UBS: "Declining Appeal of the US Dollar"... Is Now the Time to Strengthen Your Gold Portfolio? [Investing.com]

Summary

- UBS recently reported that the US dollar has lost its appeal and there is a risk of further decline.

- Global central banks are actively reducing their dollar exposure and accumulating gold.

- Investors should review their portfolio's exposure to the won or US dollar and consider alternative assets such as gold.

By Frank Holmes

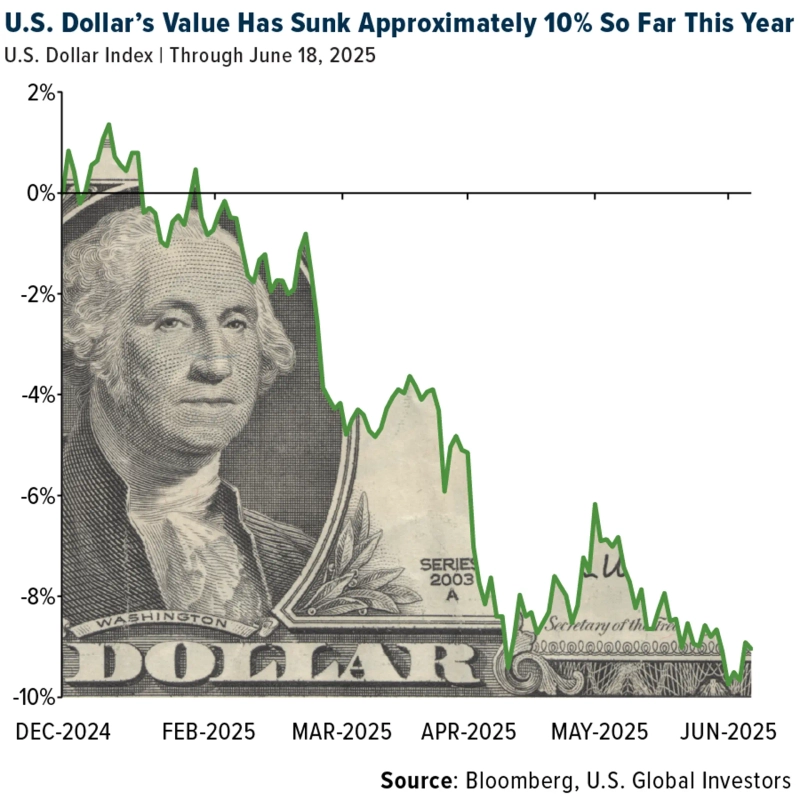

The US Dollar Index against a basket of major currencies has fallen about 10% this year through mid-June, trading at its lowest level in three years.

This is by no means a small drop, and with the US deficit widening and ongoing concerns over tariff fluctuations, there is an additional risk of further declines.

UBS noted in a client memo this week that the dollar has now "lost its appeal" and expects further weakening as the US economy slows down.

Meanwhile, according to Bloomberg, foreign vendors from South America to Asia are requesting that US importers settle payments in euros, pesos, or renminbi to avoid dollar volatility.

This is a completely different situation from the era when the dollar was the solid benchmark currency for international transactions in the postwar world order.

Gold, Now the Second Largest Reserve Asset After the Dollar

One of the most obvious beneficiaries of dollar weakness is gold. Since gold is priced in dollars, there is a historical tendency for gold prices to rise as the dollar’s value falls.

That inverse relationship has been clear this year as well, with gold rising above $3,400 per ounce, now trading just under $100 below its all-time high.

