When AI and Robots Shine, Deflation Deepens... The 'Two Faces' of the Chinese Economy

Summary

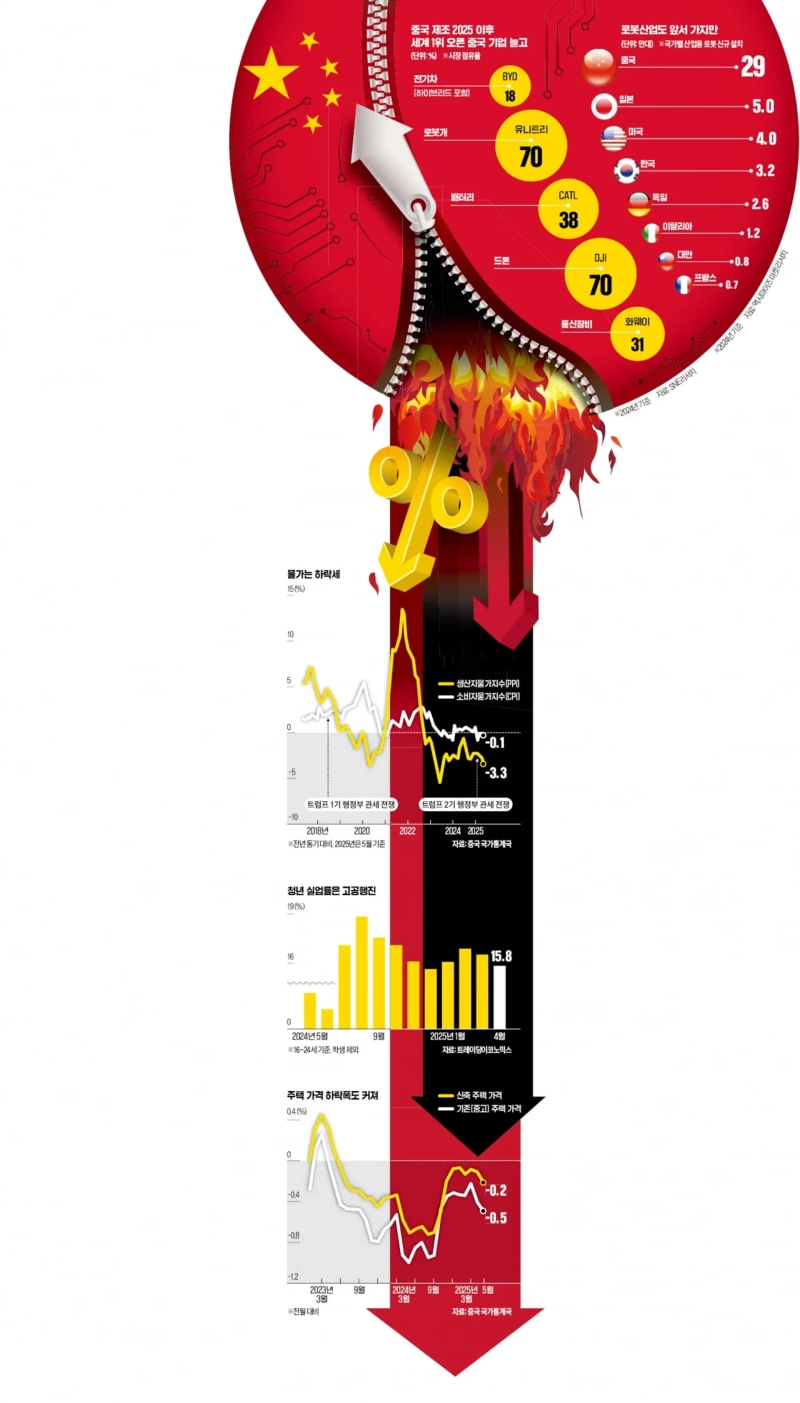

- China’s focus on advanced technology industries such as AI and robotics is fueling concerns about domestic recession and deflation.

