China Allows Rare Earth Exports for Only 6 Months... Strategic Resource Standoff with the U.S.

Summary

- China announced it would allow rare earth exports for only 6 months in an effort to maintain control over the supply chain.

- Automotive and defense industries in the U.S. and Europe are experiencing production disruptions and surging prices due to a shortage of rare earths.

- The global industry is working to diversify rare earth supply chains, but risks remain high due to limitations in refining and recycling technologies.

U.S.-China 2nd Round of Trade Talks Held, but...

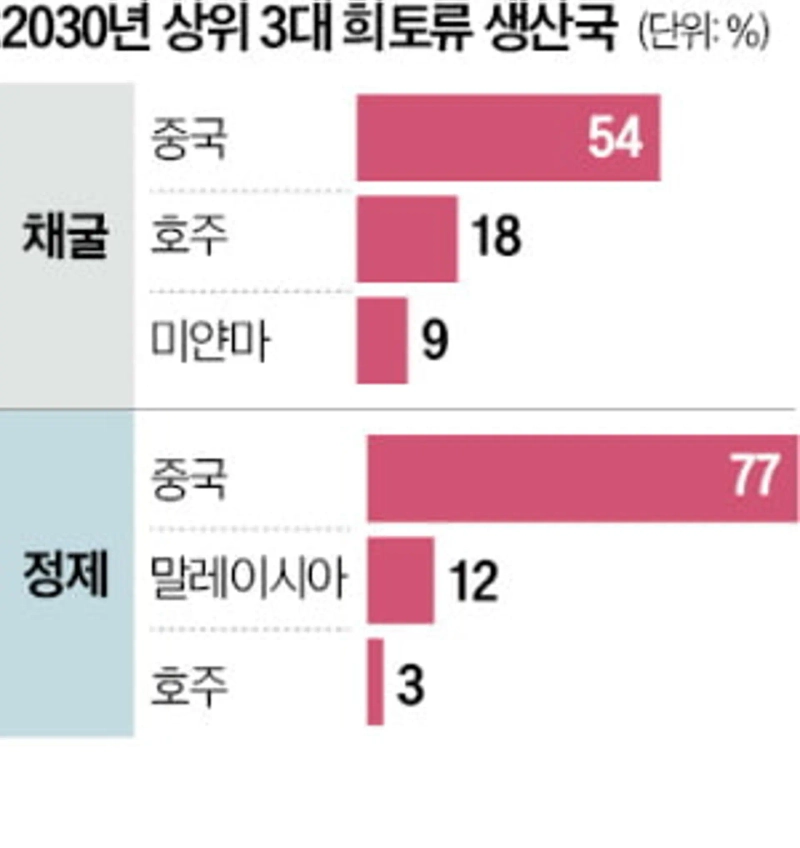

Supply Chain Control Still with China

Effectively in a State of Export Suspension

Global Auto & Defense Production Disrupted

Requests for Sensitive Company Information

Recently, rare earths have become the hottest topic in the global manufacturing industry. China restricted rare earth exports, putting the global market under widespread shock.

After negotiations with the U.S. in London, China resumed rare earth exports, but limited the permit period to 6 months. As tensions between the U.S. and China intensify, there is speculation that China may cut off rare earth supplies at any time.

◇ U.S., EU Warn: 'Could Halt Car Factories'

Since April, for a two-month period, China made prior government approval mandatory for exports of seven types of rare earths and rare earth magnets. The approval process took over 45 days, resulting in a situation that was effectively a suspension of exports.

China’s rare earth export volume was 4,785 tons in April, a sharp decrease of 15.6% compared to the previous month. It was also reported that there was no significant rebound in May.

As supply disruptions became entrenched, automakers’ stockpiles began to run out. The German Association of the Automotive Industry (VDA) stated in a press release earlier this month, “Production schedules across Germany are being affected by delays in rare earth export permits.”

Bajaj Auto, India’s largest electric vehicle manufacturer, stated, “We have no choice but to adjust factory operating rates,” and Japan’s Suzuki temporarily halted some of its assembly lines for the Swift Hybrid model.

