Editor's PiCK

Today, 8 trillion won worth of BTC and ETH options expired… Optimism emerges amid Ethereum’s upward momentum

Summary

- Researcher Adam announced that about ₩8 trillion worth of Bitcoin (BTC) and Ethereum (ETH) options expired today.

- It was reported that Ethereum broke through $3,650 and its implied volatility (IV) has reached as high as 70%.

- The proportion of call option (bullish bet) trades has been rising over the past two weeks, and institutions are also shifting their positions.

Today, approximately $6 billion of large-scale contracts expired in the virtual asset (cryptocurrency) options market, with analysis suggesting that Ethereum’s (ETH) sharp rally is driving market optimism.

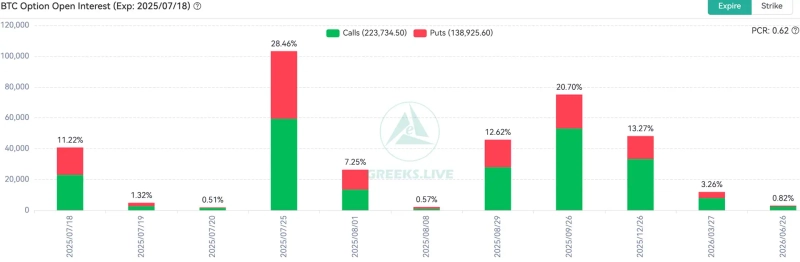

According to Adam, a researcher at the cryptocurrency options data analysis platform Greeks.live, 41,000 Bitcoin (BTC) options and 240,000 Ethereum options reached maturity today. The notional values were $4.93 billion (about ₩6.87 trillion) and $880 million (about ₩1.227 trillion), respectively, totaling $5.8 billion (about ₩8 trillion). This accounts for about 10% of the total options market open interest (OI).

Adam explained, "Recently, the ongoing upward trend without significant corrections has further fueled expectations among market participants." While Bitcoin is stabilizing around $120,000 today, Ethereum has surpassed $3,650 and is leading a rebound across altcoins.

In today’s options indicators, Ethereum’s implied volatility (IV) — a measure of its volatility — rose to as high as 70% in major segments, reflecting growing expectations for more gains. Bitcoin’s IV rebounded slightly at around the 40% level. However, as Ethereum continues to demonstrate large price swings in both directions, selective responses are required if sell pressure emerges.

Adam analyzed, "Over the past two weeks, substantial call option (bullish bet) trading has persisted," adding, "on most trading days, call options account for more than 30% of total large-volume trades, and institutions are also gradually shifting their positions."

For reference, a call option is a financial contract granting the right to purchase a specific underlying asset at a predetermined strike price. Call option buyers can exercise the option at maturity if the market price of the underlying product exceeds the agreed strike price, capturing the price difference as profit. Conversely, a put option confers the right to sell an asset at a pre-specified strike price.

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.!["Will AI take our jobs?" Fear spreads…market rattled by a plunge in shares [New York Market Briefing]](https://media.bloomingbit.io/PROD/news/874408f1-9479-48bb-a255-59db87b321bd.webp?w=250)