- Due to the prolonged real estate slump and rising youth unemployment, corporate profits and employment are contracting sharply.

- Despite the government’s benchmark rate cuts and domestic demand stimulus policies, increased cutthroat competition and export dependence are raising uncertainties about recovery.

DEEP INSIGHT

Deflation fueling the 'China Shock'

Focus on advanced technology with weak job creation effect

Neglect of policies to boost household income and domestic demand

Prolonged real estate slump… Housing sales 'plummet'

This year's consumer prices may hit lowest level in 16 years

As consumers close their wallets… Companies engage in 'cutthroat competition'

Even if it slashes profits for EVs, etc., there are aggressive price cuts

Inability to generate adequate profits leads to hiring instability

Youth unemployment rate is three times the national average

Pulling out the 'push-out export card' again?

Sole reliance on government fiscal and monetary policy hitting its limits

The offensive of China's 'Red Tech' is intensifying. From artificial intelligence (AI) to autonomous driving and humanoid robots, China's technological prowess and tech enterprises have risen to the top tier globally. Despite US technology sanctions, China continues to showcase its technical capabilities. However, the economic reality in China tells a different story. Prices are falling sharply while unemployment is soaring. Even housing prices, which have supported China's economy, continue to decline. China's technological ambition and deflation coexist. How should we view this 'two-faced' Chinese economy?

Stumbling from Single-Minded Focus on AI and Robots

During this year’s Spring Festival (Chinese New Year) holiday, a special show on China Central Television (CCTV) watched by more than 500 million people featured 16 humanoids from leading Chinese robot firm Unitree Robotics, all in red outfits, performing an elaborate synchronized dance that captured the world’s attention. Soon after, DeepSeek emerged as a rival to OpenAI, and the world’s first humanoid half marathon and the first robot combat competition were held one after another. Morgan Stanley projected that over the next four years, China's robot market will more than double in size, consolidating China's dominance in the global robotics industry. They even hailed China as “the world’s innovation hub leading the next generation of robotics.”

China has considered the state-led advanced manufacturing policy ‘Made in China 2025’ a success and is rapidly restructuring its manufacturing sector to focus on high-tech industries. Last month, China's industrial robot output soared 35.5% from a year earlier. Production of service robots increased 13.8% to a total of 1.2 million units. In addition, Huawei is accelerating the development of AI chips to replace NVIDIA.

However, alongside China’s flashy tech ambitions lies 'another China.' According to the National Bureau of Statistics of China, last month’s Consumer Price Index (CPI) declined by 0.1% compared to a year earlier. Despite the authorities’ efforts to stimulate domestic demand, it has remained in negative territory for four consecutive months. The International Monetary Fund (IMF) forecasts that China’s CPI will record 0% this year—the lowest among approximately 200 countries surveyed. If this forecast comes true, Chinese consumer prices will sink to the lowest level in 16 years, since the global financial crisis in 2009 (-0.72%). The decline in the Producer Price Index (PPI), which tracks wholesale prices, is even steeper. In the past month, China’s PPI fell 3.3% year-on-year, marking the 32nd consecutive monthly drop and the largest decline in 22 months.

Concerns about deflation are mounting. Consumer sentiment is already freezing up. Chinese companies, including those in electric vehicles, are fighting a cutthroat price competition to attract consumers. As a result, companies are finding it difficult to turn a profit and are beginning to cut back on hiring. This is part of the reason youth unemployment has soared to record highs. Over 10 million university graduates are produced in China annually. On top of deflation worries, the US-China tariff war has left businesses reluctant to open up new job opportunities. As of April, China’s youth unemployment rate for ages 16–24 reached 15.8%—three times the national unemployment rate (5.1%). This summer, a record 12.22 million college graduates are set to enter the job market, raising the prospect that youth unemployment could climb even higher.

