Editor's PiCK

China Bans Cryptocurrency, But Allows Yuan Stablecoins? [Global Money X-Files]

Summary

- Chinese IT companies are pushing for the issuance of yuan stablecoins as a strategy to counter the influence of U.S. dollar-based cryptocurrencies.

- The introduction of a stablecoin regime in Hong Kong and the possibility of Chinese policy changes are drawing attention from the investment sector.

- There are analyses that the adoption of yuan stablecoins could lead to CBDC linkage and intensify financial and geopolitical conflicts between the U.S. and China.

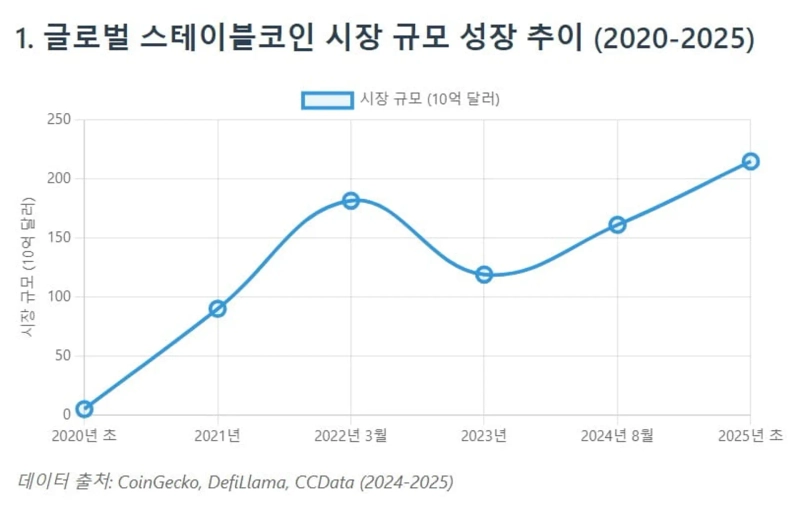

Chinese information technology (IT) companies are pushing to enter the stablecoin market, with plans to launch stablecoins based on the Chinese yuan. In the U.S., stablecoin legislation is underway. The industry is paying close attention to whether the competition between the United States and China will intensify in the global stablecoin market.

Chinese Big Tech Pushes Stablecoin Issuance

According to Reuters on the 4th, Chinese IT companies JD.com and Alibaba's financial affiliate Ant Group have reportedly requested the People's Bank of China to issue yuan-based stablecoins. This move aims to counter the growing influence of U.S. dollar-based cryptocurrencies.

The two companies have proposed to the Chinese government that they be permitted to issue stablecoins linked to offshore yuan in Hong Kong. Their stance is to promote global use of the yuan and keep the influence of U.S. dollar-based cryptocurrencies in check.

Hong Kong plans to introduce stablecoin regulations on August 1. Earlier, Hong Kong implemented a virtual asset exchange regime in 2023. JD.com and Ant Group intend to issue stablecoins in tandem with Hong Kong’s adoption of this regulatory framework.

There is also analysis that the Chinese government's attitude, which has strongly cracked down on crypto assets, may be shifting. China completely banned cryptocurrencies in 2021. However, it is now reportedly considering the strategic acceptance of stablecoins. Last month, Pan Gongsheng, Governor of the People's Bank of China, commented, "Stablecoins could revolutionize international finance, exposing vulnerabilities in the existing payment system amid geopolitical tensions." Huang Yiping, an advisor to the People's Bank of China, also said, "Issuing offshore yuan stablecoins in Hong Kong is a possible scenario."

Chinese big tech’s drive into the stablecoin market has been prompted by the rapid increase in the issuance of U.S. dollar-linked stablecoins globally. This is being viewed as a threat to yuan internationalization. Currently, over 99% of the world’s stablecoins are issued in U.S. dollars.

![China Bans Cryptocurrency, But Allows Yuan Stablecoins? [Global Money X-Files]](https://media.bloomingbit.io/prod/news/6cb82a50-28a4-4df6-8f6d-12877907bd41.webp?w=800)

Wang Yongli, co-chairman of Digital China Information Service Group, recently stated, "The expansion of U.S. dollar-based stablecoins is a new challenge to yuan internationalization," and warned, "If international settlements in yuan are not as efficient as those with dollar stablecoins, it may present a strategic risk."

Recently, many Chinese export companies have reportedly received payments in USDT (Tether), a dollar-linked stablecoin, from their trading partners instead of yuan. The causes are China’s strict capital controls, geopolitical risks, and volatility in certain emerging market currencies. CryptoHK, Hong Kong’s largest OTC crypto exchange, said that since 2021, its trade settlement volume using Tether (USDT), a U.S. dollar-linked stablecoin, for Chinese clients, has increased fivefold.

Linked with Yuan CBDC?

There are also expectations within the industry that the central bank digital currency (CBDC) settlement project ‘mBridge’ could be linked with yuan-based stablecoins. mBridge is a multi-central bank digital currency (CBDC) settlement platform jointly promoted by the central banks of China, Hong Kong, Thailand, the United Arab Emirates (UAE), and Saudi Arabia.

Launched in 2021, this project aims to technically enable and collaborate on cross-border CBDC transactions. Josh Lipsky, CBDC tracker head at U.S. think tank Atlantic Council, commented, "Yuan-Saudi oil settlements will be further accelerated using mBridge technology." In a test last February, the system enabled funds to be transferred from Abu Dhabi Bank (UAE) to Bank of Beijing in just 10 seconds, showing faster settlement than traditional SWIFT networks.

Recently, JD.com stressed during its talks with the People’s Bank of China that as the Hong Kong dollar is pegged to the U.S. dollar, it is not conducive to yuan internationalization. Instead, it reportedly suggested allowing offshore yuan-based stablecoins in Hong Kong first, then expanding to offshore markets in China’s Free Trade Zones. If such measures are permitted, cross-utilization between CBDC and yuan stablecoins between Hong Kong and China could become a reality.

![China Bans Cryptocurrency, But Allows Yuan Stablecoins? [Global Money X-Files]](https://media.bloomingbit.io/prod/news/576f73f4-b06e-449e-9f28-4bf065570058.webp?w=800)

For example, a payment (remittance) can be made in digital yuan in mainland China and received in Hong Kong as a yuan stablecoin of equivalent value, or vice versa; yuan stablecoins in Hong Kong could be exchanged for digital yuan. Such cross-border settlements could be implemented by including yuan stablecoins in multilateral networks like mBridge.

There are also concerns that yuan-based stablecoins issued by Chinese capital could escalate U.S.-China tensions. The U.S. is likely to restrict China’s financial tool (yuan stablecoins) as a challenge to the dollar system. For example, the U.S. Department of the Treasury could add yuan stablecoins distributed on overseas platforms — if used as channels for sanctions evasion or money laundering — to the sanctions list along with related institutions or networks. The U.S. has previously sanctioned crypto assets such as Iranian Petro in 2019 and Tornado Cash in 2022.

[Global Money X-Files highlights the vital yet little-known global movements of money. For convenient updates on the global economy, please subscribe to the journalist's page.]

Ju-wan Kim, kjwan@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Dow Tops 50,000 for First Time Ever as “Oversold” Narrative Spreads [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/1c6508fc-9e08-43e2-81be-ca81048b8d11.webp?w=250)