Editor's PiCK

Korean Market Led by Speculative Tokens: Korean Crypto Weekly [INFCL Research]

Summary

- Last week, trading volumes on Korean exchanges such as Upbit and Bithumb increased significantly, with major tokens like STRIKE and XRP recording high transaction volumes and returns.

- The Bitcoin Layer 2 project Merlin Chain secured a prominent position and trust in the Korean market through strong marketing strategies and community activities, leading to a sharp surge in TVL.

- There is a strong appetite for speculative assets and newly listed tokens in the Korean market, with signs of overheating appearing in both cryptocurrency and stock markets.

1. Market Overview

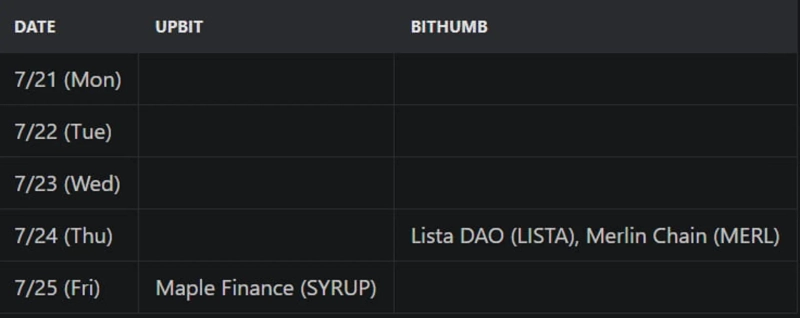

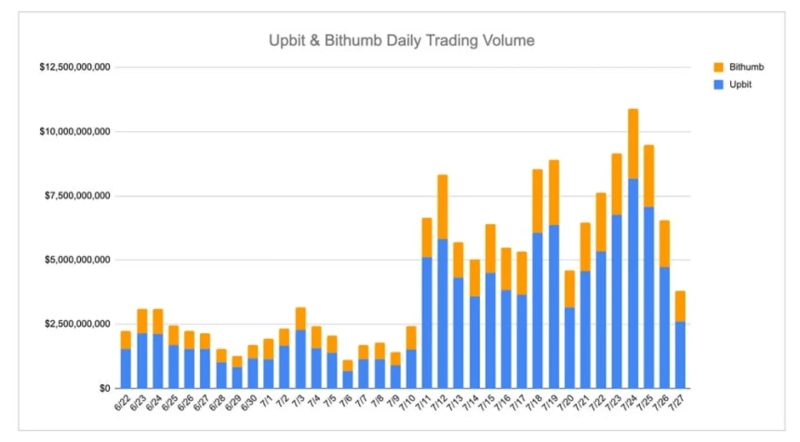

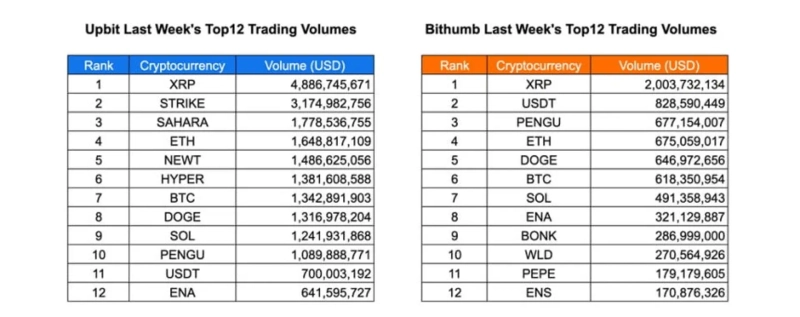

Last week, Korean exchanges added several new tokens; Upbit listed Maple Finance, and Bithumb added Lista DAO and Merlin Chain. Both exchanges are expanding their offerings, but Upbit maintains a significant advantage in market dominance, recording daily trading volumes exceeding $10 billion for several days. XRP was the top asset on both platforms, posting $4.89 billion on Upbit and $2 billion on Bithumb. STRIKE climbed to second place on Upbit with a trading volume of $3.17 billion, followed by SAHARA at $1.77 billion. This is a notable rise, considering their relatively recent listings. ETH, NEWT, HYPER, and BTC also recorded strong trading volumes. On Bithumb, USDT and PENGU each surpassed $675 million, trailing XRP, while other popular tokens such as ENA, BONK, and WLD also showed growth.

