Editor's PiCK

"Long-term Bitcoin holders have significantly higher returns than short-term holders… No large-scale selling yet"

Summary

- Investors who have held Bitcoin for the long term are reporting significantly higher returns compared to short-term holders.

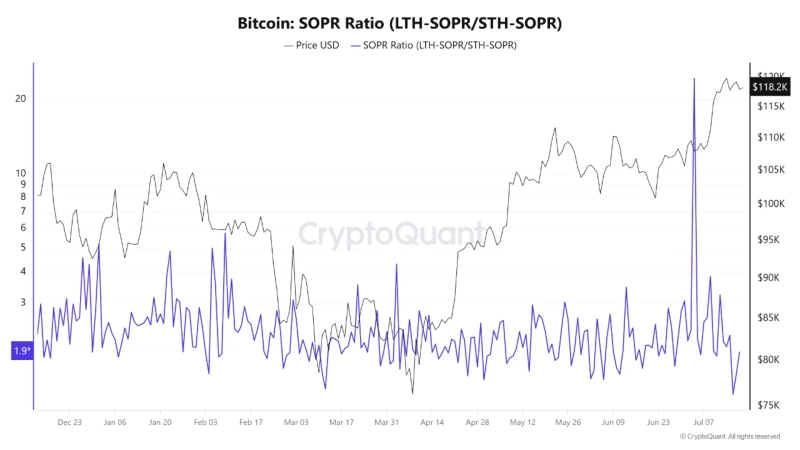

- According to CryptoQuant’s data, the SOPR ratio stands at 1.90, indicating that while some long-term holders are realizing profits, no large-scale selling trend has been observed.

- The analyst explained that if the SOPR ratio rises above 3, price volatility could increase due to strong selling pressure from major investors.

It has been found that long-term investors who have held Bitcoin (BTC) for an extended period are recording much higher returns than short-term holders.

On the 19th, an analyst from Arab Chain at CryptoQuant, a virtual asset (cryptocurrency) analysis platform, stated in a Quicktake report, "A Bitcoin SOPR ratio (SOPR Ratio: LTH-SOPR/STH-SOPR) of 1.90 indicates that large-scale holders have gradually begun to realize their profits, while small-scale holders have either not yet achieved significant gains or are not actively selling."

According to CryptoQuant, the SOPR ratio of Bitcoin stood at 1.90 on this day. This metric compares the realized returns of long-term holders, who have held Bitcoin for over 155 days, with those of short-term holders. Generally, a ratio above 1 means profit realization, while below 1 means selling at a loss.

The analyst explained, "Currently, some long-term holders are observed to be realizing profits, but it is too early to consider this a large-scale distribution trend." He added, "However, if this ratio rises above 3, heightened price volatility could occur due to substantial selling by major investors."

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.!["Will AI take our jobs?" Fear spreads…market rattled by a plunge in shares [New York Market Briefing]](https://media.bloomingbit.io/PROD/news/874408f1-9479-48bb-a255-59db87b321bd.webp?w=250)