Summary

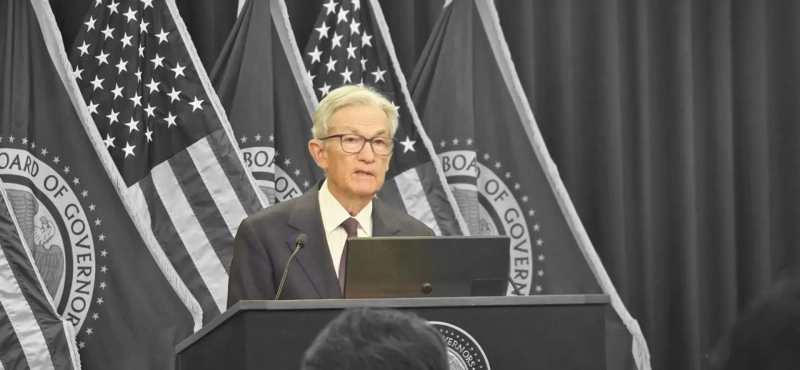

- Fed Chair Jerome Powell reiterated his wait-and-see approach, saying that he would not rush to adjust interest rates.

- Powell emphasized the potential for inflation and the importance of economic data, stating it is sufficient to wait for future economic indicators before making any rate decisions.

- Although President Trump called for interest rate cuts, the Fed remains cautious, citing the current solid economic conditions.

Fed Chair Jerome Powell maintained a wait-and-see stance on interest rate adjustments.

According to Walter Bloomberg on the 24th (local time), Powell stated, "Tariff increases stimulate inflation and are likely to burden the economy," adding, "It is sufficient to wait for upcoming economic data before adjusting interest rates." He further noted, "The current economic situation is solid, so we are in a good position to wait before making any rate adjustments."

Earlier today, President Trump asserted, "The United States should cut the benchmark interest rate by at least 2~3 percentage points," also claiming that "if rates are cut, the U.S. could save more than $800 billion annually."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit