Summary

- Ray Dalio revealed that the U.S. national debt has reached about six times its revenue and 100% of GDP, warning it will worsen in the future.

- He warned that the rise in debt, coupled with a decline in the value of the dollar and inflation, would be highly negative for bondholders.

- Dalio stated that instability in the U.S. credit market could deliver widespread shock to the global economy and society.

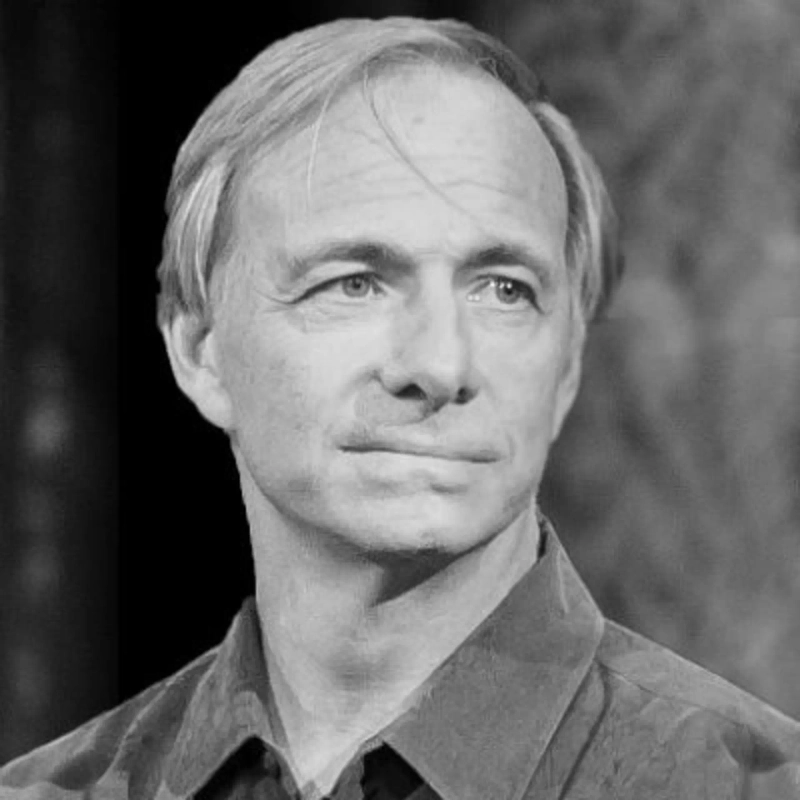

Ray Dalio, the U.S. hedge fund mogul, expressed serious concerns about the U.S. fiscal situation on the 3rd (local time) via his X (formerly Twitter).

Dalio stated, "According to the budget passed by the United States Congress, the country's annual spending will be about $7 trillion, while income will be about $5 trillion going forward," adding, "Currently, the national debt of the United States is around six times its revenue, 100% of GDP, equivalent to about $230,000 per household."

He continued, "Over the next 10 years, the debt is expected to increase to about 7.5 times revenue, 130% of GDP, and about $425,000 per household," warning that "as a result, the burden of principal and interest repayment will surge from the current $10 trillion (including $1 trillion in interest and $9 trillion in principal) to $18 trillion (including $2 trillion in interest)."

He also said, "Such circumstances may force significant cuts in government spending or trigger unimaginable tax hikes," pointing out, "If even that does not solve the issue, it will lead to massive money printing and a drop in the value of the dollar."

Dalio specifically emphasized that "a decline in the value of the dollar and inflation are highly negative for bondholders," stressing, "since the U.S. Treasury Market is the cornerstone of the global capital market, instability in the U.S. credit markets could deliver a widespread shock to the world economy and society."

He noted, "To reduce the fiscal deficit, which is about 7% of GDP, to the 3% range, fundamental measures such as adjustments to spending, taxes, and interest rates are urgently needed," expressing concern that "otherwise, turmoil accompanied by severe pain would be inevitable throughout the U.S. economy and society."

JH Kim

reporter1@bloomingbit.ioHi, I'm a Bloomingbit reporter, bringing you the latest cryptocurrency news.

![Rotation from tech to blue chips…Micron plunges 9.55% [Wall Street Briefing]](https://media.bloomingbit.io/PROD/news/d55ceac4-c0d2-4e63-aac9-f80fd45dfbbd.webp?w=250)

![[Market] Bitcoin drops intraday to the $72,000 level… debate over 'safe-haven credibility' reignited](https://media.bloomingbit.io/PROD/news/e3aeb7f7-851b-4479-bfd0-77d83a3b7583.webp?w=250)