Summary

- The clash between Israel and Iran could, in the long term, trigger higher oil prices and bring instability to the global economy.

- It was analyzed that the continued rise in energy prices can spur consumer inflation and potentially have a negative impact on share prices.

- While currently a preference for U.S. Treasuries and other safe assets is keeping interest rates within a certain range, it was noted that risk assessments could be reshaped depending on whether the U.S. becomes involved in the conflict.

By James Picerno

The clash between Israel and Iran has continued for four consecutive days through Monday, with both nations launching attacks against each other. This conflict is raising concerns that, in the long term, it could fuel a rise in oil prices and usher in a new period of instability for the global economy, which is already rattled by persistent tariff risks.

A major macroeconomic threat posed by the Israel-Iran conflict is the ongoing rise in energy prices, which could further elevate inflation.

Richard Bronze, Head of Geopolitical Analysis at the research firm Energy Aspects, remarked, "So far, Iran has mainly been targeting Israel," and added, "However, the market is watching the safety of energy infrastructure across the Middle East, especially the Strait of Hormuz—a narrow passage through which about one-third of the world’s seaborne oil and gas exports flow." Oil exports through the Strait of Hormuz remain uninterrupted as of now.

However, the situation is still unstable. An Iranian lawmaker from the parliament's security committee said that the possibility of closing the Strait of Hormuz is under consideration.

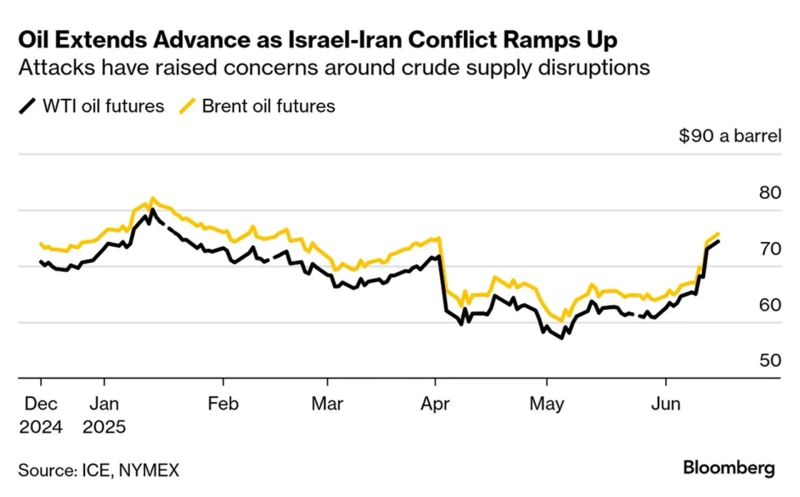

Following Israel’s strike on Iran last Friday, oil prices have been trending higher but remain within the range seen so far this year.

Luis Costa, Global Head of Emerging Markets Sovereign Credit Strategy at Citigroup Global Markets, cited hopes that the current conflict will be contained and not escalate as a key reason for the subdued market reaction. In an interview, he said, "The market is factoring in all potential scenarios. There are certainly some very bad scenarios in this story, but it’s possible for Iran to be brought to the negotiating table, or for Israel’s highly precise and focused air raids to end in the short term," and added, "There are still signs of possible resolution."

Analysts at Singapore-based DBS Bank noted, "Even the wars in the Middle East during the 1980s and '90s did not lead to sustained oil shocks," but still characterized the Israel-Iran conflict as "highly worrying." They analyzed, "Amid outcomes ranging from negative to extremely negative, the market so far has been leaning toward the less severe scenarios."

The main risk from a prolonged rise in energy prices is that it would spur consumer price inflation and, with tariff-related price pressures still persisting, could increase the overall burden on prices. U.S. consumer prices in May were relatively mild, but many economists commented, "Inflation shocks tend to emerge in the data only after several months, so it's still too early to gauge the effects of tariffs announced by the U.S. in April."

Strategists at RBC Capital Markets noted in a report, "This round of conflict could increase concerns about consumer sentiment, the broader U.S. economy, and the Federal Reserve’s policy path," and highlighted, "Such a narrative shift is likely to weigh negatively on share prices."

The U.S. Federal Reserve is expected to leave its benchmark interest rate unchanged in its policy announcement scheduled for tomorrow. The market will be closely watching Chair Powell’s remarks and the newly released Fed economic outlook. The main point of interest will be whether this Israel-Iran conflict has influenced the Fed’s economic forecasts and risk assessments.

In addition, major macro indicators to be released this week could draw attention to the movement in the U.S. 10-year Treasury yield, which stood at 4.41% as of last Friday—considered a mid-range value for the year.

Carlos Casanova, Chief Asia Economist at Union Bancaire Privée in Hong Kong, stated, "Market volatility is substantial, and investors are flocking to safe-haven assets, driving up oil prices."

This week is expected to test the market’s risk appetite. However, so far, the U.S. Treasury’s safe-haven status has offset inflation concerns, keeping interest rates within a certain range.

A key variable the market is watching is whether the United States will intervene in the conflict. Should that occur, there could be a broad re-evaluation of risk. Former President Donald Trump commented on Sunday,

"We are not involved in this. There is a possibility that we will be, but not at this moment."

Jack Janasiewicz, Portfolio Manager at Natixis Investment Managers in Boston, believes that while rising oil prices could intensify inflation, the market generally tends to discount Middle East risk in the long term.

"In these types of geopolitical events, markets usually overreact in the short run, but their impact tends to fade gradually over time. Historically, once these issues pass, they do not leave a significant mark on the markets."

This article was provided by Investing.com, and the copyright belongs to the provider. For inquiries regarding the content, please contact the relevant media outlet.

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.