Prices Falling, Unemployment Rising

The duality of China's economy is seen as an inevitable phenomenon as rapid growth slows to moderate growth. China’s annual economic growth rate, once above 10%, has hovered around 5% in recent years, as the old formula of cheap labor and massive resource input has hit its limits.

To overcome this, the Chinese government has introduced a new paradigm of ‘high-quality development,’ focusing on productivity improvements powered by high technology. With protectionism and supply chain turmoil in countries like the United States, this was seen as an inevitable step.

China is making every effort to dominate sectors such as electric vehicles, semiconductors, batteries, AI, and robotics, where its rivalry with the US is intensifying. It has poured in astronomical industrial subsidies, invested heavily in R&D, and prioritized talent development. As a result, among the ten key technologies specified in ‘Made in China 2025’ and the AI domains added in 2018, China has produced world-leading companies in at least seven areas: electric vehicles and batteries, drones, high-speed rail, new materials, solar panels, 5G communication, and power facilities.

But experts note that compared to traditional economic stimulus measures like infrastructure investment or real estate development, the advanced technology sector has a relatively smaller impact on job creation and growth rates, eventually worsening domestic demand. The state’s heavy focus on advanced technology has come at the cost of social safety net expansion and household income policies necessary for a domestic demand-driven economy.

In particular, the main cause of domestic weakness—real estate stagnation—persists. China’s real estate market slowdown is now in a prolonged phase. From January to May of this year, real estate development investment declined 10.7% year-on-year. New home sales (by area) fell 2.9%. Last month, new home sales by China’s top 100 developers dropped 8.6% to 294.6 billion yuan (about ₩56 trillion). The price of new homes in 70 major Chinese cities fell 0.22% from the previous month—the largest fall in seven months. Prices for existing homes also dropped 0.5%, marking the steepest decline in eight months.

Since last September, the government has rolled out measures to revitalize the market—including mortgage rate cuts, relaxed housing transaction regulations, lower down-payment ratios, and converting unsold homes to public housing—but with little effect. That’s because overall economic anxiety, triggered by the US-China trade conflict and concerns of an economic slowdown, has spread among consumers.

A shift in America’s approach to China has also contributed to the economic slump. Under the Joe Biden administration, high tariffs targeted only key Chinese high-tech sectors like electric vehicles, semiconductors, and solar panels. But under the second Donald Trump administration, high tariffs are being applied to all Chinese products. As a result, not only is domestic demand weak, but the export sector has also been hit hard.

Helpless Against Deflation, Fears of a 'China Shock'

Even if the US-China trade war eases, China’s deflationary pressures are unlikely to be fully resolved. Deflation has become entrenched, making it hard for the government’s fiscal or monetary policies alone to solve the problem. Many analysts worry that these pressures will continue to stifle domestic demand, creating a vicious cycle where shrinking corporate profits and jobs fuel even more deflation. There are market concerns that China’s economy may be heading for a Japan-style prolonged slump—a so-called ‘China Shock.’

While the government is rushing to prioritize domestic demand boost this year, significant risks remain. Whether various measures—benchmark rate cuts, massive bond issuances, or upgrades-for-old-consumer product swap programs—will actually stimulate consumption remains unknown.

In this situation, more Chinese companies are turning to so-called 'push-out exports.' Global industries already awash with cheap Chinese products—such as steel, electric vehicles, batteries, and petrochemicals—may face even more intense cutthroat competition. According to Kim Jae-deok, head of the Beijing office at the Korea Institute for Industrial Economics and Trade, “The main reason for the current situation may be the lack of Chinese government policies that directly increase household income for consumers,” adding, “Expanding large-scale social welfare, creating jobs through greater public investment outside of advanced technology sectors, and raising the minimum wage should all help boost overall incomes and purchasing power, letting China escape deflationary pressures.”

Beijing = Eun-Jeong Kim, Correspondent kej@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.