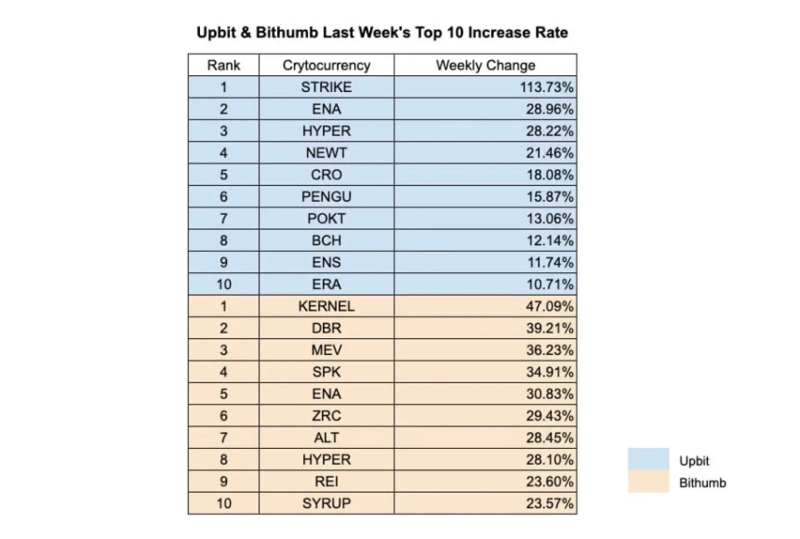

In terms of performance, STRIKE surged 113.73% week-over-week, marking the largest gain among Upbit’s top rising tokens, while ENA (+28.96%) and HYPER (+28.22%) also posted double-digit growth on both exchanges. Mid-cap tokens such as NEWT, CRO, and PENGU, alongside infrastructure tokens like POKT, BCH, and ENS, showed solid upward trends. On Bithumb, KERNEL DAO recorded the most notable gain at 47.09%, closely followed by DBR, MEV, and SPK, each rising over 30%. Rollup-related tokens like ZRC and ALT also performed well. While Bithumb expanded listings and visibility, Upbit continued to firmly control trading volume and user activity, especially around fast-moving narrative-based assets.

2. Exchanges

2-1. Newly Listed Coins

Last week, several new listings occurred on major Korean exchanges.

Upbit listed Maple Finance.

Bithumb listed Lista DAO and Merlin Chain.

Key Marketing Strategies & Highlights

Merlin Chain (MERL)

Merlin Chain is a Bitcoin Layer 2 project that received significant attention in the Korean market in Q1 2024. At the time, numerous Bitcoin L2 projects were being launched, but among them, Merlin stood out with the highest TVL. Merlin successfully positioned itself as a project building its own ecosystem and executed an effective KOL marketing strategy in Korea.

At this time, assets like Rune, ORDI, and other BRC-20 tokens were experiencing a boom. Merlin promoted itself as a platform where users could stake various quality assets in this ecosystem—such as Quantum Cats, bitDisc-black by bitsmiley, and pups—to earn Merlin points. Through proactive KOL marketing, Merlin attracted high-value asset holders into the Merlin Chain ecosystem, which naturally led to a surge in total TVL and reinforced Merlin’s leading position.

To improve accessibility for users unfamiliar with the Bitcoin ecosystem, Merlin produced onboarding content and user guides. The Merlin team clearly understood the project’s accessibility challenges and provided exactly what users wanted. These efforts were effectively communicated to the community via KOLs.

Following its highly anticipated TGE, Merlin continued its marketing efforts in Korea. With the vesting schedule of airdropped tokens, the project maintained steady exposure in Korea. Merlin also began hosting AMAs and established a dedicated Korean community, organizing various events. When large-scale wildfires broke out in Korea, the Merlin Foundation made donations, further solidifying Merlin’s presence and trust in the market.

2-2. Trading Volume

Despite Bithumb’s ongoing marketing campaigns, Upbit has far outpaced other Korean exchanges in terms of trading volume, a trend that is apparent on the daily charts. Last week, Upbit consistently maintained high daily levels, even surpassing $10 billion on its peak trading day, while Bithumb’s contribution was relatively modest.

In terms of individual asset trading volume, XRP solidified its position as the dominant asset among Korean retail investors, posting $4.89 billion on Upbit and $2 billion on Bithumb. STRIKE closely trailed on Upbit with $3.17 billion, showing strong speculative interest after a recent price surge. Meanwhile, the newly listed SAHARA reached $1.77 billion to take third place on Upbit, showing rapid growth. Other high-volume tokens on Upbit included ETH, NEWT, HYPER, and BTC, each recording over $1.3 billion in weekly trading volume.

