Editor's PiCK

Powell Stands Firm Against Trump's Rate Cut Pressure: “No Prosperity Without Price Stability” [Fed Watch]

Summary

- The Fed held the benchmark interest rate at 4.25~4.5% and signaled a cautious stance on possible rate cuts this year.

- Powell highlighted the uncertainty of tariff policy and the still-unresolved pressure of inflation, saying a prudent approach is required before considering policy adjustments.

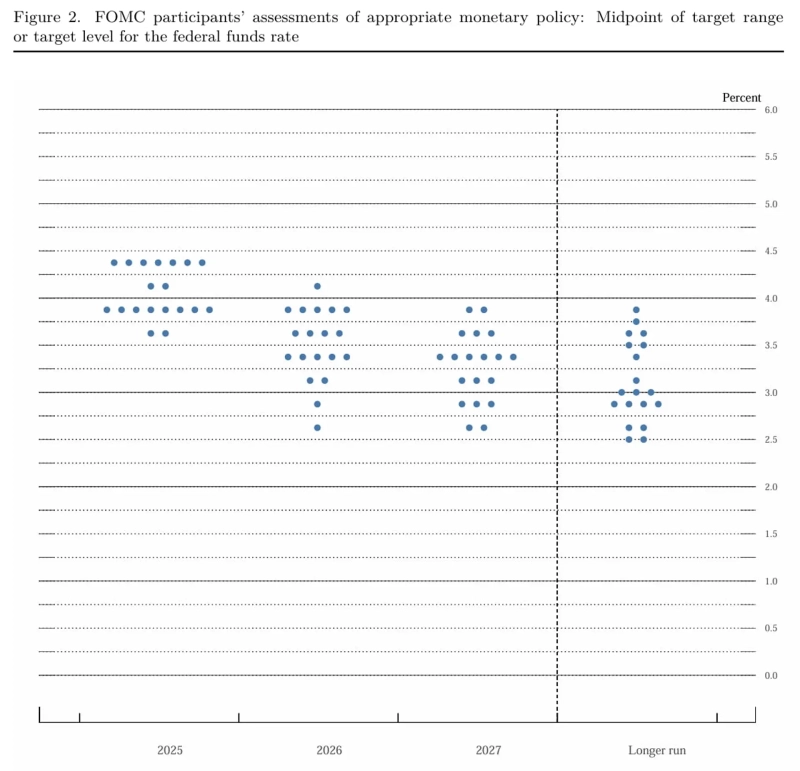

- According to the dot plot in the June economic outlook, some members foresee rate cuts this year, but growing caution about rate cuts is evident within the Fed.

Jerome Powell, Chair of the Fed, stated at a press conference after the monetary policy decision meeting (FOMC) on the 18th (local time), “Tariff policy continues to change,” adding, “It remains to be seen what impact tariffs will have.”

At this FOMC, participants kept the interest rate unchanged at the current level of 4.25~4.5% per annum. This marks the fourth consecutive decision to hold rates steady this year. In his opening remarks before the press conference, Powell said, “We believe that the current policy stance is in a good position to respond promptly to potential economic developments,” but emphasized that the impact of tariff policy “remains uncertain.”

He mentioned that US GDP for the first quarter was revised down slightly due to companies increasing imports before tariff hikes, assessing that such fluctuations have “complicated” GDP measurements including final domestic demand (PDMP). Excluding net exports, inventories, investment, and government spending, the PDMP recorded 2.5%, showing robust growth. He further explained, “Within the PDMP, consumer spending growth has slowed, but real investment, which was weak in the fourth quarter, rebounded.”

However, “Recent months have seen increased uncertainty in economic outlooks for households and businesses, mainly due to trade policy,” Powell said. He added, “It is still uncertain how these trends will affect future spending and investment.”

The Fed judges that labor market conditions remain solid. Powell said, “Over the past three months, employment growth averaged 135,000 jobs per month, and the unemployment rate stayed low at 4.2%, maintaining a narrow range over the year.” He added, “While wage growth remains above inflation, it is gradually moderating.” These various indicators, he introduced, “show that labor market conditions, though overall imbalanced, are consistent with maximum employment.”

Therefore, he analyzed, “The labor market is not a major driver of inflationary pressures.” According to the economic projections summary (SEP) released that day, the median unemployment rate forecast for year-end is 4.5%, slightly higher than the March outlook. “Inflation has eased significantly from its mid-2022 peak, but remains somewhat above the 2% quarterly target based on the Consumer Price Index (CPI),” Powell said.

Other data showed that over the past 12 months, total CPI rose 2.3%, and core CPI—excluding volatile food and emergency items—rose 2.6%. “In recent months, inflation expectations from both market- and survey-based indicators have increased, with respondents from households, businesses, and professional forecasters citing tariffs as a key factor,” he reported.

However, “most long-term inflation expectation indicators remain consistent with our 2% inflation target,” adding, “The SEP’s median inflation outlook stands at 3% for this year—slightly higher than March—falling to 2.4% in 2026, and 2.1% in 2027,” he explained.

Powell said, “Changes in trade, immigration, fiscal, and regulatory policies are ongoing, and their impacts are uncertain.” He added, “The effects of tariffs will depend on their final levels, and the related economic impact, tied to expectations of those levels, peaked in April and has since diminished.”

He believes the effects of inflation could be temporary or persistent. He emphasized, “To avoid the outcome of persistent inflationary effects, it is vital to assess the size of tariff impacts, the time taken to fully reflect them in prices, and to ensure that long-term inflation expectations remain anchored.”

He also said, “The Fed’s mandate is to anchor long-term inflation expectations and prevent temporary price increases from turning into persistent inflation problems.” He reiterated, “We must remember that without price stability, it is impossible to achieve long-term prosperity for all Americans.”

Powell stressed, “We may face difficult scenarios considering how far the economy diverges from its target state and considering potentially different time horizons for closing those gaps,” and said that “at present, it is appropriate to wait for more clarity on the expected path of the economy before considering a policy adjustment.”

Regarding the dot plot, Powell introduced, “The median projection for the appropriate level of the federal funds rate is 3.9% at year-end, the same as March; it is expected to fall to 3.6% at the end of next year, and 3.4% at the end of 2027,” noting that “these individual projections are always subject to uncertainty, which is unusually high right now.”

According to the dot plot in June’s economic outlook published by the Fed, the committee expects two rate cuts of 0.25 percentage points each to occur at FOMC meetings this year. In total, 10 members anticipated more than one cut this year, two marked down only one cut, and seven projected no cuts at all.

Compared to the March dot plot, where just four members expected no cut, this is a notable increase. This reflects growing caution over rate cuts within the Fed.

Washington = Lee Sang-eun, Correspondent selee@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.