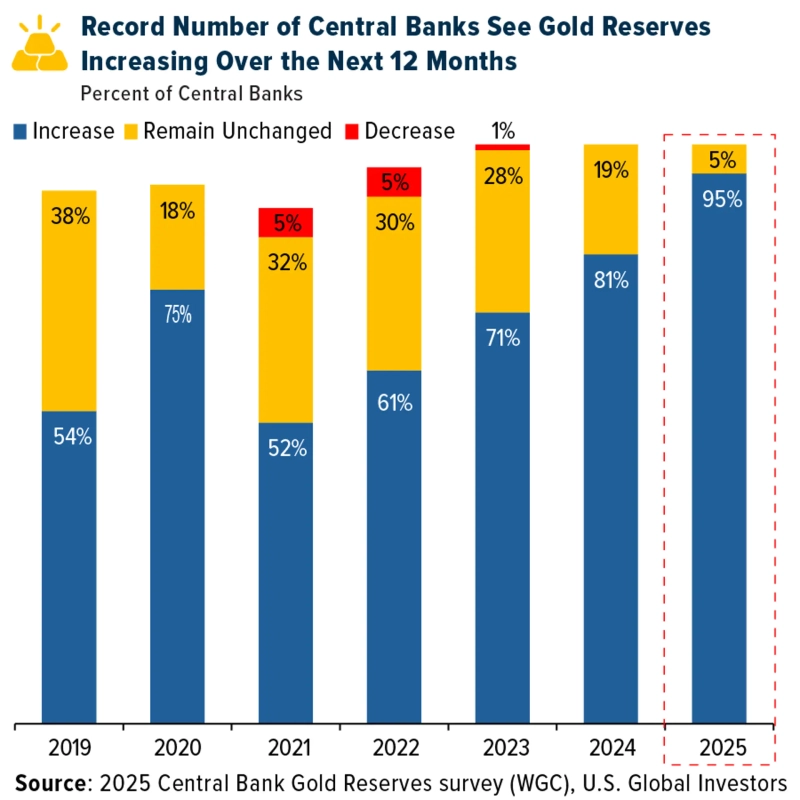

Despite these high prices, central banks around the world continue to accumulate gold. According to the World Gold Council (WGC), official gold purchases have exceeded 1,000 tons for three consecutive years, more than double the 10-year annual average. Currently, global gold reserves are almost at the same level as in 1965 under the Bretton Woods System.

A recent report from the European Central Bank (ECB) revealed that, for the first time in history, gold's share of global foreign exchange reserves reached 20%, surpassing the euro (16%).

This is truly noteworthy and aligns with the WGC’s latest survey. According to the WGC, 95% of central banks expect to increase their gold holdings within the next 12 months—a record high since WGC began these surveys.

The Global South Leads the Way

Most gold purchases by central banks are occurring in the Global South. Countries such as Turkey, India, China, and Brazil have increased their gold reserves over the past few years.

These nations are also seeking alternatives to the dollar-based financial system and increasingly view the dollar system as a source of vulnerability.

In Asia, for example, CNBC reports that ASEAN member states are advancing regional plans to reduce dollar reliance by settling more local currency in regional trade.

China is further accelerating its yuan-based Cross-Border Interbank Payment System (CIPS). CIPS is positioned as the yuan alternative to SWIFT, and this month alone, China expanded the network by adding six new overseas banks covering Africa, the Middle East, and Central Asia.

Sanctions Accelerate the Trend

Following Russia’s invasion of Ukraine in 2022, Western sanctions have highlighted the risks of holding dollar assets. According to the European Central Bank (ECB), in five out of the ten largest annual increases in gold holdings since 1999, the countries involved had been sanctioned either that year or the previous year.

For many emerging economies, gold acts as geopolitical insurance. While US Treasuries or SWIFT access may be frozen at any time, it is much more difficult to freeze physical gold stored in domestic vaults.

What This Means for US Investors

Of course, the dollar is not about to disappear overnight. It still dominates global trade and bond markets, accounting for about half of all global transactions.

However, increasing evidence suggests that this dominance is gradually weakening.

This means that US investors—especially those approaching or already in retirement—should carefully review how much of their portfolio is exposed to a single currency. Just as central banks are reducing dollar exposure by purchasing gold and foreign assets, individual investors can prepare in the same way.

As you know, I have long advocated the ‘10% golden rule’: allocating 10% of a portfolio to gold and gold-related investments—splitting 5% into physical gold and 5% into high-quality gold mining stocks.

This article is provided by Investing.com, and the copyright belongs to the source. For inquiries regarding the article content, please contact the media outlet.

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to crypto assets](https://media.bloomingbit.io/PROD/news/d8b64ab3-376a-41c1-a0a8-5944ff6b90c7.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)