Editor's PiCK

As Middle East tensions ease but rekindled fears emerge… 24-hour futures liquidation nears $503.9 million

Summary

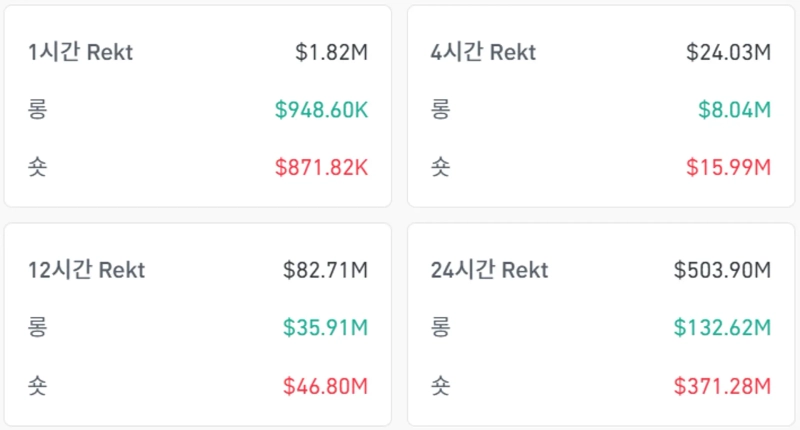

- In the past 24 hours, position liquidations totaling $503.9 million occurred in the perpetual crypto futures market.

- Notably, the largest liquidation was seen in Ethereum (ETH), while large-scale long and short liquidations also took place in Bitcoin (BTC).

- Both Bitcoin and Ethereum prices are currently on an upward trend.

Over the past 24 hours, the perpetual cryptocurrency futures market saw total position liquidations amounting to $503.9 million.

According to CoinGlass data on the 24th (local time), the total amount of futures positions liquidated in the crypto market over the past 24 hours reached $503.9 million. Following the ceasefire agreement between Israel and Iran, Bitcoin (BTC) rebounded to $105,000, triggering a wave of short (sell) position liquidations. However, as Israel hinted at additional airstrikes for what it claimed were ceasefire violations by Iran, there was also a sharp rise in long (buy) position liquidations. Specifically, $132.62 million worth of long positions and $371.278 million worth of short positions were liquidated.

Ethereum (ETH) recorded the largest liquidation among assets. In the 24-hour period, Ethereum saw $167.87 million in position liquidations, with $49.5 million coming from long positions and $118.37 million from short positions. Bitcoin (BTC) ranked second during the same period, with $153.53 million in liquidations, including $32.52 million from long positions and $121.01 million from short positions.

As of 9:40 p.m., based on the Binance USDT market, Bitcoin and Ethereum were up 3.65% and 6.78% respectively, trading at $105,026 and $2,409 each.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit