Summary

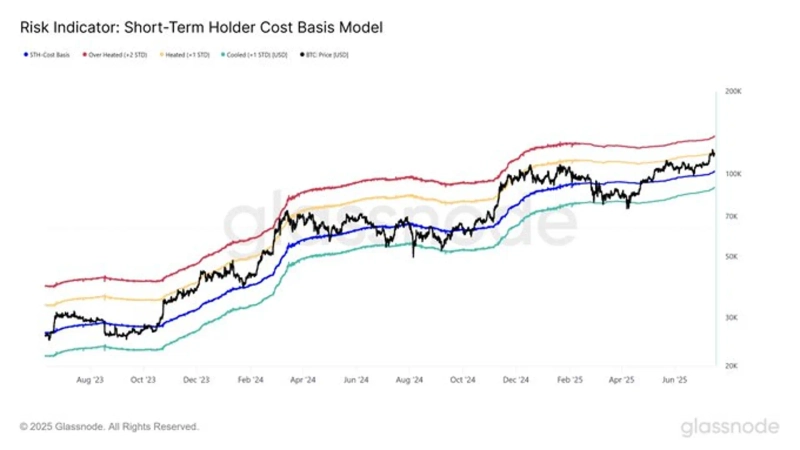

- Glassnode reported that Bitcoin (BTC) has surpassed the +1 standard deviation from the average cost basis of short-term holders (about $120,000).

- This area has served as a key resistance during previous bull markets.

- Glassnode indicated that if this trend continues, the next resistance will be the +2 standard deviation zone at around $136,000.

Bitcoin (BTC) has surpassed the +1 standard deviation (approximately $120,000) from the average cost basis of short-term holders. This level has historically served as a key resistance during previous bull markets.

On the 18th, on-chain data analytics platform Glassnode announced on X (formerly Twitter), "BTC has reached the upper band of +1 standard deviation from the Short-Term Holder cost basis, which is about $120,000." This point has repeatedly acted as resistance during bullish phases.

Glassnode stated, "If this trend continues, the next resistance will be the +2 standard deviation zone, around $136,000."

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.!["Will AI take our jobs?" Fear spreads…market rattled by a plunge in shares [New York Market Briefing]](https://media.bloomingbit.io/PROD/news/874408f1-9479-48bb-a255-59db87b321bd.webp?w=250)