock. Helima Croft of RBC Capital Markets assessed, "As long as Iran’s key oil facilities (such as Kharg Island) remain unharmed, the impact on oil prices will be limited."

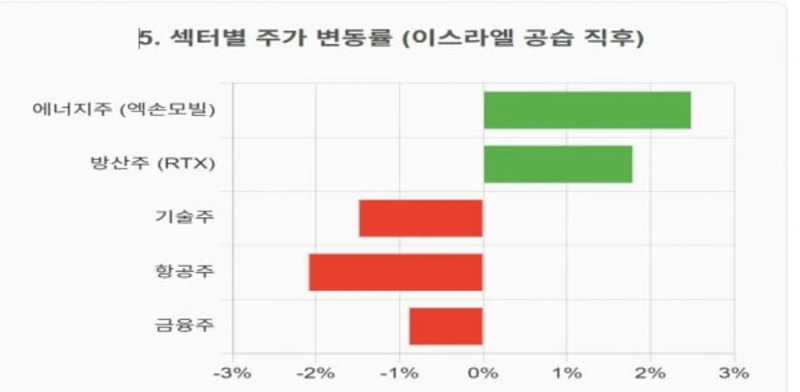

The global stock market entered a correction led by major countries. On the 13th, the S&P 500 micro futures fell up to 1.2%, and Nasdaq 100 futures plunged 1.4%. The European STOXX600 index dropped 0.8%, showing broad weakness. Korea’s KOSPI also slipped below the 2,900 mark. Growth stocks, especially in technology, took a large hit due to risk-off sentiment, while defense and energy themes showed strength.

The global bond market echoed past trends. Typically, during geopolitical crises, government bond yields in developed countries like the U.S. fall (prices rise), serving as safe-haven assets. On the 13th, the U.S. 10-year Treasury yield dropped 0.007% points to close at 4.349%. A month earlier, on May 22, it had hit 4.61%, marking a new low in a month. On the same day, the 10-year Japanese government bond yield fell 0.046%P to 1.407%, and the 30-year yield declined 0.022%P to 2.876%.

In crypto, Bitcoin and other cryptocurrencies showed initial steep drops, followed by partial recoveries and mixed trends. Traditionally, digital assets are considered high-risk, and often decline alongside stocks during market crashes. Indeed, this time Bitcoin plummeted within 24 hours to just above $102,000. Afterwards, it recovered much of the initial losses, displaying marked volatility.

This is attributed to investors initially selling cryptocurrencies for cash, but then returning to partial buying amid the perception of limited escalation. The duality of 'risk-averse vs. alternative assets' was at play, with Bitcoin standing out more as a speculative risk asset highly correlated with stocks than as 'digital gold.'

Scenario 2: Escalated Local War (Wider Conflict Involving the Region)

This scenario involves Iran announcing harsh retaliation and expanding the conflict regionally. Escalating Israeli strikes and robust Iranian responses form a vicious cycle, with the dispute spreading across the broader Middle East, including Lebanon, Syria, and Yemen. Iran orders Hezbollah to launch missile attacks on Israel, and pro-Iran militias in Iraq and Syria target U.S. bases and Israeli sites. Iran itself fires medium-range ballistic missiles at Israeli territory in retaliation.

Israel continues with 2nd and 3rd waves of attacks on military infrastructure in Iran. Iran may also consider countries like Saudi Arabia and the UAE that support Israel and the U.S. as targets, launching missile strikes on refineries or ports in those Gulf oil-producing states. With this localized escalation, the Middle East could spiral into its most complex multi-conflict since the 1973 Yom Kippur War. Still, the U.S. avoids official involvement. China and Russia offer diplomatic support to Iran, checking U.S. influence.

Global financial markets would experience greater and longer-lasting shock than in Scenario 1. There would be heightened demand for safe-haven assets, and stagflation risks would emerge from spikes in oil prices and broader economic impacts.

In forex, the U.S. dollar would surge and emerging market currencies would plunge. As risk-off trades intensify, investors would flock to the dollar, yen, Swiss franc, etc. The U.S. dollar remains the world’s main reserve and deepest safe haven. In contrast, the Korean won, Chinese yuan, and other EM currencies, as riskier assets, would come under heavy selling pressure.

The won may break well past the psychological threshold of 1,400 per dollar, with more declines possible (higher rates). Korea’s FX authorities would intervene for stability, but such efforts may be limited even at the cost of depleting reserves. The yuan may also face depreciation pressure due to China’s heavy oil imports and capital outflow.

For commodities, the jump in oil and gold may be far more pronounced. Perihan Al-Rifai, Senior Research Fellow at the Empower ME Initiative, forecast, "If Iran actually disrupts maritime traffic in Hormuz or launches strikes on oil facilities, crude prices could soar to the $120–130 per barrel range." J.P. Morgan warned, "In a worst-case scenario, U.S. CPI could rise to 5%," highlighting the $120 oil scenario. This means an additional climb of 60–70% from current levels—a true oil shock.

Still, some relief is possible from OPEC+’s spare capacity and the release of U.S. strategic reserves. Gold is also expected to gain further. Some project that it may target $4,000 per ounce from the current $3,400 area, especially if the dollar weakens and demand for gold spikes.

The global stock market would feel more risk-off pressure, potentially taking greater losses. Leading indexes in developed economies may enter a bear market with drops over 10%. U.S. and European airlines, travel, and transport stocks could be hit hard by oil spikes and war risks. Tech and consumer stocks would come under downward pressure as discount rates rise due to inflation and as growth outlooks deteriorate amid slowdown worries. Conversely, energy, defense, and commodity stocks are expected to relatively outperform.

