"Who goes to banks these days?" Sudden shift... 15 trillion withdrawn, and 'this place' is booming in popularity

Summary

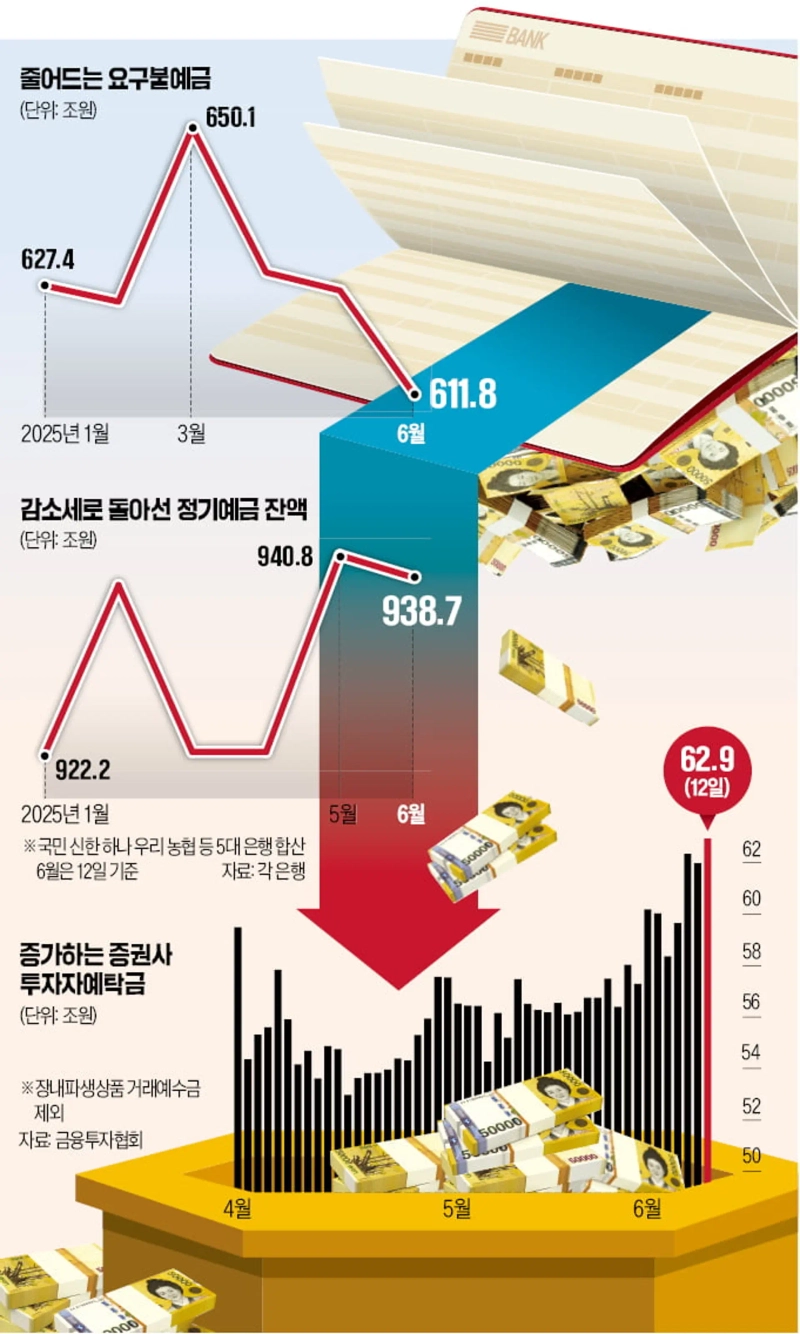

- It was reported that, due to the recent effects of low interest rates, demand deposits at the five major banks have plummeted by nearly 15 trillion won this month.

- The funds withdrawn from banks are moving into the stock and real estate markets, driving a large influx of idle investment capital.

- The market expects the 'money move' phenomenon to accelerate further if there is an additional cut in the benchmark interest rate.

15 trillion withdrawn from bank demand deposits

Accelerating flow into real estate and stock market

'Money Move' gaining speed

Demand deposits plunge to 611.8 trillion in just two weeks

Stock market deposits rise by 5.6 trillion this month

Demand deposits—considered idle funds awaiting investment—at the five major commercial banks have plunged by nearly 15 trillion won this month. Time deposit balances have also turned downward after three months. Analysts say that funds disappointed by low interest rates are shifting en masse to bullish real estate and stock markets.

"Who goes to banks these days?" Sudden shift... 15 trillion withdrawn, and 'this place' is booming in popularity. On the 16th, total demand deposit balances at the five major banks—Kookmin, Shinhan, Hana, Woori, and NongHyup—as of the 12th stood at 611.8826 trillion won, down 14.8663 trillion just this month. Compared to the end of last year, that's a decrease of 19.3509 trillion. Demand deposits have been shrinking for three consecutive months and continued to contract this year.

