[Analysis] "Bitcoin demand declines after May…Investor sentiment leans toward 'holding'"

Summary

- It was analyzed that the market sentiment for Bitcoin is still close to holding.

- Recently, demand for Bitcoin has been on a declining trend since last month's peak.

- Market demand remains strong enough to absorb the current selling pressure, and the market is reportedly remaining in a balanced state.

An analysis has indicated that market sentiment surrounding Bitcoin (BTC) is close to holding (HODL).

On the 19th, DarkPost, a contributor to CryptoQuant, stated on X (formerly Twitter), "Although some (Bitcoin) investors took profits on the previous day (18th), the scale of selling remained relatively low," adding, "Overall market sentiment still leans towards holding." DarkPost further remarked, "Currently, the reason Bitcoin hasn't climbed to higher price levels is due to a lack of strong demand."

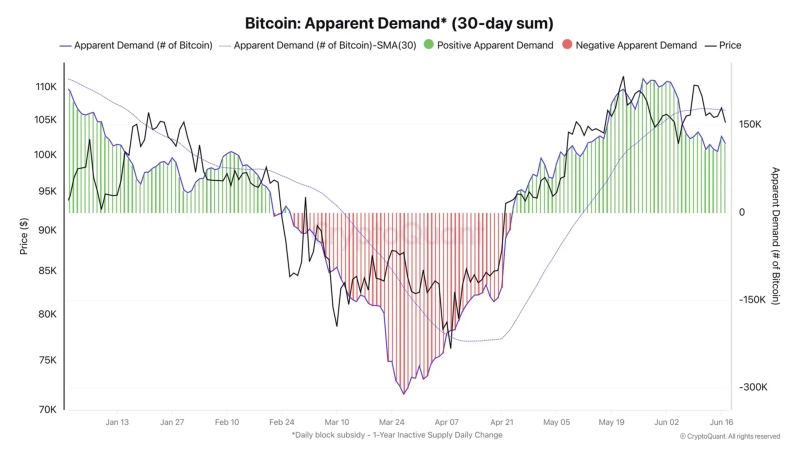

DarkPost mentioned 'Apparent Demand' as one of the on-chain indicators. He explained, "By comparing the newly introduced supply and inactive supply that hasn't moved for over a year, one can visualize the market demand flow," and added, "If this ratio exceeds 0, it implies demand has turned positive."

He continued, "While demand has been decreasing since last month's previous peak, it still remains strong enough to absorb the current selling pressure," and concluded, "It appears the current market remains in a state of equilibrium."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)