Summary

- More than $120,750,000 was reported as net inflow into the US Bitcoin (BTC) spot ETF market.

- BlackRock's 'IBIT' and Fidelity's 'FBTC' were revealed to have attracted the largest investments.

- Bitcoin price surged about 5% following President Donald Trump's executive order allowing cryptocurrency investment in 401(k) retirement accounts.

Over $100 million in net funds have flowed into the United States Bitcoin (BTC) spot ETF market.

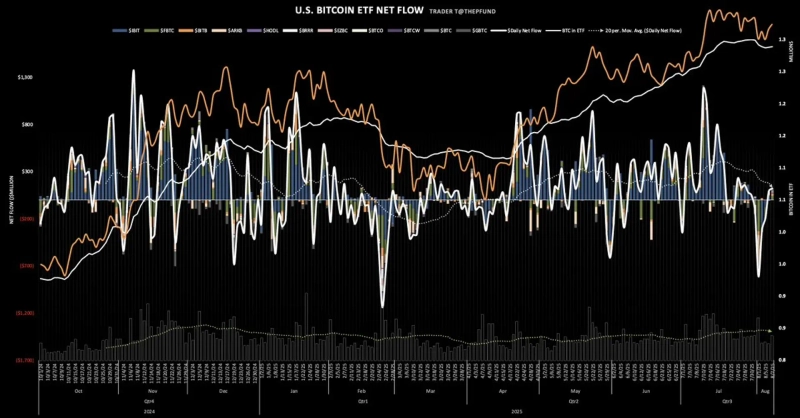

According to trader T's data on the 7th (local time), a total of $120,750,000 was poured into Bitcoin spot ETFs traded in the United States.

BlackRock's 'IBIT' attracted the most funds with $156,250,000, followed by Fidelity's 'FBTC' with $43,450,000. Next, VanEck's 'HODL' saw a net inflow of $21,490,000, Bitwise's 'BITB' and Grayscale's 'BTC' recorded $17,170,000 each, Grayscale's 'GBTC' had $18,480,000, and Franklin Templeton's 'EZBC' saw a net inflow of $3,380,000.

Meanwhile, ARK Invest's 'ARKB' recorded a net outflow of $390,000. There was no net flow reported for Invesco's 'BTCO', Valkyrie's 'BRRR', or WisdomTree's 'BTCW'.

Meanwhile, Bitcoin surged after President Donald Trump signed an executive order fully permitting cryptocurrency investments in 401(k) retirement accounts. On the day, the price of Bitcoin, which at one point had dropped to $112,650, soared approximately 5% to surpass $117,300.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)