Summary

- It has been analyzed that demand for Bitcoin remains high.

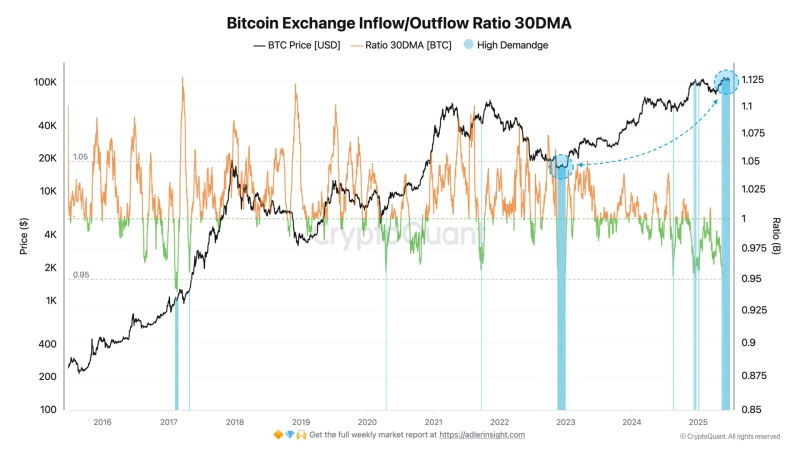

- It was stated that Bitcoin's exchange inflow and outflow ratio is at a level similar to the early stage of the 2023 bull market.

- The larger amount of coins withdrawn from centralized exchanges suggests investors are showing a tendency for long-term holding.

An analysis has indicated that demand for Bitcoin (BTC) remains at a high level.

On the 25th (local time), CryptoQuant contributor Axel Adler Jr. stated on X (formerly Twitter), "The ratio of Bitcoin's exchange inflows and outflows has reached a level similar to the early stages of the bull market at the end of 2023," adding, "This suggests that demand for Bitcoin is still high." Currently, the 30-day simple moving average of Bitcoin's exchange inflow-outflow ratio is at the level of 1.125.

Additionally, there was an analysis regarding the amount withdrawn from exchanges. The analyst stated, "Considering the weekly inflow and outflow trends of centralized exchanges (CEX) at present, a total of 4,300 BTC has been withdrawn," noting that the greater amount of withdrawn coins reflects investors' long-term holding sentiment.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit!["Will AI take our jobs?" Fear spreads…market rattled by a plunge in shares [New York Market Briefing]](https://media.bloomingbit.io/PROD/news/874408f1-9479-48bb-a255-59db87b321bd.webp?w=250)