Oil companies could see additional share price rises due to higher earnings. However, if oil prices rise too high, 'demand destruction' could eventually trigger corrections in energy stocks. Defense contractors could remain strong, as expansions in war would lead to higher military spending and weapons demand globally.

Bond markets would likely see a surge in demand for government bonds and other safe assets. U.S., German, and Japanese bond yields could fall further. Persistent oil price rises may keep inflation expectations elevated, limiting the decline in real yields—a complex setup. Corporate and EM bonds likely experience clear negative effects. The premium on emerging dollar bonds may rise, creating external funding challenges for weaker economies.

In crypto, a liquidity crunch and extremely risk-off sentiment could prompt mass selling of cryptocurrencies. If institutional investors pull out from Bitcoin ETFs, the market shock could intensify. Other factors may also play a part: Iran, being excluded from the U.S. financial system, could increase its use of crypto as a means of sanction evasion—potentially drawing greater regulatory scrutiny from the U.S. and acting as a negative factor for global crypto markets.

Scenario 3: Full-Scale War & U.S. Intervention

The worst-case scenario. A full-scale Israel-Iran military conflict erupts, and the U.S. effectively enters the fray. Iran announces a comprehensive retaliation, firing hundreds of ballistic missiles at Israeli cities and bases. The Iranian Revolutionary Guard deploys mines in the Strait of Hormuz and attempts to seize or sink oil tankers using fast boats, seeking to completely blockade the strait.

Iran also launches missile and drone strikes on U.S. bases in Bahrain, Qatar, Kuwait, and the UAE, causing American casualties. In response, the U.S., invoking defense treaties and protection of its nationals, launches mass air strikes on Iranian military facilities. Russia sharply increases weapons support for Iran, entering indirectly. China criticizes the U.S. and mounts only diplomatic campaigns internationally. Effectively, it’s a third Middle East war.

Global markets risk entering a state of panic. The shock could rival a Black Swan event, bringing market dysfunction from surging volatility and liquidity crunches.

In forex, the U.S. dollar is expected to spike. Global funds would rush into dollar assets such as Treasuries, pushing the dollar index above 120. However, as the U.S. itself becomes a wartime belligerent, long-term trust in the dollar could erode. Although mid-crisis, the traditional 'crisis = dollar preference' rule holds, prolonged involvement fueling fiscal strain may raise doubts about the dollar’s value. The euro would likely weaken against the dollar amid risk-off.

The yen could strengthen as a haven in the short run, but Japan’s energy import dependence might cause medium-term weakness if oil prices soar. EM currencies (the won, the yuan, etc.) could face compounded downward pressure versus the dollar, raising the specter of a currency crisis. During the 2008 financial crisis, the won plunged by nearly 50%.

For commodities, prices for oil and other key raw materials could hit record highs. If the Strait of Hormuz is blocked and Middle East oil facilities go offline, 20–30% of global crude supply could be paralyzed. Brent crude could surpass its 2008 peak ($147), spiking to $150–200 per barrel. Oil prices also jumped in the 1979 Iranian Revolution and 1990 Gulf War; in Scenario 3, supply losses could exceed these.

Gold could smash through $4,000 per ounce and hit record highs daily. If central banks pile in and dollar confidence is shaken, gold prices could accelerate further. Iran, as a producer of lithium and uranium, could spark rapid gains for those commodities in case of supply shortages.

In equities, mass selling could trigger share price crashes. Investors, liquidating risk positions across stocks and commodity futures, could spark 20–30% drop in major indexes in short order. There’s risk of circuit breakers being triggered, as seen during the 2008 Lehman shock or the early 2020 COVID panic. This year’s global stock run-up has left valuations stretched, making them more vulnerable to steep drops if full-scale war breaks out.

U.S. equities would see declines across the board except for energy and aerospace/defense. Tech stocks could see particularly steep corrections due to elevated valuations. Financials may drop on market instability; industrials and materials on recession fears. In emerging markets, risk of liquidity evaporating is high due to capital exodus. Korea, with its global linkage and added pressure from rising exchange rates, could plummet even faster.

In bonds, U.S. and other advanced economies’ government bond yields would drop sharply amid surging safe-haven demand. The U.S. 10-year Treasury yield could plunge from the 4% range to below 3%. There is even forecast that yields may revisit the COVID crisis lows of 0.5–0.7%. The move could be far more dramatic than during the Soleimani incident. German and Japanese bond yields could also revisit record lows.

However, the safe-haven rally is only a short-term refuge. If the war drags on, inflation and soaring government bond supply could reverse the rally into bond weakness. Should spending and inflation sap trust in the bond market, yields could rebound higher. Massive U.S. war expenditures would bloat the deficit and send bond issuance soaring.

In crypto, extreme turmoil could ensue. As liquidity evaporates, Bitcoin could tank, trading volumes could collapse, and investor sentiment would deteriorate sharply. Still, if trust in traditional financial systems erodes, Bitcoin may increasingly be viewed as an alternative store of value. If the U.S. prints dollars to fund the war, dollar inflation could boost Bitcoin’s scarcity premium.

However, Bitcoin still does not command the trust of traditional assets like gold. During the Israel-Hamas war, gold rallied while Bitcoin fell. If the war drags on and global capital movements are restricted, stablecoins could surge as a channel for sanctions evasion and capital transfer, driving their market value up as well.

Juwan Kim, Reporter kjwan@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.