Summary

- It was reported that Naver and Kakao surged by 32.80% and 36.77% respectively, fueled by expectations for AI and coin policies.

- Experts assessed that the probability of Naver rising further is high, stating that domestic demand recovery policies may support a rebound in its share price.

- Despite expectations for benefits from OpenAI partnership and won-based stablecoin at Kakao, its stock outlook is mixed due to revenue structure and government policy issues.

Naver, poised for further gains if domestic demand recovers

Mixed outlook for Kakao

Naver and Kakao, once dubbed ‘national villains’ among stocks, have rebounded sharply after a long slump. While some profit-taking has recently occurred, experts predict additional upside for Naver.

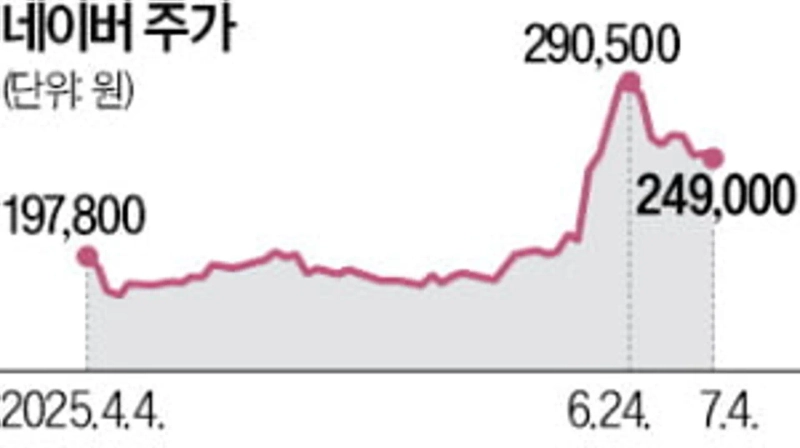

According to the Korea Exchange, Naver’s share price soared by 32.80% from last month through the 4th of this month. On the 23rd of last month, when it reached its highest level in over three years, it climbed to 295,000 won during intraday trading. The rally was triggered when Ha Jung-woo, former head of Naver Cloud’s AI Innovation Center, was appointed as the inaugural chief of AI Future Planning, and Han Seong-sook, former CEO of Naver, was nominated as Minister of SMEs and Startups. President Lee Jae-myung’s pledge during the presidential campaign to introduce a won-based stablecoin also contributed to the stock’s rise. Subsidiary Naver Financial is preparing a stablecoin payment service.

Kakao’s share price also jumped by 36.77% since last month. The prospect that subsidiary Kakao Pay will benefit if won-based stablecoin payments are implemented has come into focus. News that Kakao entered into a strategic partnership with OpenAI in the US and plans to launch a Korean-style super AI agent further stoked the rally.

However, compared to last month's peak, Naver’s stock is still down 14.29%. Analysts attribute this to a surge in profit-taking activity as the stock spiked for the first time in a while.

Experts generally believe “the likelihood of an additional rise in Naver’s share price is high.” They say domestic demand recovery policies, such as the government’s supplementary budget plan, could boost Naver’s advertising and e-commerce sales in the second half.

Kakao’s stock has also fallen 17.05% from last month's peak. Opinions on Kakao’s outlook are mixed. While some believe Kakao could also benefit if domestic demand recovers as with Naver, others argue that since much of Kakao Commerce’s sales depend on the ‘gift’ feature, it may see only limited gains from economic improvement.

Despite the government’s concentrated investment in the AI industry, forecasts suggest Kakao’s trickle-down effect may be limited. This is because, instead of joining the government’s core Sovereign AI policy, Kakao is developing related services through a partnership with OpenAI. Some point out the stock's surge has outpaced improvements in business results.

Reporter Seongmi Shim smshim@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Dow Tops 50,000 for First Time Ever as “Oversold” Narrative Spreads [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/1c6508fc-9e08-43e2-81be-ca81048b8d11.webp?w=250)