The crisis also hit the U.S. industry. Last month, the Alliance for Automotive Innovation (AAI) sent a confidential letter to the Trump administration saying, “Shortages of rare earths could halt U.S. vehicle assembly plant operations.” They explained that disruptions had already occurred in the production of key components such as transmissions, motors, seat belts, lighting, and cameras. Ford, Toyota, Stellantis, BMW, and Hyundai Motor Company are all members of AAI.

A turning point was set amid this situation. Senior delegations from the U.S. and China held the second round of trade negotiations in London on the 9th and 10th. President Trump posted on social media, “China will supply all the rare earths needed first.”

However, China limited the rare earth export permit period for U.S. companies to 6 months. A source involved in the U.S.-China negotiations said, “China is trying to maintain control over rare earths so it can secure favorable ground in future talks.”

Gracelin Baskaran, Director of the Critical Minerals Security Program at the Center for Strategic and International Studies (CSIS), said, “China wants to maintain leverage,” and noted, “Since any deal could be broken at any time, U.S. companies remain directly exposed to risk.”

◇ Rare Earth Risks Spread Across High-Tech Industries

The rare earth supply shock was not limited to the automotive sector.

China Allows Rare Earth Exports for Only 6 Months... Strategic Resource Standoff with the U.S. The humanoid robot 'Optimus', developed by Tesla, uses over 2kg of rare earths just in the permanent magnets for its drive motors. Elon Musk, the CEO of Tesla, stated in the first-quarter earnings call, “Production plans for the humanoid have been delayed due to issues sourcing rare earth magnets.”

The defense industry is even more sensitive. Most of the rare earths essential for high-power radar for fighter jets, missile guidance systems, and small satellite drive units are sourced from China. Last month, the U.S. Department of Defense announced plans to expand rare earth stockpiles, while the Japan Ministry of Defense urgently allocated a budget for developing alternative materials to reduce the use of Chinese rare earths in sensitive equipment.

An industry official stated, “Rare earth supply instability essentially translates directly to power projection gaps.”

In reality, rare earth prices are soaring. As of early June, yttrium used in solid-state lasers was $8,550 per kg, up 22.1% from early April, while dysprosium, needed for high-temperature motor magnets, climbed 17.2% from early April to $272.5.

The control over rare earths is expanding from simple ‘volume control’ to ‘information control’.

The Financial Times (FT), citing multiple company sources, reported that Chinese authorities are requiring the submission of sensitive information on production details, customer lists, and prior transactions as part of the rare earth and magnet export permit process.

Andrea Pratesi, supply chain director at Italian speaker maker B&C Speakers, stated in an interview: “We submitted production line photos, videos, market information, customer lists, and even some order forms,” adding, “If you don’t submit the requested material, they won’t even accept the application itself.” China’s demand for information is effectively becoming a condition for transactions.

◇ ‘Urgent Need to Diversify Supply Chains’

The global industry is declaring a move away from China and working to diversify rare earth supply chains.

U.S.-based MP Materials is expanding refining facilities at the Mountain Pass Mine in Nevada and is considering establishing processing facilities in the Middle East in partnership with Saudi Aramco.

The European Union (EU) has requested that the Chinese government simplify export procedures and introduce a ‘white list’, and is pursuing official negotiations. However, China is sticking to its position on “sovereign management of strategic resources.”

The problem is that rare earths are not simple mined minerals. The refining process, which extracts metal from ore, requires high costs and causes heavy pollution, raising high barriers to entry for private companies.

Companies such as Sumitomo Metal Mining in Japan and Imerys in France have commercialized rare earth recycling technology, but this only replaces a tiny fraction of total supply.

Experts pointed out that the current rare earth dispute is no mere trade issue, but rather a harbinger of new resource geopolitics.

Kim Joo-hyun, a doctor at the Korea Institute of Geoscience and Mineral Resources, warned, “With the simultaneous growth of AI, electric vehicles, and defense industries, rare earths have become even more strategic than lithium. Without a national long-term supply chain strategy, industrial competitiveness could be lost.”

Reporter: Lee Hyein hey@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.