Summary

- China is focusing on supplying manufacturing data to AI companies based in Zhejiang and announced its pursuit of a national 'data economy' strategy.

- The US recognizes the importance of securing manufacturing data and is striving to attract high-tech manufacturing plants from allies like Korea.

- Korea possesses world-class potential in manufacturing data, but lacks detailed, systematic policies for management and processing.

The Path to Becoming One of the Top 3 AI Powers

(1) Discover Korea's 'True AI Competitiveness'

Manufacturing Data: The 'Rare Earths' of the AI Era

Collecting even minute details like operating temperature

Optimal management of equipment maintenance and delivery schedules

Chinese government strengthening 'Data AI'

Zhejiang, the hub of 'the world's factory,' takes the lead

Providing learning assets to companies like DeepSeek

"Let's keep China in check"...the US tightens its stance

Limited production base leads to weak manufacturing data

Korea, Japan, and allies expand efforts to collaborate

Korea lacks effective data management and processing policies

Concerns over US big tech seizing new business opportunities

Urgent need for strategic asset regulations and countermeasures

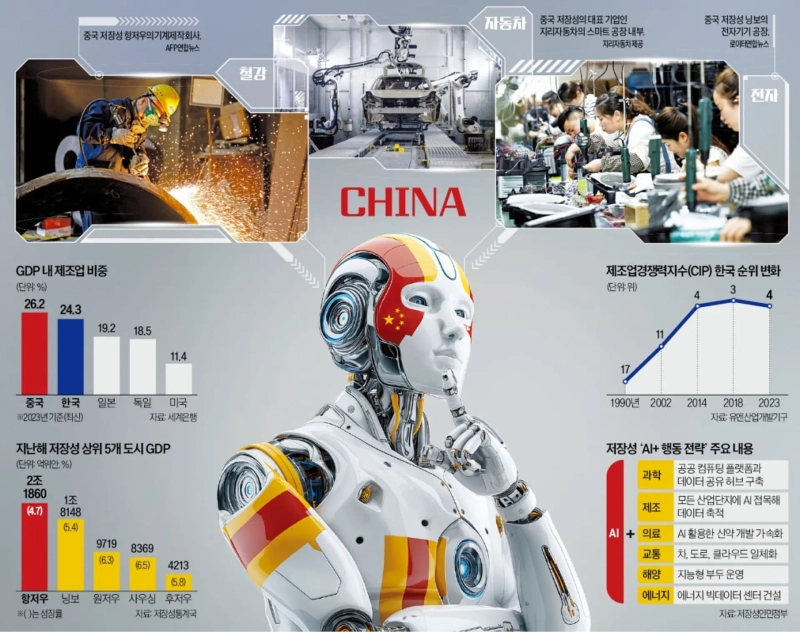

China has achieved the most dramatic rise in global manufacturing competitiveness rankings. According to the United Nations Industrial Development Organization (UNIDO)'s Competitive Industrial Performance (CIP) Index, China rose from 32nd in 1990 to 2nd place in 2018 and has remained there since. In this process, the accumulated manufacturing data has served as training assets for many AI companies in China. Experts say the combination of DeepSeek, dubbed China's 'sovereign AI,' with manufacturers like Huawei, BYD, and Xiaomi is the true 'Red Tech' that the US fears. The reason the US, hit hard by rare earths, seeks to bring advanced manufacturing plants from allied countries such as South Korea, Taiwan, and Japan home is to secure manufacturing data, now called the 'rare earths' of AI.

DeepSeek's 'Secret Weapon' Developed in China

According to tech industry and diplomatic sources on the 19th, American think tanks are currently intensively researching the manufacturing ecosystem of Zhejiang, China, where DeepSeek was born. Reports out of China indicate that Zhejiang, often called the barometer of manufacturing trends, has generated massive volumes of manufacturing data for training DeepSeek's learning models.

