'Synchronization' Spurred by Trump Tariffs... Korean Won Moves in Tandem with the Yuan

Summary

- The Bank of Korea has analyzed that the Korean won has recently become highly synchronized with the Chinese yuan.

- Due to the strengthening of U.S. protectionism, the synchronization between the currencies of Korea and China has increased as their economies are expected to be negatively affected.

- The Bank of Korea advised that the Korean won may be influenced by movements of the yuan for the time being, so it is important to watch the yuan’s trend closely.

'Most Synchronized' out of 33 Currencies

Increased Trade Dependence Leads to Correlation

BOK: "Will be Influenced by China's Direction for the Time Being"

The Bank of Korea has reported that the Korean won has recently become strongly synchronized with the Chinese yuan again. Both the won and the yuan have been affected by global trade shocks caused by U.S. tariff policies. A structural issue where foreign investors regard the won as a proxy currency for the yuan was also cited as a reason driving this synchronization.

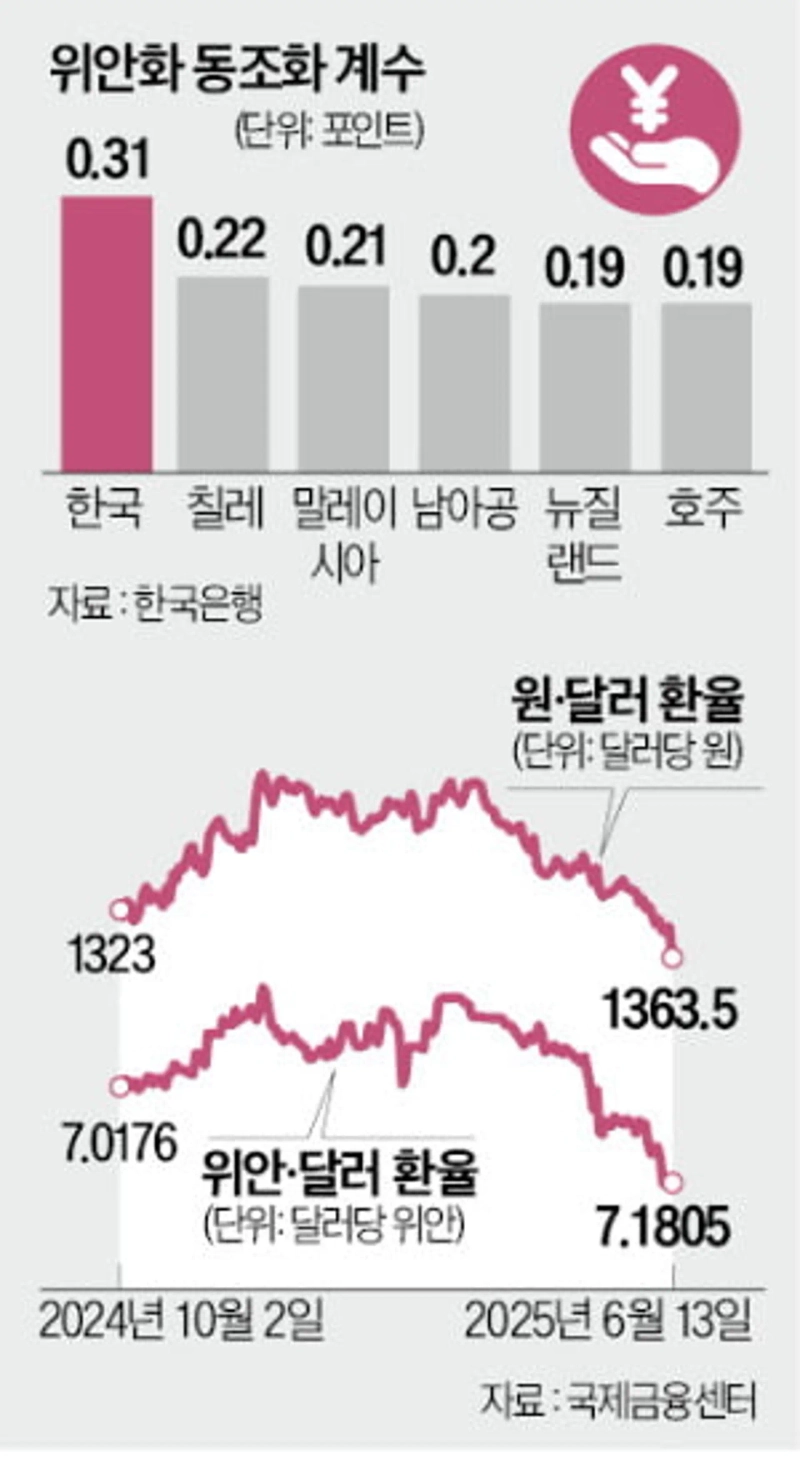

According to the BOK's International Department report, 'Recent Background and Characteristics of the Synchronization Between the Korean Won and the Chinese Yuan’, released on the 16th, the won is found to be the currency most synchronized with the yuan among 33 currencies excluding key reserve currencies. The won’s synchronization coefficient is 0.31, significantly higher than Chile (0.22), Malaysia (0.21), and Australia (0.19). The won tends to be more synchronized with the yuan during depreciation periods and less so during appreciation. In a depreciation phase, when the yuan changed by 1%, the won changed by 0.66%, and in appreciation phases, there was no significant correlation.

The reason the won moves in the same direction as the yuan is the high economic interdependence between the two countries. About 20% of Korea's total trade volume is with China. The closed nature of China’s foreign exchange market is also cited as a factor. Some investors who have difficulty accessing the yuan conduct investments in China while hedging with the won. A foreign exchange market official said, “Many global investors view the won as a proxy for the yuan.”

According to the BOK, the tendency for the two currencies to synchronize weakened somewhat during the COVID-19 period due to a decrease in Korea-China trade volume, but became stronger again from last October. It is analyzed that following the inauguration of the second Donald Trump administration in the U.S. and the strengthening of protectionism, both the Korean and Chinese economies were expected to be negatively affected, causing both currencies to depreciate together.

A BOK official explained, "The proportion of exports to the U.S. from Korea and China is relatively high at 18.7% and 14.6%, respectively," adding, "the strengthening of U.S. protectionist measures and related trade policy uncertainties simultaneously influenced the won and the yuan, increasing their synchronization." He also said, "Going forward, the won may be influenced by the yuan's direction, so it is important to closely watch the yuan's movements." On this day, no clear synchronization trend between the won and the yuan was observed in the foreign exchange market. The KRW/USD exchange rate (as of 3:30 p.m.) ended the weekly session at 1,363.80 won, down by 5.80 won.

After news broke on the 13th of Israel’s airstrike on Iran, risk aversion led to a sharp rise in the exchange rate, but on this day, market participants evaluated the move as a technical pullback. The yuan remained stable after the People's Bank of China set the yuan/dollar central parity rate at 7.1789 yuan per dollar (0.0017 yuan, 0.02% higher from the previous day, implying a yuan depreciation) with little further fluctuation in the morning session.

Jin-kyu Kang, Reporter josep@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.