Editor's PiCK

"When Altcoin Spot ETFs Are Approved, Solana Long and Litecoin Short Strategies Are Advantageous"

Summary

- K33 Research analyzed that if an altcoin spot ETF is approved, a strategy of long on Solana and short on Litecoin would be advantageous.

- The report expressed that the Solana trust faces low selling risk and is robust, while the Litecoin trust carries a high risk of selling pressure.

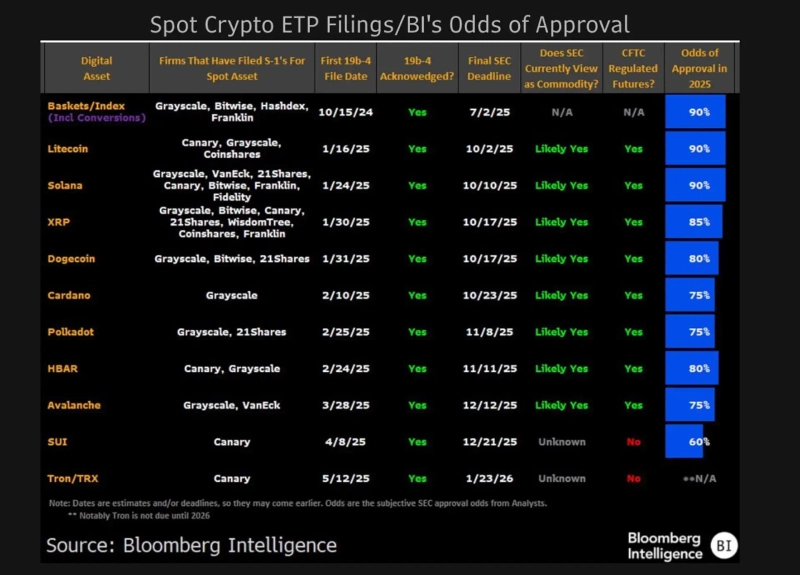

- According to Bloomberg, Solana and Litecoin are expected to have the highest spot ETF approval probability this year, each at 90%.

An analysis has indicated that if altcoin spot exchange-traded funds (ETFs) are approved, it would be advantageous to hold a long (buy) position in Solana (SOL) and a short (sell) position in Litecoin (LTC).

According to The Block on the 18th (local time), K33 Research stated in a report, "When the Ethereum (ETH) spot ETF was approved, Grayscale's Ethereum trust converted to an ETF, leading to an outflow of more than 50% of its assets under management," and added, "If an altcoin spot ETF is approved, it is favorable to take a long position on Solana and a short position on Litecoin." Currently, Grayscale holds trust products for Solana and Litecoin.

K33 reported that Grayscale's Solana trust has been exhibiting strong performance. According to the report, "The Solana trust has never traded at a discount since its launch," and noted, "It holds only 0.1% of the total Solana supply, so the risk of selling due to market outflows or redemptions is low."

In contrast, it was predicted that there is a high possibility of liquidity outflow for Litecoin. The report stated, "The Litecoin trust frequently trades at a discount," and added, "Since it holds 2.65% of the total Litecoin supply, the risk of selling pressure is high." Furthermore, "There are only two issuers that have applied for a Litecoin ETF, so there are not enough entities to absorb the selling pressure," the report explained.

Thus, it was reiterated that when the spot ETFs for these two assets are approved, establishing a long position on Solana and a short position on Litecoin is a more reasonable strategy.

Meanwhile, according to Bloomberg data, this year, Solana and Litecoin are the assets with the highest probability of spot ETF approval. Each has recorded an approval probability of 90%.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit!["Will AI take our jobs?" Fear spreads…market rattled by a plunge in shares [New York Market Briefing]](https://media.bloomingbit.io/PROD/news/874408f1-9479-48bb-a255-59db87b321bd.webp?w=250)