Many factories in Zhejiang—'the world's factory'—are equipped with sensors and IoT devices that collect data in real time on temperature, vibration, humidity, and pressure. Data is transmitted to cloud systems built independently by Chinese big tech companies such as Alibaba and is used for AI training materials. Zhejiang is considered the most active region for predictive maintenance—early detection of equipment failures and quality issues. Processes like production volume, delivery schedules, and inventory calculations are all optimized by AI. The data accumulated in this way provides valuable training assets for both Chinese big tech and AI startups.

China has designated Zhejiang as a test bed for manufacturing data circulation and is pressing forward with a 'data economy' policy at the national level. Last year, Zhejiang's Gross Domestic Product (GDP) rose 5.5% to over ¥9 trillion, ranking fourth among China's 34 provinces. Hangzhou, the provincial capital, and Ningbo, the second largest city, posted 4.7% and 5.7% growth, respectively, with GDPs of ¥2.186 trillion and ¥1.814 trillion, both well over the ¥1 trillion threshold.

"Pay Attention to Geely’s Ningbo Factory"

What attracts US think tanks is Zhejiang's advanced manufacturing capability. Last year, the AI sector grew 11.6% year-on-year, and robotics skyrocketed 93.8%. Other IT sectors also posted strong annual growth: computers 49.5%, electric vehicles 47.8%, smartphones 36.9%, and integrated circuits 28.8%—an overall 8.3% growth in IT. Traditional segments like chemical fibers (64.6%), rubber and plastics (44.4%), and textiles (40.9%) made significant leaps as well.

Despite the US–China trade and tariff war, the number of newly established foreign-invested companies in Zhejiang last year numbered 4,794, up 7.7% from the prior year. Major global firms such as Saudi state oil giant Aramco, Danish global shipping company Maersk (ranked second worldwide), and Germany’s top auto parts manufacturer ZF Friedrichshafen AG have opened factories in Hangzhou, pouring out more manufacturing data.

The Zhejiang government declared this year the 'first year' of its bid to become a 'global manufacturing data hub,' launching projects like the 'AI Development Action Plan' (2025–2027) and the '415X Advanced Manufacturing Cluster.' Their so-called 'data leap' aims to blend AI across all industries including science, manufacturing, consumption, and transportation. For example, Geely Automobile, the first Chinese car manufacturer to break into the global top 10 in vehicle sales last year, generates 30 terabytes of manufacturing data per day at its Ningbo plant, using 800 robots, high-resolution cameras, LIDAR, and temperature, vibration, and motor sensors—all used for AI training. The factory floor itself becomes an AI training ground.

Korea’s World-Class Manufacturing AI Potential

The US leads China in AI algorithm development and semiconductor design, but its production base has shifted overseas to countries like Vietnam, India, and Mexico, leading to a significant shortage of manufacturing data. Manufacturing makes up only 11% of US GDP—a sign of weak industrial foundations. This lack of manufacturing data is not just about a lack of factories in the US. A societal aversion to manufacturing is a major factor.

According to the '2024 Trade and Globalization American Perception Survey' released last year by the Cato Institute, a free-market think tank in Washington, DC, 80% of Americans responded that the US should secure more manufacturing jobs. However, only 22% said they would want to work in manufacturing. This is why the US is approaching South Korea, which possesses advanced manufacturing capabilities, under the banner of 'AI cooperation' and 'consulting.'

In the '2024 World Robotics Report' from the International Federation of Robotics (IFR), Korea topped the world in 'robot density' with 1,012 robots per 10,000 employees—six times the global average. Korea is the only country with a robot density over 1,000, far outdistancing Singapore in second place at 770. Korea has bounced between 3rd and 4th place since 2020 on this index.

Although Korea has accumulated high-quality manufacturing data on the foundation of world-class manufacturing infrastructure, it practically lacks concrete policies for systematic utilization. A report from the government's Planning and Coordination Committee released on the 18th only summarized general plans like building data centers and creating an 'AI expressway,' with little mention of how to manage or process manufacturing data. If this policy gap continues, opportunities for high value-added creation using domestic data could be lost to US big tech. There is an urgent need to define manufacturing data as a strategic asset and to establish guidelines to prevent indiscriminate external transfers.

Kyungjoo Kang, qurasoha@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.