Editor's PiCK

[Today's Global Trending Coins] Pump.fun·Espresso·Kaito & More

Summary

- Pump.fun is a Solana (SOL)-based meme coin issuance platform that recently drew investor attention due to a significant price decline.

- Espresso is a base layer project that stood out as the first project selected for 'Kaito Capital Launchpad' and is notable for its sale of up to $4 million in governance tokens.

- USDC is being highlighted for positive news due to the passage of a stablecoin bill, partnerships in traditional finance, and an increase in USDC deposits on Hyperliquid (DEX).

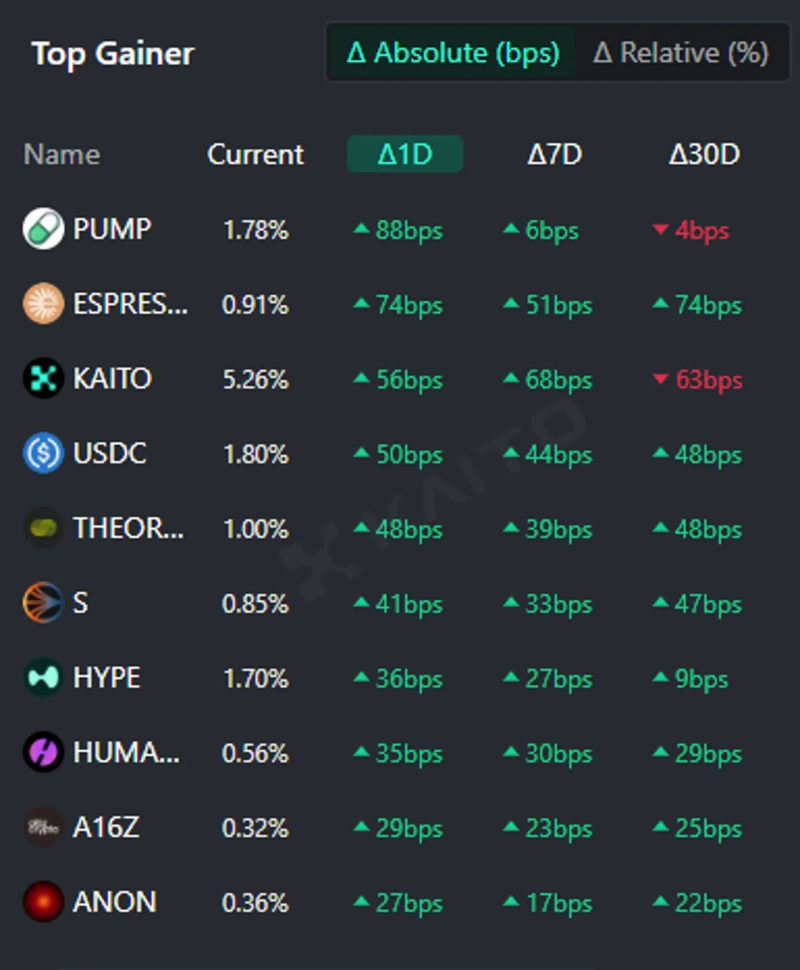

According to Token Mindshare, an index by the AI-based Web3 search platform Kaito that quantifies the influence of specific tokens in the virtual asset market, the top 5 virtual asset-related keywords attracting the most attention on the 23rd are Pump.fun (PUMP), Espresso (ESPRESSO), Kaito (KAITO), USDC (USDC), and Theoriq (THEORIQ).

Ranked first is Pump.fun, a meme coin issuance platform based on Solana (SOL). The recent sharp price decline appears to have drawn significant attention. Previously, during its token offering (ICO), Pump.fun raised over $500 million in just 12 minutes, garnering major industry interest; however, the current price is below the ICO price ($0.004). As of 12:06 p.m., Pump.fun is trading at $0.003647 on CoinMarketCap, down 6% from the previous day.

Second is the base layer project Espresso. It received significant attention for being selected as the first project on the newly launched 'Kaito Capital Launchpad' the previous day. An ICO has also commenced. The Espresso Foundation plans to sell up to $4 million worth of governance token ESP.

Kaito, which launched the new platform 'Capital Launchpad', is ranked third. Capital Launchpad is similar in form to the on-chain virtual asset angel investment platform Echo and aims to support investors in participating in early-stage high-potential projects.

The dollar-based stablecoin USDC ranks fourth. The passage of the GENIUS Act, a stablecoin bill in the US, seems to have increased mentions of USDC. Bank of America signed a collaboration with Circle, the issuer of USDC, raising expectations for its inclusion in traditional finance. Additionally, the USDC deposit on the decentralized futures exchange (DEX) Hyperliquid (HYPE) has more than doubled since the beginning of the year, reaching $4.9 billion, which is considered a positive factor.

Finally, at fifth place is Theoriq, known for its agent swarm protocol. Theoriq garnered attention by announcing a $1 million reward program for Theoriq Yappers. Previously, Theoriq had also promised a $1 million reward to Kaito stakers.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)