BlackRock Bitcoin ETF Surpasses $83 Billion in Total Assets Under Management, Enters Top 21 ETF Rankings

Summary

- BlackRock's spot Bitcoin ETF (IBIT) has surpassed a total assets under management of $83 billion, ranking 21st among all ETFs.

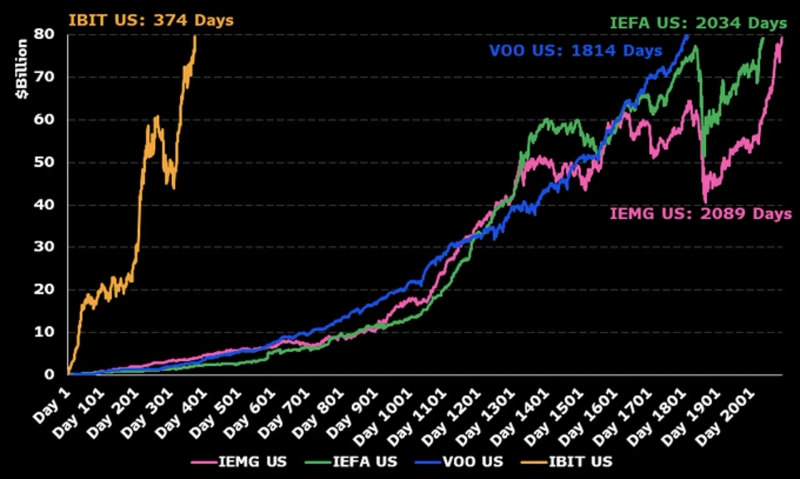

- IBIT reached the $80 billion milestone in 374 days, setting a record five times faster than previous well-known ETFs.

- Analyst Balchunas explained that the recent surge in Bitcoin price has been a major factor driving the increase in asset value.

BlackRock's spot Bitcoin (BTC) Exchange-Traded Fund (ETF) 'IBIT' has surpassed $80 billion (approximately ₩114 trillion) in Assets Under Management (AUM), making it the 21st largest ETF overall.

On the 11th, Eric Balchunas, a Bloomberg ETF analyst, announced via X (formerly Twitter), "IBIT surpassed $80 billion on the 10th (local time), achieving this milestone five times faster than any previous record for a well-known ETF." The previous record belonged to Vanguard's 'VOO', which took 1,814 days to reach $80 billion. IBIT reached this figure in just 374 days, and as of today, its assets total $83 billion.

Balchunas further stated, "For the first time, the total assets under management across all spot Bitcoin ETFs have also exceeded $140 billion (approximately ₩192.5 trillion)," adding, "Over $1 billion flowed in within a single day on the 11th, and the recent surge in Bitcoin price has played a major role in increasing the asset value."

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

![Did it crash because of Trump?…The 'real reason' Bitcoin collapsed [Hankyung Koala]](https://media.bloomingbit.io/PROD/news/d8b4373a-6d9d-4fb9-8249-c3c80bbf2388.webp?w=250)