Summary

- Analyst Henrik Zeberg evaluated Bitcoin as a high-risk risky asset, not as a 'special asset.'

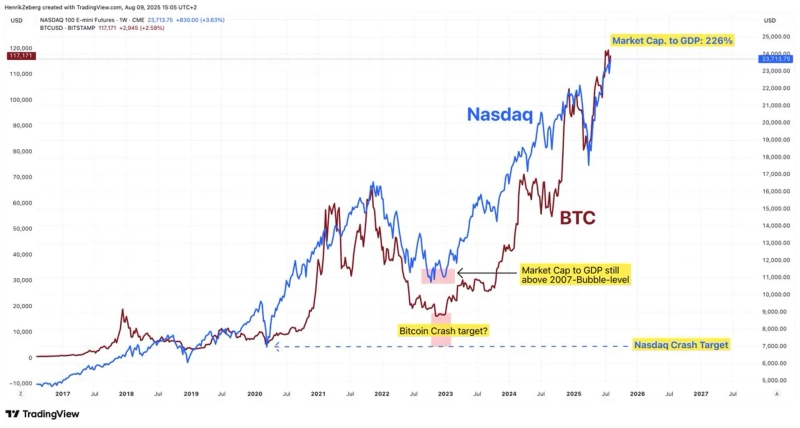

- He noted that Bitcoin and the Nasdaq move in sync due to their technological ties, and that they are both part of the 'second tech bubble.'

- Zeberg warned that if the Nasdaq bubble bursts, the price of Bitcoin could also plummet.

Henrik Zeberg, a Swissblock analyst, stated on the 9th (local time), "Bitcoin (BTC) is not a 'special asset.' Rather, it should be considered a high-risk asset with strong risk characteristics."

On this day, analyst Zeberg wrote on his X, "There is a severe bubble in the Nasdaq index. Even if it corrects to the 2022 level, the market capitalization to GDP ratio still exceeds the 2007 bubble level," adding, "Bitcoin and the Nasdaq are exhibiting synchronized trends because both assets are highly related to technology."

Zeberg further stated, "A 'second tech bubble (Tech Bubble 2)' is forming now, and Bitcoin is also part of it," forecasting that "the peak of the bubble will manifest when fears of economic recession intensify." He added, "If the Nasdaq bubble collapses, the price of Bitcoin will also crash," warning, "Do not get swept up in bubble euphoria or logic such as 'You just don't understand Bitcoin.'"

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)