Editor's PiCK

"Bitcoin Hits All-Time High, But... On-Chain Indicators Suggest 'Not Overheated'"

Summary

- Although Bitcoin (BTC) has reached a new all-time high, it has been stated that no overheating signals have appeared in on-chain data.

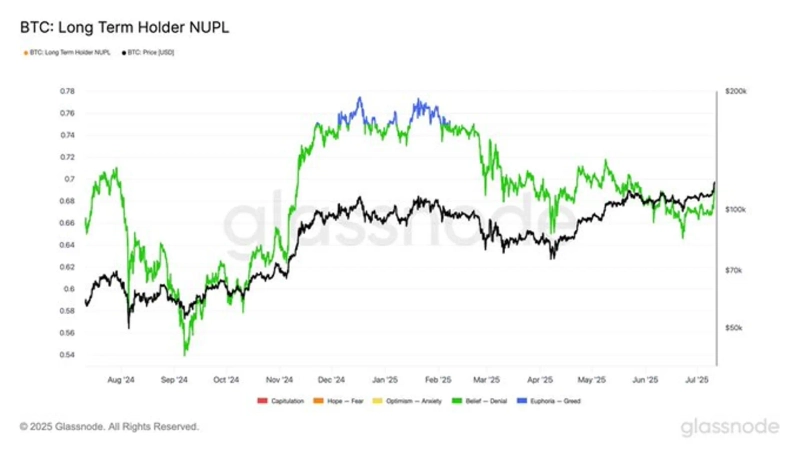

- Glassnode stated that the NUPL indicator remains at 0.69, meaning it has not entered the 'euphoria zone', and the period with NUPL above 0.75 in this cycle is much shorter than before.

- The NUPL indicator is used to gauge speculative overheating and selling pressure, and current analysis suggests the market has not yet reached its peak.

Bitcoin (BTC) has surpassed $118,000, setting a new all-time high, but on-chain data analysis suggests it has not yet entered an overheated zone.

On the 11th, on-chain analytics firm Glassnode said, “Although Bitcoin broke through $118,000 and set a new record high, the Net Unrealized Profit/Loss (NUPL) indicator for long-term holders remains at 0.69, which means it has not yet reached the 'euphoria' zone.”

They added, “During this cycle, the period when the NUPL indicator exceeded 0.75 lasted only about 30 days. This is significantly shorter compared to 228 days in the previous cycle (2021), which suggests that the market has not yet reached its peak.”

The NUPL indicator estimates the potential profit level of long-term Bitcoin holders and is generally considered to indicate a speculative overheated zone when above 0.75. The market often uses the NUPL indicator to determine when selling pressure may increase.

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

![Did it crash because of Trump?…The 'real reason' Bitcoin collapsed [Hankyung Koala]](https://media.bloomingbit.io/PROD/news/d8b4373a-6d9d-4fb9-8249-c3c80bbf2388.webp?w=250)