On Bithumb, USDT and PENGU each recorded trading volumes above $675 million, following XRP. This suggests increasing demand for stablecoins and emerging meme or community-based assets. Notably, tokens such as ENA, BONK, and WLD also ranked in the top 12, reflecting greater diversification in both speculative and newly listed assets.

Overall, while Bithumb has expanded listings and visibility, Upbit remains ahead in trading activity and user engagement, particularly among popular assets and new market entrants.

2-3. Top 10 Gainers

Last week, STRIKE (STRK) posted the top returns on Upbit, surging 113.73% as renewed market attention and investment flowed into DeFi lending platforms. ENA (+28.96%) and HYPER (+28.22%) also saw strong gains on both Upbit and Bithumb, indicating synchronized momentum across exchanges. NEWT (+21.46%), CRO (+18.08%), and PENGU (+15.87%) closely followed, benefiting from community-driven activity and a rotation into mid-cap tokens. POKT (+13.06%), BCH (+12.14%), ENS (+11.74%), and ERA (+10.71%) rounded out Upbit’s leaderboard, reflecting interest in infrastructure, L1, and governance-related tokens.

On Bithumb, KERNEL DAO (KERNEL) led with a 47.09% weekly gain, likely driven by mounting expectations for DAO participation. DBR (+39.21%) and MEV (+36.23%) followed, both benefiting from early listing momentum and ecosystem news. SPK (+34.91%) and ENA (+30.83%) posted strong cross-exchange volume, strengthening overall demand. ZRC (+29.43%) and ALT (+28.45%) rose on hopes related to rollups and L2s, while HYPER (+28.10%) saw renewed upward movement. REI (+23.60%) and SYRUP (+23.57%) also continued to rise, both reflecting second-half momentum from speculative inflows.

3-1. Kaia x KakaoPay Hackathon, Ongoing Heat for Stablecoins

Interest in stablecoins is heating up in Korea. Kaia is collaborating with KakaoPay to host Korea’s first KRW stablecoin hackathon. The event features a total prize pool of ₩100 million (about $75,000) and is supported by regulatory agencies. There are two tracks: an ideathon focused on KRW-based stablecoin concepts, and a hackathon on Kaia-USDT integration.

This partnership, along with Kaia’s recent collaboration with Tether, signals KakaoPay’s growing ambitions in stablecoins. Korean Web3 users are curious not only about the potential impact on Kaia’s price but also about accessibility. Many wondered whether even non-developers, such as those with a humanities background, could participate in the ideathon.

3-2. Concerns of Discrimination Against Korean Founders by Domestic Exchanges

A long-standing issue in Korea’s crypto industry has surfaced in the news again: bias by domestic exchanges against projects led by Korean founders. While crypto teams led by Koreans are common, projects with Korean founders getting listed on domestic exchanges remain extremely rare. Many projects establish overseas entities or exclude Korean team members to improve listing chances.

Although regulatory acceptance for crypto has improved under the current administration, the article pointed out that this reverse discrimination is a phenomenon unique to Korean exchanges. Community sentiment ranged from disappointment to pragmatism. “Honestly, bad actors will dump crypto regardless of nationality,” and “Through all this talk of institutional adoption, I hope the market becomes healthier in every way.”

3-3. Trading Frenzy Grips Korea in Both Cryptocurrency and Stocks

This week saw an explosive surge in Korean crypto trading volume—but the market wasn’t overheated only there. One news article focused on the resurgence of individual stock trading, describing classrooms packed with enthusiastic students paying ₩500,000 (about $380) for stock trading courses. The curriculum included weekly macro updates and hands-on trading strategies, offering an even more educational alternative to paid signal groups.

The crypto community’s comments highlighted the overlapping risk appetite across the markets, such as, “This could be a sign of a short-term peak,” “Leverage trading is still risky,” and “KOSPI 4,000, sounds crazy but maybe it’s possible.” A speculative frenzy is clearly gripping the Korean market.

*All content is provided for informational purposes only and is not intended as a basis for investment decisions, recommendations, or advice. The information herein carries no responsibility for investment, legal, or tax matters of any kind.

INF Crypto Lab (INFCL) is a consulting firm specialized in blockchain and Web3, providing one-stop services for enterprise Web3 strategy, tokenomics design, and global market expansion. It works alongside major domestic and overseas securities firms, game companies, platforms, and global Web3 firms, from strategy to execution, and leverages its experience and references to drive the sustainable growth of the digital asset ecosystem.

This report is independent of the editorial direction of media outlets. All responsibility lies with the information provider.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)