Editor's PiCK

U.S. 'GENIUS Act' on Verge of Passing…Is the Stablecoin Era About to Begin in Earnest?

Summary

- With the possibility of the U.S. Congress passing the 'GENIUS Act' rising, it's expected that stablecoins will formally enter institutional markets.

- If the CLARITY Act passes along with the GENIUS Act, it is anticipated that cryptocurrencies could be fully integrated as institutional investment assets.

- On the back of optimistic crypto week expectations, the price of Bitcoin surpassed $120,000 for the first time ever, and there’s analysis suggesting further upside is possible.

This Week Is U.S. Congress 'Crypto Week'

High Expectations for 'GENIUS Act' Passage

If Passed, Trump Expected to Sign Immediately

"Stablecoins Reach Major Milestone"

With the arrival of Crypto Week in the U.S. Congress, expectations are rising for the enactment of the GENIUS Act (Stablecoin Act). If the GENIUS Act passes Congress, observers say that the cryptocurrency industry may write a new chapter in history.

On the 16th (local time), according to industry sources, President Donald Trump held a meeting in the Oval Office at the White House with some House members who opposed the GENIUS Act. President Trump announced on his social media, Truth Social, "After a short discussion, they all agreed to vote in favor tomorrow (the 17th)."

The House vote on the GENIUS Act scheduled for the 17th (local time) is regarded as the key highlight of Crypto Week. Earlier, the House designated this week as Crypto Week to focus on reviewing cryptocurrency legislation.

Besides the GENIUS Act, the House also plans to vote this week on the CLARITY Act (Cryptocurrency Market Structure Act) and the Anti-CBDC Surveillance State Act. Although the procedural vote for the bill review was defeated, there is a plan to resume the process as soon as possible.

'95%' Probability of Enactment This Year

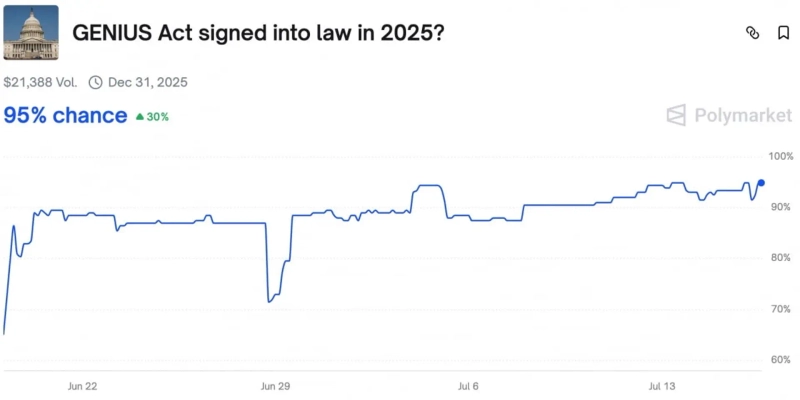

Industry experts give the highest odds to the GENIUS Act passing. This is a comprehensive bill regulating stablecoins, which already cleared the Senate last month. Since there is bipartisan agreement in the Senate regarding the integration of stablecoins into the institutional framework, it is analyzed that barring major variables, passage through the House should not be difficult. As of this date, even Polymarket, the world’s largest betting site, put the GENIUS Act’s probability of being enacted within the year at 95%.

Taking President Trump’s commitment to promoting stablecoins into account, there is a high likelihood that the presidential signature procedure will follow immediately if the GENIUS Act passes. If this happens, the GENIUS Act will become the first-ever U.S. federal law in the crypto sector.

Omar Elassar, Global Head of Strategic Partnerships at Animoca Brands, a global blockchain company mentioned in the article, explained: “The GENIUS Act will not just enable but require institutional participation in the (stablecoin) market. As already proven in places like the United Arab Emirates (UAE), clear and purpose-built (crypto) regulations attract institutional players.” He went on to say, “The GENIUS Act marks a significant milestone in stablecoin policy and could spark the start of genuine harmony between stablecoin innovation and regulation on a global scale.”

The GENIUS Act is also expected to have a substantial impact on traditional finance (TradFi). Altan Tutra, CEO of MoreMarkets, predicted, “If the GENIUS Act passes, stablecoin adoption will expand, and the demand for U.S. Treasury bonds and T-bills as stablecoin backing assets will likely increase. This can fundamentally change not only how traditional finance operates but also how it is affected by macroeconomic factors.”

"Institutionalization Accelerates"

If the CLARITY Act passes as well, the impact of this Crypto Week could be nothing short of seismic. As the act’s name implies, the CLARITY Act aims to fill regulatory gaps for cryptocurrencies. Since it already passed “markup” sessions in both the House Agriculture and Financial Services Committees last month, the chances of its passage are also considered high. In fact, Polymarket gave a 57% chance of enactment for the CLARITY Act as of this day.

If both the GENIUS Act and CLARITY Act pass the House, it is analyzed that not only stablecoins but the entire crypto sector will be institutionalized as investment assets. Will K, CEO of the decentralized exchange (DEX) Buoy (VOOI), stated, “The GENIUS Act and CLARITY Act will establish a regulatory foundation for both institutional and individual investors to operate between cryptocurrencies and traditional finance. This means cryptocurrencies like Bitcoin and stablecoins will become part of modern investment portfolios alongside stocks, commodities, and forex.”

Attention is also focused on the impact this Crypto Week may have on Bitcoin prices. Bitcoin recently surged on crypto week anticipation, surpassing $120,000 for the first time ever. CryptoQuant contributor Crypto Dan analyzed, “Bitcoin has entered a new phase, but on-chain data shows the market has not yet overheated. Compared to previous short-term peaks, the overheating level is much lower, suggesting Bitcoin could shoot up and break new all-time highs again in the second half of the year.”

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)