Time deposit balances (938.7552 trillion won) also fell by 2.1123 trillion this month. They had increased by 18.3953 trillion last month, but this was only a 'temporary spike' and returned to a declining trend within a month. After the Bank of Korea cut the benchmark interest rate at the end of last month, large amounts of funds began leaving the banking sector. Leading banks like Kookmin and NongHyup have been steadily lowering deposit and savings rates since the beginning of this month.

Market funds have continued to flow into the recently surging stock market. According to the Korea Financial Investment Association, as of the 12th, investor deposits in the domestic stock market (excluding settlement deposits for derivative transactions) stood at 62.9444 trillion won, up 5.6472 trillion this month. Securities companies' comprehensive asset management account (CMA) balances rose by 2.3488 trillion during the same period.

A financial industry official said, "With growing expectations for the new government's stock market support measures, funds are moving into equities," adding, "If the Bank of Korea cuts the benchmark rate again in the latter half of the year, the 'money move' from banks to the stock and real estate markets is likely to accelerate."

Disappointed by paltry interest rates, depositors pour 8 trillion into the 'June bull market'

Moving to booming stocks and real estate due to bank interest rates falling below the benchmark

NongHyup Bank, on June 2nd, cut the interest rate on its flagship deposit product, 'Great Satisfaction Real Interest Deposit,' from an annual 2.4% to 2.15%, dropping all deposit and savings rates by 0.25~0.30 percentage points. This signaled a wave of deposit rate cuts at other banks. An executive at a major bank said, "Reflecting the Bank of Korea's cut in benchmark interest rates, banks are now seriously lowering deposit rates," adding, "It's getting harder to attract funds with deposits and savings."

◇ Falling rates trigger withdrawals

Now, most deposit products yield less than the benchmark rate (annual 2.5%). According to the Korea Federation of Banks, the base interest rate for 38 time deposits with a one-year maturity sold nationwide averages just 2.26% per annum. The highest rate, including all preferential conditions, averages 2.57%. This explains why time deposits, which had been increasing this year, started to decrease this month. As of the 12th, time deposit balances at Kookmin, Shinhan, Hana, Woori, and NongHyup stood at 938.7552 trillion won, down 2.1123 trillion from the end of last year.

The decline in demand deposits—considered the banking sector's idle funds—has become even steeper. This month alone, demand deposits at the five major banks (611.8826 trillion won) dropped by 14.8663 trillion. Considering this drop happened over just seven business days, total monthly outflow could exceed 20 trillion, according to projections. Over the past two years, monthly declines in demand deposits exceeding 20 trillion were recorded five times: July 2023 (23.4239 trillion), January 2023 (26.036 trillion), April 2023 (31.5511 trillion), July 2023 (29.1395 trillion), and April 2024 (20.7743 trillion).

Although regular installment savings (42.2925 trillion won) rose by 627.1 billion this month, most of the funds raised came from small, high-interest products with monthly contributions below 300,000 won. A bank official said, "Due to government regulations, it's not easy to aggressively expand lending, so we aim to secure as much low-cost deposits as possible, such as through joint accounts, to respond accordingly."

◇ Funds flock to booming stock market

Funds leaving the banking sector appear to be flowing into the bullish stock and real estate markets. Investor deposits in the local stock market (62.9444 trillion as of the 12th) increased by 5.6472 trillion this month. If you add the 2.3488 trillion increase in securities CMA balances, nearly 8 trillion flowed into the stock market just this month. On the 16th, the KOSPI Index closed at 2,946.66, up 1.80% from the previous trading day despite military clashes between Iran and Israel. Within eight trading days following the presidential election on the 3rd, the index jumped 9.17%. Amid expectations that the new government will actively support the market, the bull run continues.

The real estate market is also heating up. According to the Korea Real Estate Board, in the second week of June, Seoul apartment sale prices rose 0.26% from the previous week, marking 19 straight weeks of gains. With the 'all-in' phenomenon (maxing out loans to buy homes) gaining momentum, the five major banks' outstanding mortgage loans increased by 1.4799 trillion won and unsecured loans by 600.2 billion won in June.

Given the deepening economic slowdown, there are projections that if the Bank of Korea cuts rates again, 'money move'—the mass exodus of funds from banks to other markets—could accelerate. Société Générale (0.3%), JPMorgan (0.5%), Citigroup (0.6%), and the Bank of Korea (0.8%) all expect Korea’s GDP growth rate to remain in the 0% range this year.

Yoon Yeo-sam, a researcher at Meritz Securities, said, "Although the benchmark rate is expected to fall to 2.0% per annum, the new government's expansionary fiscal policy will be a variable," adding, "If supplementary budgets and so forth channel more funds to real estate and virtual assets, the central bank could become more cautious about further rate cuts."

Kim Jin-sung (reporter) jskim1028@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.