Editor's PiCK

14,400 Bitcoins flowed into exchanges in two days…"Short-term downside risk ↑"

Summary

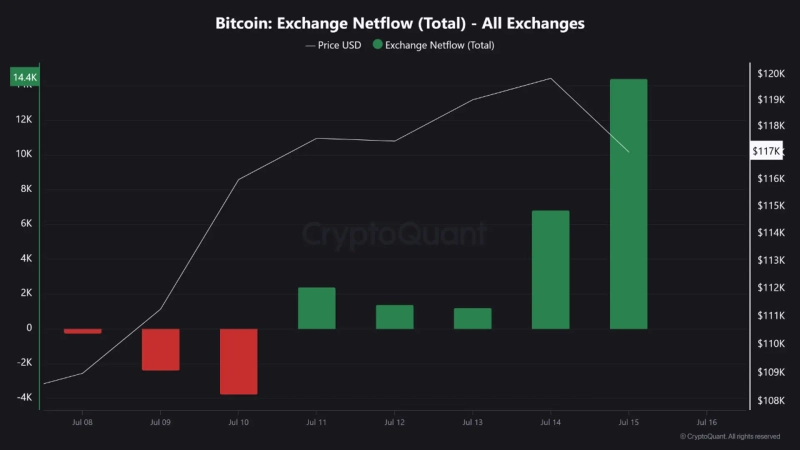

- It has been reported that over 14,400 BTC were transferred to exchanges in the past 48 hours.

- A CryptoQuant contributor noted that increasing profit-taking among traders is leading to higher spot selling pressure.

- The analysis indicates that if this trend persists, the short-term downside risk for Bitcoin will be elevated.

There is growing analysis that the surge in Bitcoin (BTC) inflows to exchanges is increasing the likelihood of a short-term decline.

On the 15th (local time), Enigma Trader, a contributor to CryptoQuant, stated in a report, "Over the past 48 hours, more than 14,400 BTC have flowed into cryptocurrency exchanges," adding, "This represents the largest inflow seen in recent weeks."

The report continued, "Traders are transferring their Bitcoins to exchanges in order to realize profits. This means that spot selling pressure is rising," and further added, "If this trend continues, the short-term downside risk for Bitcoin will become even greater."

Meanwhile, the previous day, Bitcoin hit an all-time high (ATH) of $123,218 on Binance. As of 5 PM, Bitcoin was trading at $116,770 on the Binance USDT market, a 4.82% drop compared to 24 hours ago.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit![[Today’s Key Economic & Crypto Calendar] Atlanta Fed GDPNow, More](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[New York Stock Market Briefing] Rebound on bargain hunting in blue chips…Apple jumps 4%](https://media.bloomingbit.io/PROD/news/3710ded9-1248-489c-ae01-8ba047cfb9a2.webp?w=250)